How Much Does it Cost to Hire a Financial Advisor?

The fee model used by financial advisors varies greatly. Many charge hourly rates of $150-400 per hour, but the average is closer to $400.

Some also charge a percentage of the AUM of their clients’ accounts, while others collect a commission on top of those fees. Online advisors typically charge a subscription fee and charge by the month. The following are the most common fee models and their relative costs.

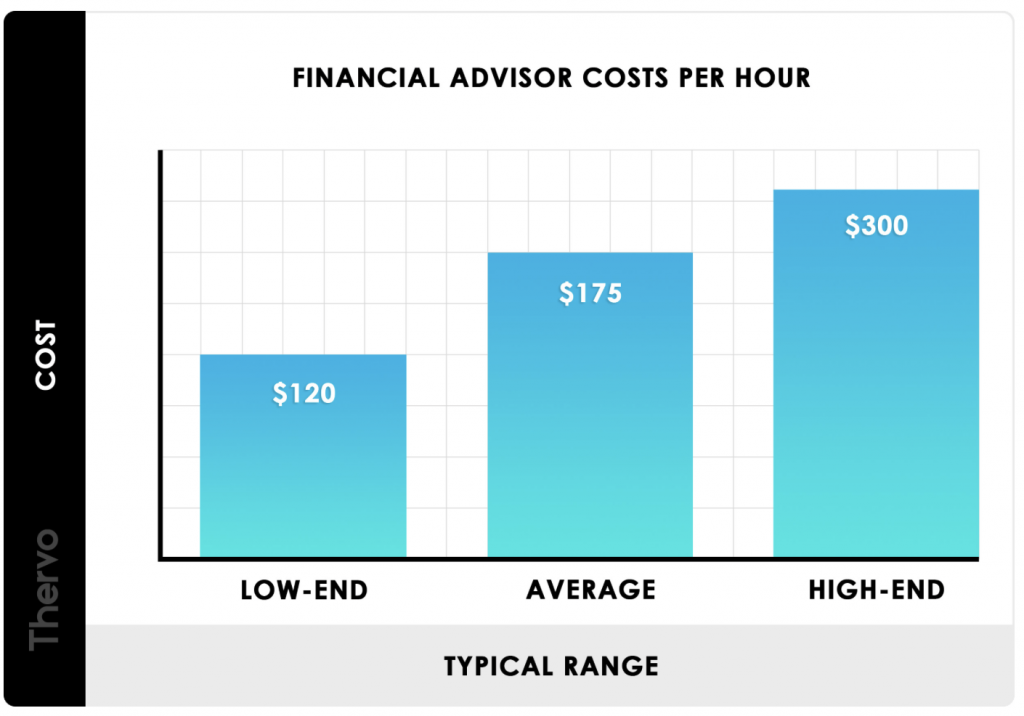

Hourly planners range from $150 per hour to $400+ per hour

An hourly financial planner charges a retainer fee for 10 hours of planning, and can bill $150 per half-hour or more.

If you hire an hourly financial planner for 10 hours a year, you’d pay that fee once per month.

Additional hours would be charged at the hourly rate. Hourly financial planners can offer full-service portfolio management, while some focus solely on 1:1 time. While they can provide investment advice, hourly planners are not the best choice for a person looking to delegate their tasks.

If you love kids, you can turn your passion into a profitable side business. Several sites hire freelance writers to take care of children.

The pay varies from $7 to $16 per hour, and some even pay you straight to your bank account. Some sites offer to pay you directly through PayPal.

Another option for freelance writers is to be a taxi driver. There are apps that pay writers for their services, and they can accept requests through the app.

Robo advisors charge a percentage of AUM

Unlike human financial advisors, robo-advisors generally charge a much lower fee for their services. Human advisors typically charge 1% of the AUM of their clients.

The fee charged by a robo-advisor will vary depending on the service and the amount of money you invest, but it’s typically a small fraction of that.

You can also choose to invest in a robo-advisor’s tax-loss harvesting strategies, which can increase your returns and reduce your tax bill.

Robo advisors also earn money through the marketing of other products and services, such as credit cards, mortgages, and insurance policies.

They also earn revenue through strategic partnerships. The fee structure varies by service, but is typically capped at 1% of AUM.

Other fees include wire transfers, expedited deposits, and other transactions. Robo advisors may offer services in other financial sectors, too. One robo advisor, M1 Finance, recently began offering loans up to 4% interest. They also allow account holders to borrow up to 35% of their portfolio.

Fee-based advisors collect commissions on top of fees charged on assets

A few questions you should ask yourself before hiring a fee-based advisor. How much do these financial advisors earn?

A fee-based advisor collects commissions on top of the fees that they charge their clients, while a commission-only advisor makes all of their money from client fees.

The answer depends on your needs and your investment portfolio. Some advisors charge hourly rates, while others charge a flat fee for services.

The biggest downside of fee-based services is the possibility of conflicts of interest. Although not all people who collect commissions have bad intentions, there is always room for abuse of the system.

You may question if the investment you made is the right one just because your advisor made the biggest commission. Then you might dig deeper into the disclosure documents to find out for sure. And this may be a good thing – because fee-based firms can also profit from revenue-sharing structures.

Online advisors charge a monthly subscription fee

Many online financial advisors charge a monthly subscription fee for their services. These monthly payments are much less expensive for the consumer.

While an annual subscription fee is the standard model for financial planners, more are dividing this cost into monthly subscription fees.

In some cases, this can make the service more accessible and easier on the wallet. Likewise, some advisors offer ongoing services for a flat fee charged at periodic intervals. These types of services may be beneficial if you have a complex financial situation.

Fee-based models are more expensive than others, but they support a team of financial advisors who take a holistic approach to your financial planning.

These advisors often include investment management at no extra charge, ongoing advice and assistance with executing your plan.

Some providers offer regular checkups and periodic advice to adapt their strategies to meet your changing financial needs.

The fees may be less than 1% of the total amount of investable assets but they are more convenient for people who don’t have much to invest.

Did you enjoy reading this article? If so, check out more today!

Fact Check

We strive to provide the latest valuable information for our readers with accuracy and fairness. If you would like to add to this post or advertise with us, don’t hesitate to contact us. If you see something that doesn’t look right, contact us!