How to Become a Millionaire as a Teacher

Have you ever considered how a teacher may earn a million of dollars in fortune?

Have you ever wondered how YOU may become a Millionaire if you are a teacher?

Considering that there are around 4.2 million teachers in North America, I’m sure you’re not the only one asking oneself this issue.

According to edweek.org, the average teacher pay in 2019 is approximately $61,730 USD.

That’s a nice wage, but it’s not anywhere close to a million dollars, which begs the question: how do teachers become millionaires?

There are actually quite a few possibilities, albeit some are less plausible than others.

I will elaborate on these less plausible methods later in the post, but for now, let’s focus on what I believe to be the most likely method of becoming a millionaire on a teacher’s income.

So let’s jump right into it –

Here are the 5 steps to making a millionaire as an educator.

*Become a School Teacher

*Earn At Least $70,000 Per Year

*Invest up to 45% of Your Gross Income for At Least 16 years

*Generate an Average Return of 10% Over the 16-Year Period

*Become a real Millionaire

1. First Become a Teacher

Okay, so first things first. If you want to become a millionaire as a teacher, you need to first become a teacher.

Currently, how does one become a teacher?

Well, I assume that in most places a bachelor’s degree and a master’s degree in education are required.

But let’s be honest: I know nothing about becoming a teacher.

If you are reading this essay, I assume you are either already a teacher or know more about how to become one than I do.

So let’s suppose that my explanation of how to become a teacher was clear and proceed to step two.

That was simple!

#2. Earn At Least $70,000 Annually

As stated at the beginning of this article, the average teacher pay in the United States is approximately $60,000.

Specifically $61,730, according to edweek.org (As of 2019). But for the sake of simplicity, let’s just say $60,000.

If you already earn $60,000 or more annually, congratulations! Proceed to step three.

If not, that’s fine too! It is still possible to make a millionaire as a teacher, but it will take longer. No huge deal. I should also note that I am referring to your gross income, or profits before taxes.

Invest at least 45 percent of your gross income for a minimum of 16 years.

Okay, now step 3.

#3. Invest Your Income

Invest 45 percent of your income over 16 years to become a millionaire as an educator.

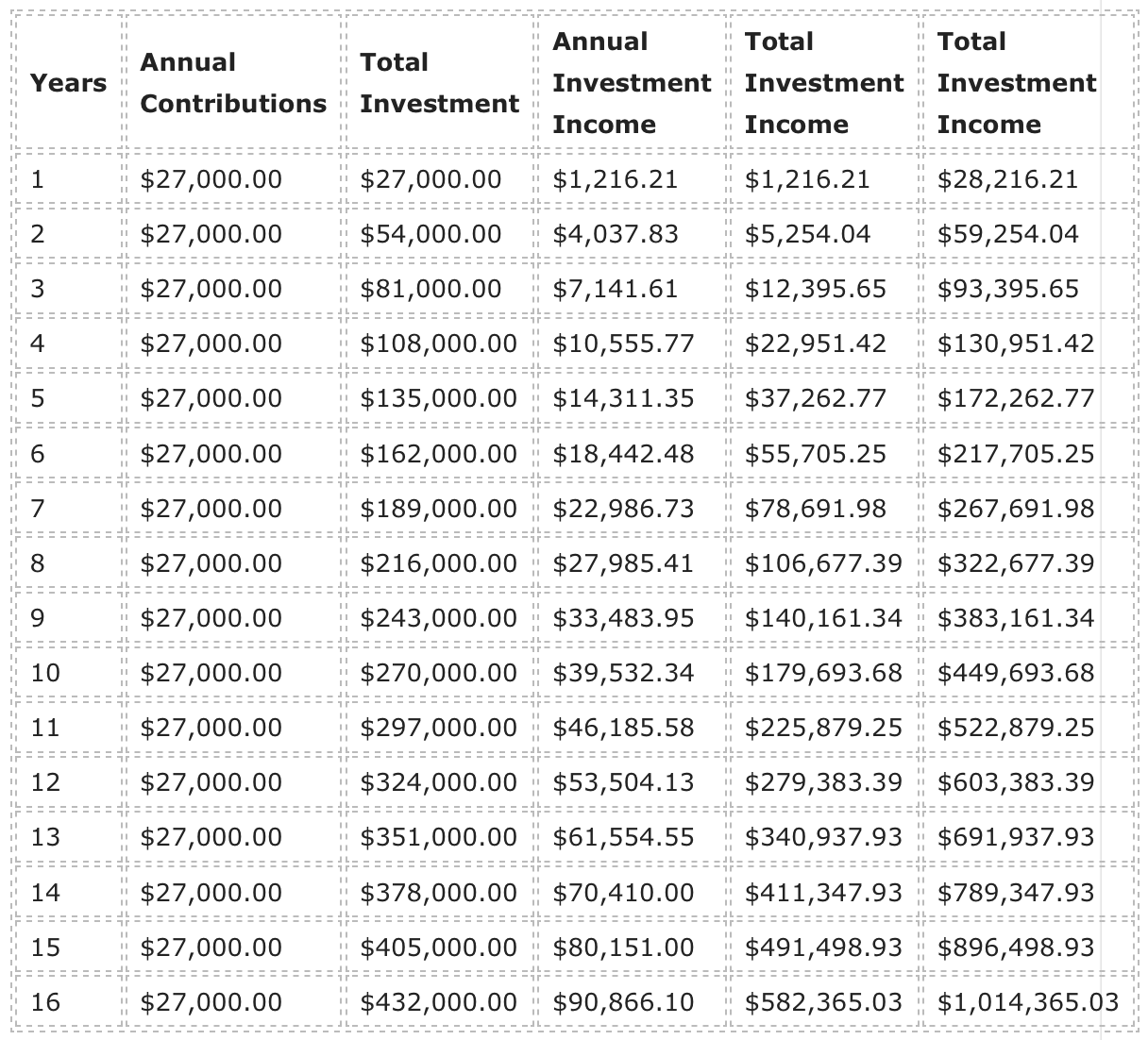

In other words, if you earn $60,000 annually, you should be saving and investing approximately $27,000 annually. This amounts to $2,250 monthly.

I recognise that this is not a simple task. However, becoming a millionaire is not simple.

In step 4, I will explain in greater detail how to invest these funds, but for now, know that they will serve as the basis for your financial success.

If you believe that $27,000 per year for sixteen years equals $432,000, you are correct.

However, you will not simply save this money and let it accumulate dust; you will invest it to make it work for you.

By investing in the stock market, I do not mean making high-risk investments, learning how to day trade, or spending 10 hours per day analysing stock charts.

I’m referring about passive investments with an average annual return of roughly 10 percent. Which brings us to the following stage. Moving forward to Step 4.

#4. Generate a 10% average return over a 16-year period.

Now that you’ve committed to saving a significant amount of your income, it’s time to put those funds to work through the power of investment and compound interest.

If you achieve an average return of 10% on your investments during this 16-year period, you will have approximately $1,014,365.

In other words, you will become a millionaire. It may sound absurd, yet it is true. This is the effectiveness of compounding. Compound interest is the world’s eighth marvel. Albert Einstein said, “He who understands it, earns it; he who does not, pays it.”

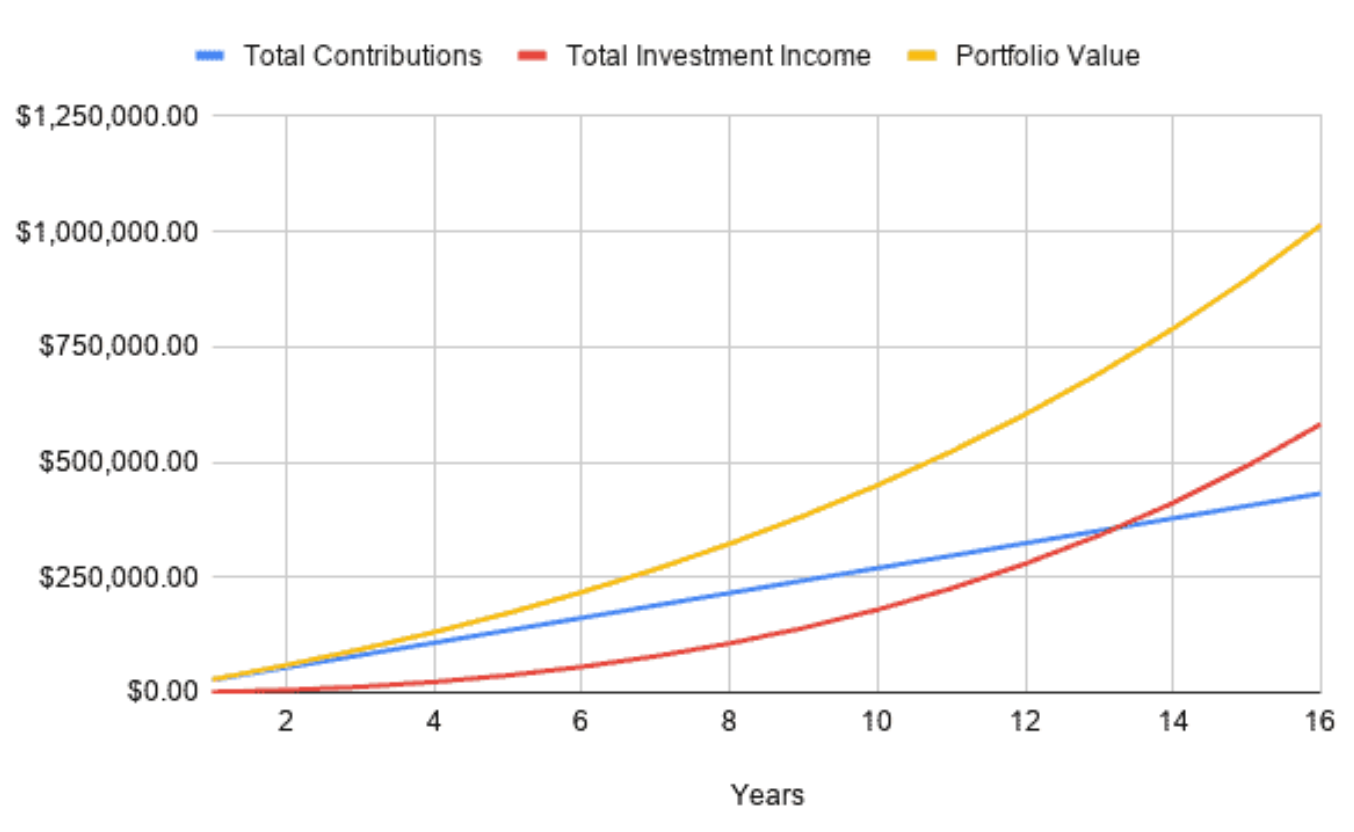

I have attached a table and a graph to illustrate how the math works out.

Clearly, the arithmetic works. I would not mislead you!

The millionaire club is yours after sixteen years of extremely diligent savings and good investment returns.

And we’re only talking about 16 years here; if you’re a teacher who is 30 years old, you could retire well before your 50s, can you imagine?

However, what’s the catch?

Sincerely, there is no “catch,” however I will say that stages 3 and 4 are simpler to state than to carry out.

Firstly, it is DIFFICULT to save nearly half of your pre-tax income. You will wind up storing more than you bring home.

But hey, maybe you’re a budgeting pro and this won’t be a problem for you. Or perhaps you are married and your partner also generates a substantial salary, making this step quite simple.

If that’s the case, then that’s fantastic. You must now consider how to achieve a return on investment (ROI) of 10 percent on average.

If you’ve read my blog before, you know that I don’t provide specific investment advice such as “buy in this stock or that stock” because, let’s face it, nobody knows what will happen on the stock market, not even me.

To produce an average return on investment of 10 percent over a 16-year period, you do not need to be a professional investor or to donate your money to Warren Buffett.

Keep in mind that you are not need to achieve this 10 percent return every year, as some years may be lower and others will be higher.

From 1926 through 2018, the S&P stock market index, which represents a broad picture of the entire economy, returned approximately 10 to 11 percent annually.

So, if you had invested in a single index fund in 1926 (hypothetically, they did not exist back then), you would have averaged a return of 10 to 11 percent up until 2018.

Simple and easy, right? Again, this is easier said than done, but I strongly advise investigating index funds and robo-advisors.

#5. Finally, Become a Millionaire

It takes a lot of hard work to become a millionaire as a teacher, so celebrate your achievement with a drink and a high five.

However, you still need to be prudent with your finances.

A million dollars is a substantial amount of money, and depending on your lifestyle and age, it may last you the rest of your life – but you must be cautious.

Things to be careful of:

- Family members who want money

- Sleazy financial sales people

- Taxes

- Don’t buy what you don’t need – Large impulsive purchases

Determine your desired lifestyle after consulting with a trusted financial advisor on the best method to handle your finances.

Are you going to keep working? Retire? Do you work part-time? Move overseas? Who can say!

The beautiful thing about being a billionaire and having money is that you have the ability to make decisions based on what you want to do, as opposed to what you are required to do due to financial commitments.

At What Specific Age Can a Teacher Become a Millionaire?

Okay, so you now know that it is indeed possible to become a billionaire on a teacher’s income.

But at what age may a teacher acquire millionaire status?

Actually, it depends. It depends on numerous variables.

The five-step approach outlined above assumes you earn $70,000 per year, are prepared to save 45$ of your salary, and are patient enough to wait 16 years.

However, what if these assumptions do not correspond with your current circumstances or future objectives? Okay, that’s fine!

You can set your own timetables for when you want to become a millionaire depending on your own particular circumstances, which I will detail below.

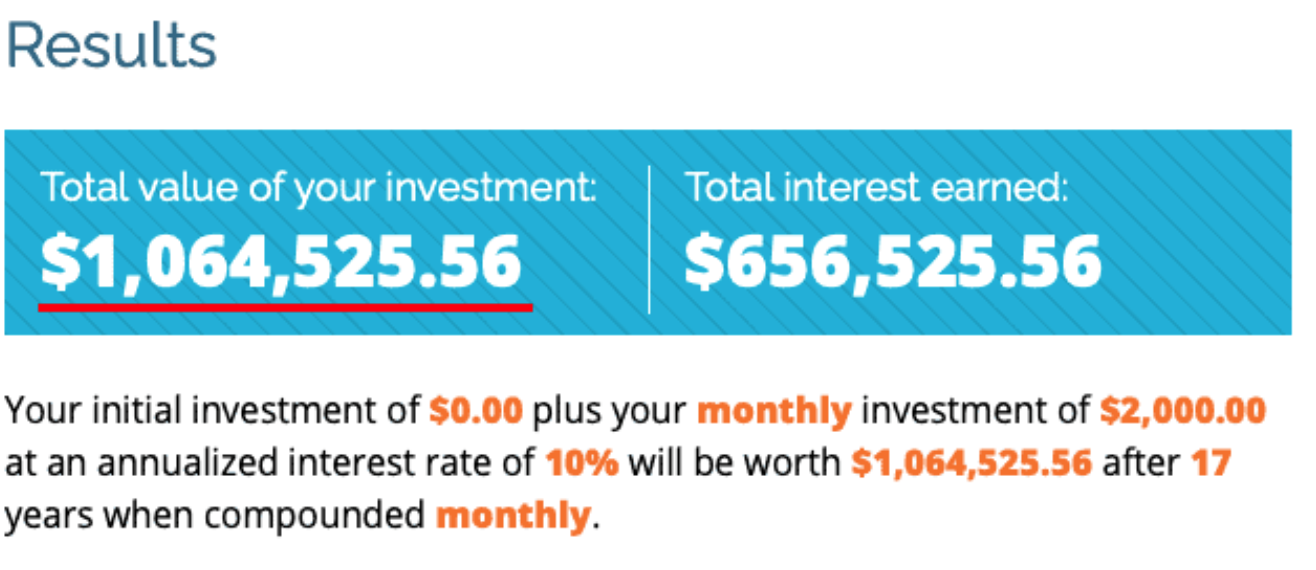

Follow the link to the Compound Interest Calculator and fill up each field as indicated below.

If you have already invested funds, include them in the Initial Investment section.

For Monthly Addition, enter the amount of money you intend to invest each month. If you intend to save and invest $24,000 each year, you would enter $2,000 in this section.

The Interest Rate field follows.

Now, investment income produced through stocks is not interest, thus you may disregard the fact that the field is named Interest Rate.

Simply imagine that it refers to your return on investment; everything will work out the same.

Therefore, in this industry, everything depends on the ROI you anticipate from your investments. If you are extremely risk-averse, it may only be 4 to 7 percent.

If you, like me, are risk-tolerant but yet need security, an annual return between 8 and 10 percent is fair.

If you are risk-seeking like my buddies, you could invest between 11 and 15 percent in this industry. However, I would not recommend striving for such a high ROI over an extended period of time, as it is quite dangerous and could result in significant losses.

In conclusion for Years to Grow – What age do you hope to become a millionaire?

Age 40? 45? 60? Who can say! Only you.

Use the difference between the age at which you intend to become a millionaire and your current age to calculate your growth rate.

Provide a timeline that you believe is reasonable. Obviously, you cannot become a millionaire by saving and investing 10 percent of your income for three years.

After completing these steps, click Calculate to view the total worth of your investment if you adhered to this strategy.

If it’s more than $1,000,000, then stick to this plan and you’ll become a billionaire at your desired age.

If you prefer your strategy more, you can completely disregard my 5-step procedure. I will not know!

If the total value of your investments is less than $1,000,000, that’s fine, but you’ll need to change at least one of the following.

Either increase your monthly contributions, boost your average return on investment, or let your money grow over a longer period of time (let compound interest work its magic).

So experiment with these values until you find a solution that works for you.

Final Conclusion

Consequently, becoming a billionaire as a teacher is a highly attainable objective.

Work, save, and invest repeatedly. That’s the end of it.

Repeat this process often, and you will finally reach your goal.

Despite the fact that it may take longer than you anticipated and the process will undoubtedly have its ups and downs, I’m confident that it will be a rewarding experience.

There are other ways for a teacher to become a billionaire besides long-term investing.

You could win the lottery, marry into a wealthy family, or receive a substantial bequest, but what are the odds?

There is a chance, although it is minor compared to the way I described previously.

If you win the lottery or inherit $40 million from a distant relative like Longfellow Deeds, then congratulations! Ignore all of my advice and live your greatest life as a billionaire educator.

Fact Check

We strive to provide the latest valuable information for our readers with accuracy and fairness. If you would like to add to this post or advertise with us, don’t hesitate to contact us. If you see something that doesn’t look right, contact us!