[ad_1]

The Woke Salaryman did a comic book strip to elucidate why some wealthy individuals won’t ever be joyful.

I can establish with this text as a result of they body properly a “disturbance within the pressure” that I can’t clarify very nicely.

The Woke Salaryman feels that wealthier individuals can by no means be joyful as a result of there’s all the time some increased attainment that their friends have reached.

They concern they could by no means get there, affecting their total outlook.

The query is: The place is that this ‘there’?

How can we outline there?

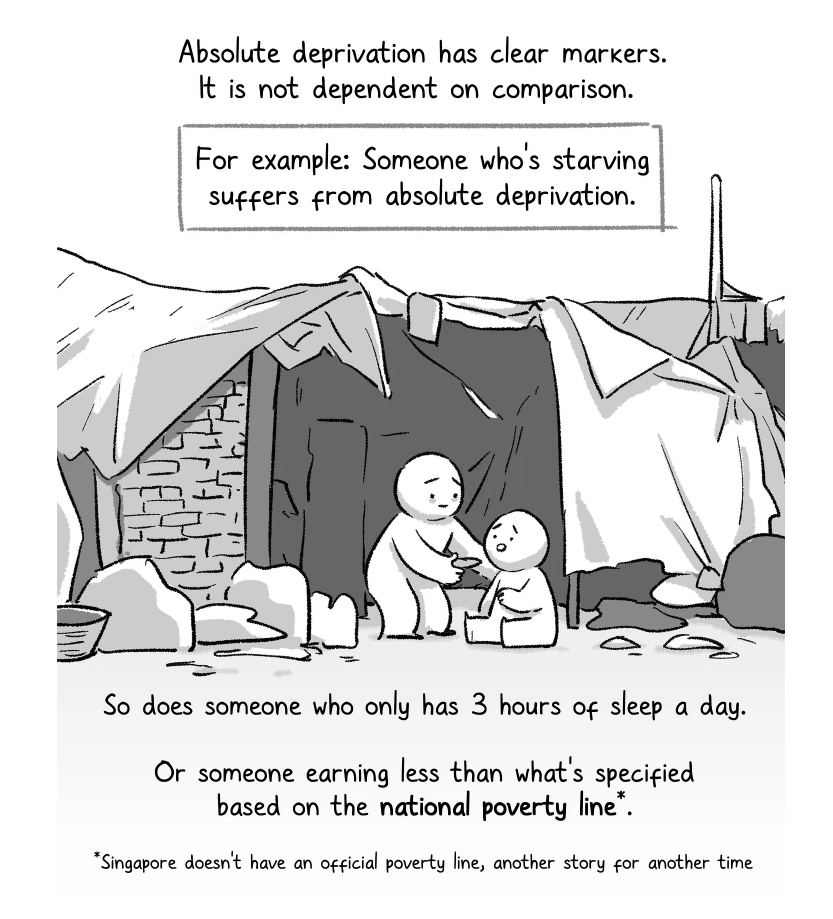

The Woke Salaryman identifies two sorts of deprivation: Absolute and Relative Deprivation.

Table of Contents

The Distinction Between Absolute and Relative Deprivation.

Within the grand scheme of issues, absolute deprivation has universally authorised markers if we take a step again. We’d like the bottom layer of Maslow’s hierarchy of wants.

This implies we aren’t disadvantaged of the next:

- Respiratory, meals, water, intercourse, sleep, homeostasis, excretion

- Safety of physique, of employment, of sources, of morality, of the household and for well being

If we survey a bunch of people with completely different backgrounds and monetary means about whether or not it’s good to be disadvantaged of such issues, a really giant chunk of the individuals will disagree that we ought to be disadvantaged of such issues within the fashionable age.

Absolute deprivation ought to be a transparent avoidance, below probably the most wise metrics.

One other type of deprivation borns out of evaluating to a different particular person, group of individuals, in several areas, in several revenue teams.

They’ve a sure way of life, which you don’t have presently, and a few have so wealthy of a life-style that you just concern you gained’t have.

That is relative deprivation.

In Telegram chats, and in actual life, I hear the fixed debate and recommendation to not evaluate to others, to follow having extra gratitude about what you have already got in your life.

Monetary Safety Versus Monetary Independence

If we reference my Levels of Wealth chart:

There’s a distinction between build up our monetary sources in order that we are able to safe a conservative money move to supply for our annual fundamental survival bills and present bills.

The previous is to forestall absolute deprivation, if we cease work, or can’t work and the latter is not only that diploma of deprivation but additionally offering for our way of life.

In my view, fundamental monetary safety, even at phases 5 and 6 could shore up absolute deprivation and people phases are interesting sufficient to achieve.

The Pervasive Mindset: Any type of Deprivation is Unhealthy

Right here is the darkish secret, when you expertise or know of the existence of a sure way of life, you’ll assume deprivation will not be good.

So in our monetary independence planning, we HAVE to safe that in a conservative method with our passive revenue.

The issue is with fairly a good bit of way of life, is deprivation of that way of life wholesome or unhealthy is so debatable.

Is provision on your youngster’s tuition from secondary to junior faculty important?

Ought to we be deprive of a five-room HDB flat straight out of college?

Doesn’t having the ability to afford a 20-table wedding ceremony banquet for many an indication of absolute deprivation?

Some would say the road between relative and absolute deprivation is weak however in my view, it ought to be extra clear reduce:

We must always all have the ability to agree upon what way of life human beings shouldn’t be disadvantaged of.

There ought to be grades to way of life and there ought to be a vital quantity for meals, and a premium good-to-have quantity.

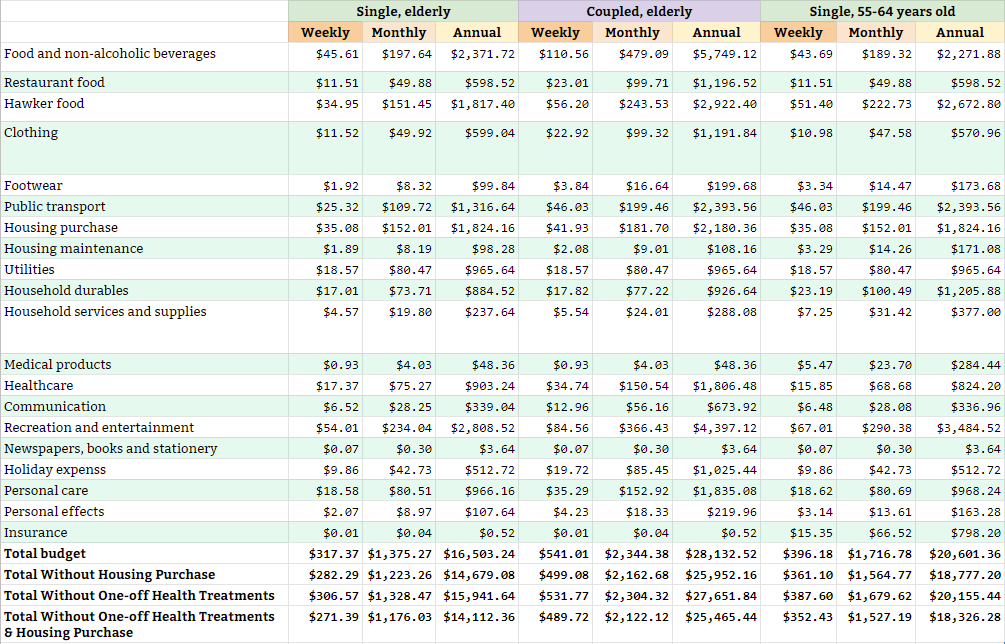

In 2019, Lee Kuan Yew Faculty of Public Coverage launched their analysis on the family budgets vital for older individuals to fulfill their dwelling wants. It comes as much as $1.3k to 2.3k, relying on whether or not you’re single or a pair.

We’re not saying whether or not that’s correct, however we should always have the ability to agree upon what we shouldn’t be disadvantaged of with much less ambiguity.

Having a Wealth Machine that Prevents One Deprivation is Higher Than Depriving of All the things

In monetary independence planning, we should always take a look at assuaging completely different ranges of deprivation, create completely different milestones, and speak about attaining the primary stage after which following by the subsequent:

- A wealth machine that gives money move to forestall some deprivation.

- A wealth machine that gives money move to forestall most deprivation.

- A wealth machine that gives money move to forestall all deprivation.

This framing is a method of practising gratitude.

Associated: Why Wealth Machines are Vital to Constructing Wealth Correctly

Realizing that your wealth alleviates some deprivation extraordinarily nicely is healthier than proudly owning a number of wealth however not feeling safe as a result of your wealth doesn’t safe ALL of your life.

There may be an excessive amount of concern concerning the failure to safe money move for all bills as a result of any deprivation is an absolute failure of the plan.

I believe in case you are wise and also you replicate upon this, you’ll agree with me.

However you could have to reframe how you concentrate on the completely different levels of deprivation and contentment.

I invested in a diversified portfolio of exchange-traded funds (ETF) and shares listed within the US, Hong Kong and London.

My most popular dealer to commerce and custodize my investments is Interactive Brokers. Interactive Brokers let you commerce within the US, UK, Europe, Singapore, Hong Kong and lots of different markets. Choices as nicely. There aren’t any minimal month-to-month prices, very low foreign exchange charges for foreign money trade, very low commissions for varied markets.

To seek out out extra go to Interactive Brokers at this time.

Be a part of the Funding Moats Telegram channel right here. I’ll share the supplies, analysis, funding information, offers that I come throughout that allow me to run Funding Moats.

Do Like Me on Fb. I share some tidbits that aren’t on the weblog publish there usually. You can too select to subscribe to my content material by way of the e-mail beneath.

I break down my sources in line with these matters:

- Constructing Your Wealth Basis – If you recognize and apply these easy monetary ideas, your long run wealth ought to be fairly nicely managed. Discover out what they’re

- Lively Investing – For energetic inventory buyers. My deeper ideas from my inventory investing expertise

- Studying about REITs – My Free “Course” on REIT Investing for Newcomers and Seasoned Traders

- Dividend Inventory Tracker – Observe all of the widespread 4-10% yielding dividend shares in SG

- Free Inventory Portfolio Monitoring Google Sheets that many love

- Retirement Planning, Monetary Independence and Spending down cash – My deep dive into how a lot it’s worthwhile to obtain these, and the alternative ways you might be financially free

- Providend – The place I presently work doing analysis. Price-Solely Advisory. No Commissions. Monetary Independence Advisers and Retirement Specialists. No cost for the primary assembly to grasp the way it works

[ad_2]

Source_link

Hello!! My name is Abraham

I'm a passionate finance enthusiast dedicated to providing you with valuable insights into budgeting, investing, and the art of wealth-building. Let's embark on a journey to unlock your financial potential together. Subscribe to my blog for practical, money-smart tips that will pave the way to your financial success."