How to Calculate Your Loan to Value Ratio

When calculating your mortgage rate, it is important to understand what your loan-to-value ratio is. Lowering your LTV can reduce your risk of default. A 20% down payment is more likely to be permanent than a 3% down payment.

Learn more about LTV ratios in mortgages and home equity lines of credit. This article will walk you through how to calculate your LTV. It will also give you tips for choosing a lender.

Calculating loan to value ratio

When calculating the amount of a mortgage, a lender will consider several factors in determining the Loan to Value Ratio, or LTV. These factors include the size and condition of the house or property, recent improvements, and other aspects.

A higher LTV means the lender is more likely to accept your loan application, but it may also mean a higher interest rate.

Depending on the type of loan, you can expect to pay an interest rate as high as 20%, although some banks do not require valuations for certain types of loans.

The loan to value ratio is a measure of the risk a borrower poses to the lender, and it is used to determine whether the mortgage is worth the amount borrowed.

The lower the ratio, the better for the homeowner. On the other hand, a higher LTV is a risky investment.

However, this is a good starting point for homeowners who plan to make improvements to their home in the near future. Using a loan to value ratio calculator is an excellent way to determine the exact ratio of a mortgage.

LTV is a metric used by lenders to gauge the risk associated with a loan. Higher LTVs make the lender’s loan more risky.

A low LTV allows the lender to extend more credit while limiting the risk. In addition, a low LTV gives the borrower some cushion if the lender does not get his money back. While a low LTV is better for the borrower, a high LTV is better for the lender.

Impact of LTV ratio on interest rate

If you’re thinking about purchasing a home, you may be concerned about the impact of loan to value ratio (LTV) on your interest rate. Although lower LTVs are typically better for long-term interest rates and lending terms, they may not be as good for borrowers who are averse to debt.

However, there are ways to lower your LTV without sacrificing your ability to make the monthly payments.

The first step to lowering your loan-to-value ratio is to make a larger down payment. This will decrease your loan-to-value ratio and reduce your overall borrowing costs.

A higher down payment will increase the amount of equity you have in your home, which will lower the interest rate and make your loan more affordable. A high LTV can also result in a higher monthly payment, which may not be affordable for some buyers.

Another option is to increase your down payment. If you can’t afford to put a larger down payment, consider looking for a less expensive home. This will decrease your LTV and reduce your monthly payments.

You may even be able to make a smaller down payment if you can offer the seller a lower price in exchange for the home. This strategy may work, but it requires patience and extra money.

Impact of LTV ratio on home equity line of credit

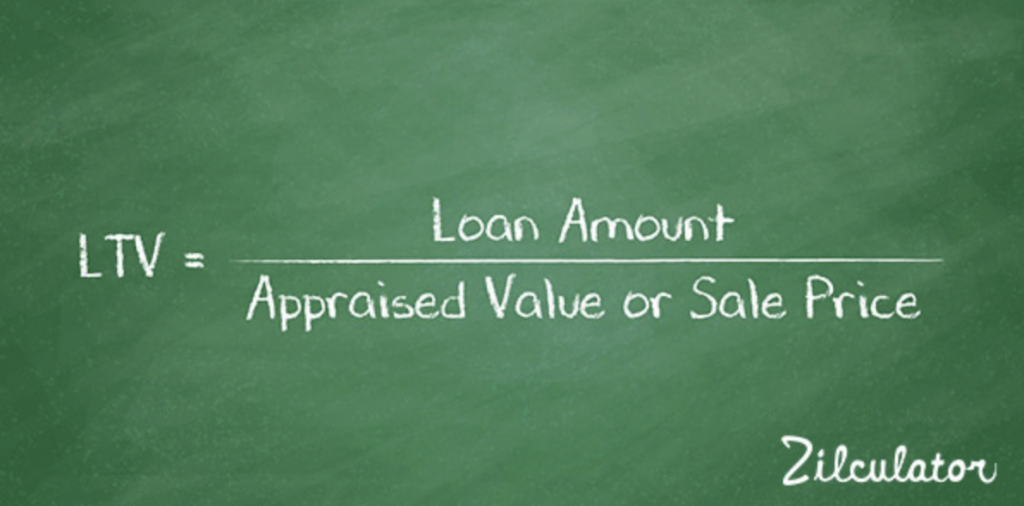

To calculate your loan to value ratio, divide the total amount borrowed by the appraised value of the property.

If the property is worth $240,000, your loan to value ratio is 80 percent. The loan to value ratio is one of the many criteria lenders use to determine loan approval.

A higher loan to value ratio will result in higher payments that may stretch your budget and make the loan more expensive over time. As you pay off your principal, your loan to value ratio will decrease.

The loan to value ratio is often referred to as the LTV. It is calculated based on the total amount of debt secured by your property.

A low LTV means that your home is worth a large enough amount to qualify for a home equity line of credit.

When determining your loan to value, try to keep your debt to property ratio below 50 percent. This will help you qualify for the lowest rate home equity loan or line of credit available.

Although there are exceptions to the rule, most lenders use an 80% combined LTV as a general guideline.

A high CLTV may mean high interest rates, but if you have enough equity in your home, you can refinance at a lower rate. Understanding how LTV and CLTV ratio affect home equity loans will help you determine how much of your equity you can use.

Maintaining your credit score will help you lock in competitive rates and minimize your risk of losing your home to foreclosure.

Did you enjoy reading this article? If so, check out more today!

Fact Check

We strive to provide the latest valuable information for our readers with accuracy and fairness. If you would like to add to this post or advertise with us, don’t hesitate to contact us. If you see something that doesn’t look right, contact us!