How to create a mortgage calculator in Microsoft Excel

When it comes to mortgage-related expenses like interest and monthly payments, one of the most useful features of Excel is its ability to calculate them.

Even if you are not highly familiar with Excel operations, creating a mortgage calculator in Excel is a straightforward process.

This article will show you how to design a mortgage calculator as well as an amortization schedule in Microsoft Excel using the formulas provided.

Method No. 1

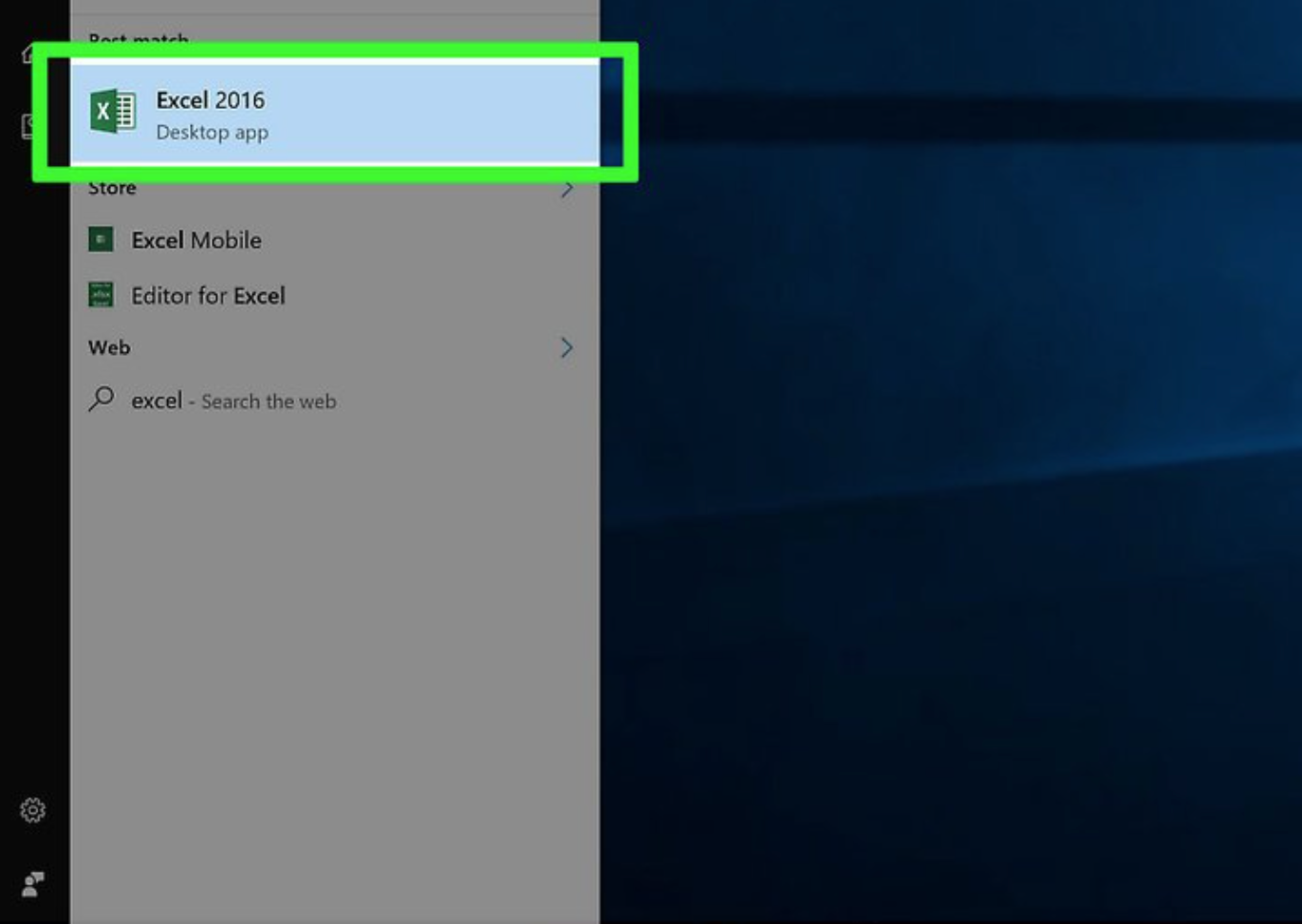

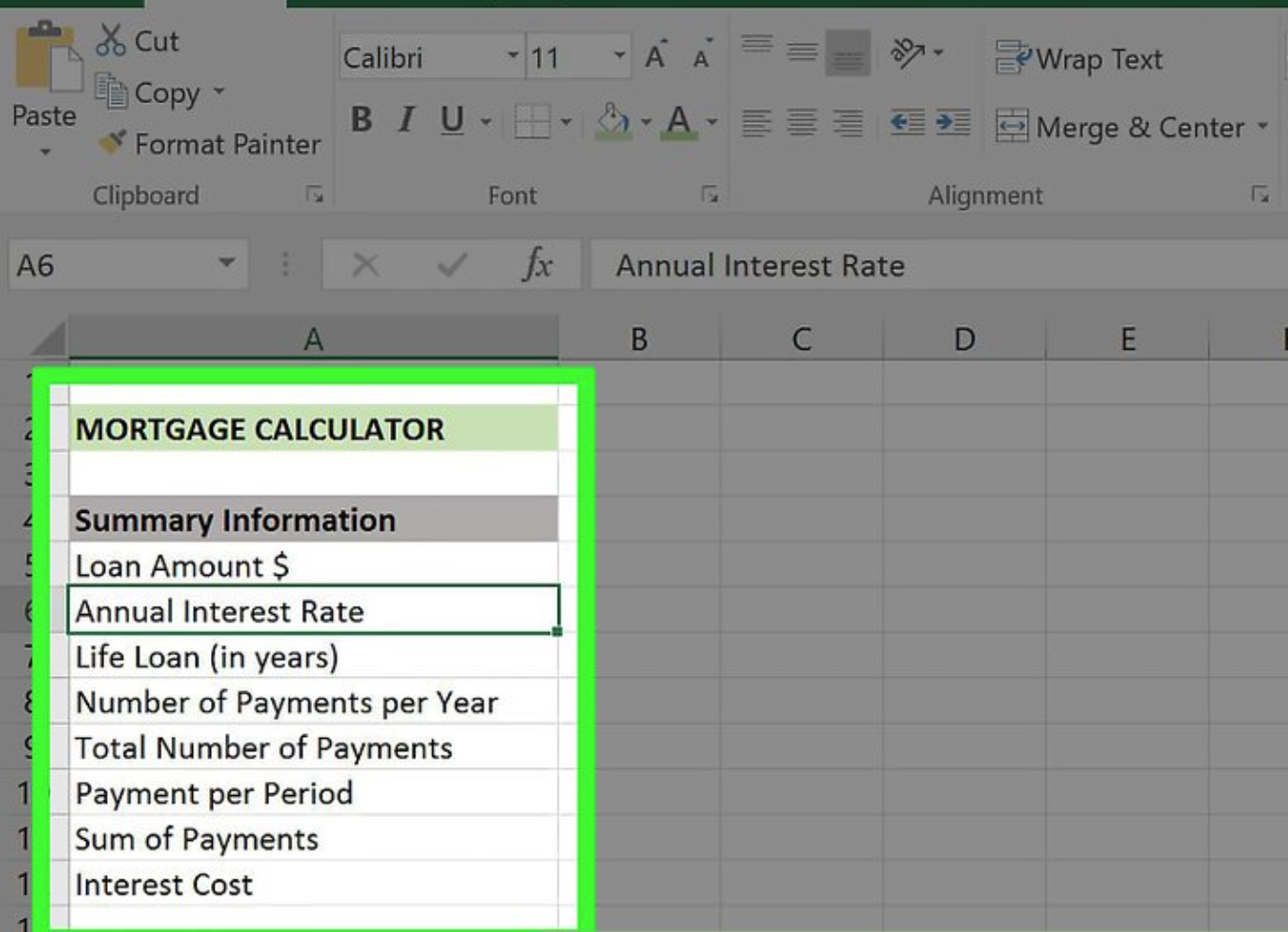

#1. Creating a Mortgage Calculator

- Loan Amount $

- Annual Interest Rate

- Life Loan (in years)

- Number of Payments per Year

- Total Number of Payments

- Payment per Period

- Sum of Payments

- Interest Cost

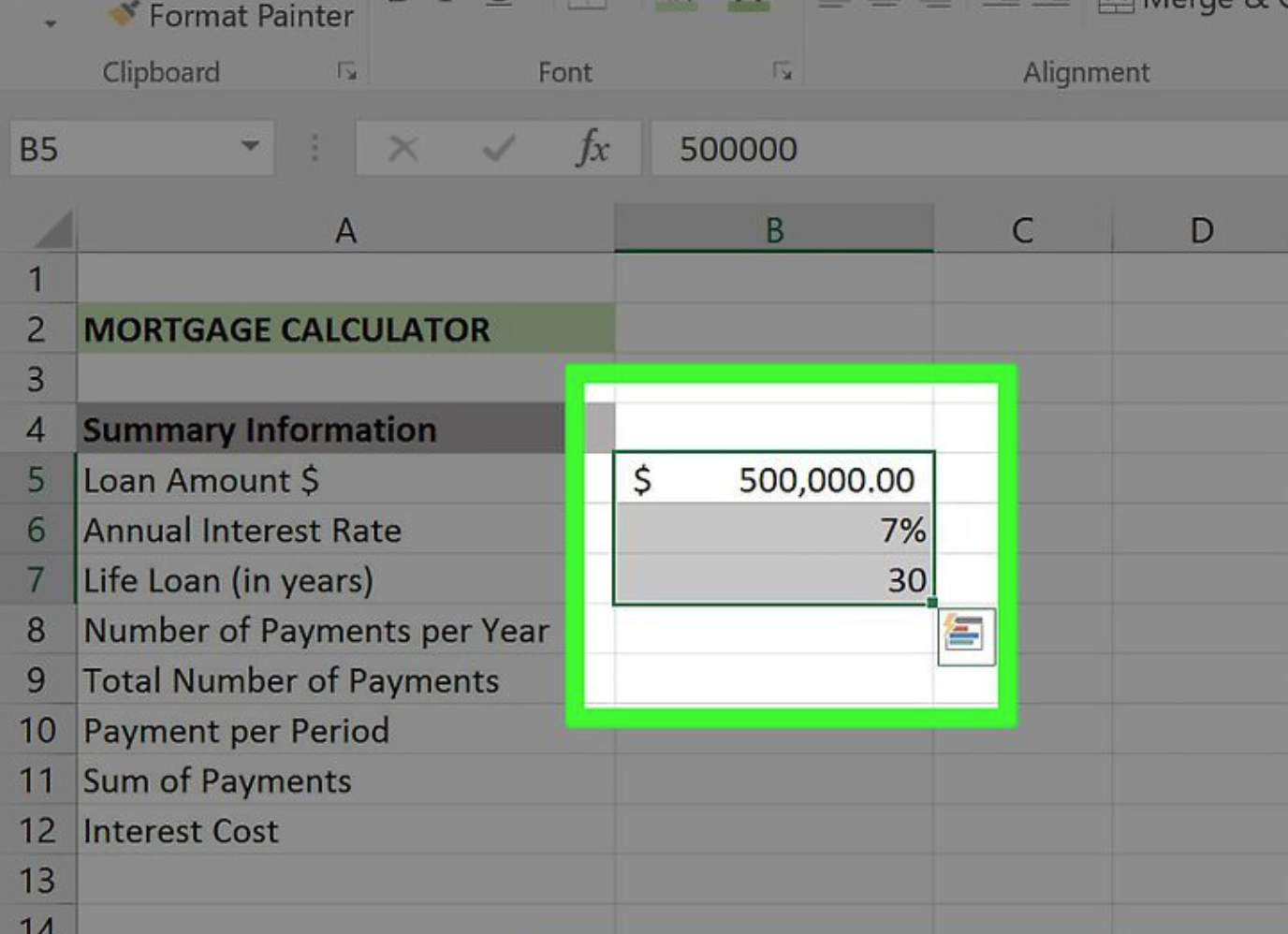

Enter your values. All of them will be placed in your “B” column, which will be just to the right of your “Categories” column.

You’ll need to fill in the blanks with the right numbers for your mortgage.

- Your Loan Amount value is the total amount you owe.

- Your Annual Interest Rate value is the percentage of interest that accrues each year.

- Your Life Loan – The loan’s worth is the period of time you have to pay it off, expressed in years.

- Your Number of Payments per Year value is how many times you make a payment in one year.

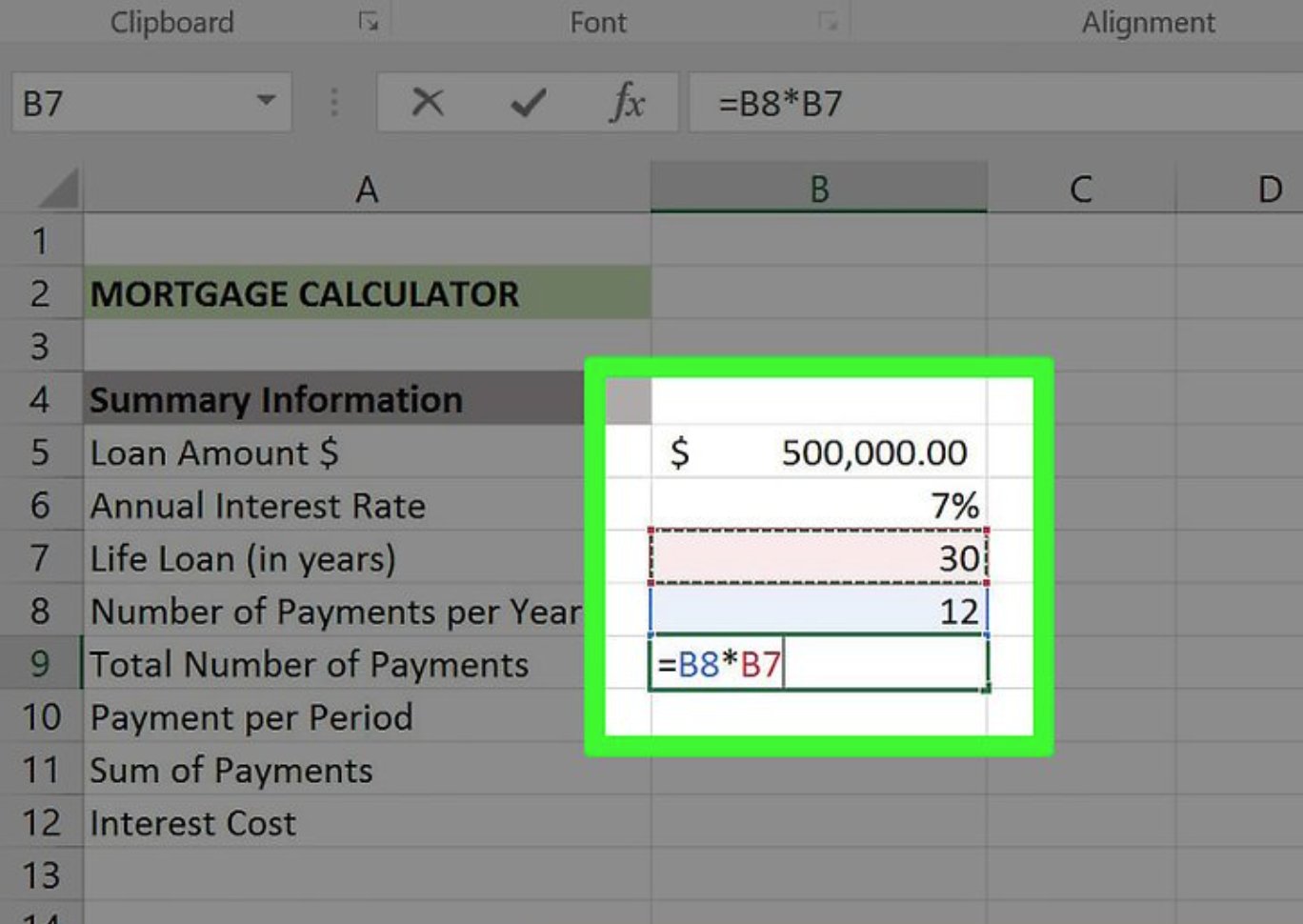

- Your Total Number of Payments value is the Life Loan value multiplied by the Payments Per Year value.

- Your Payment per Period value is the amount you pay per payment.

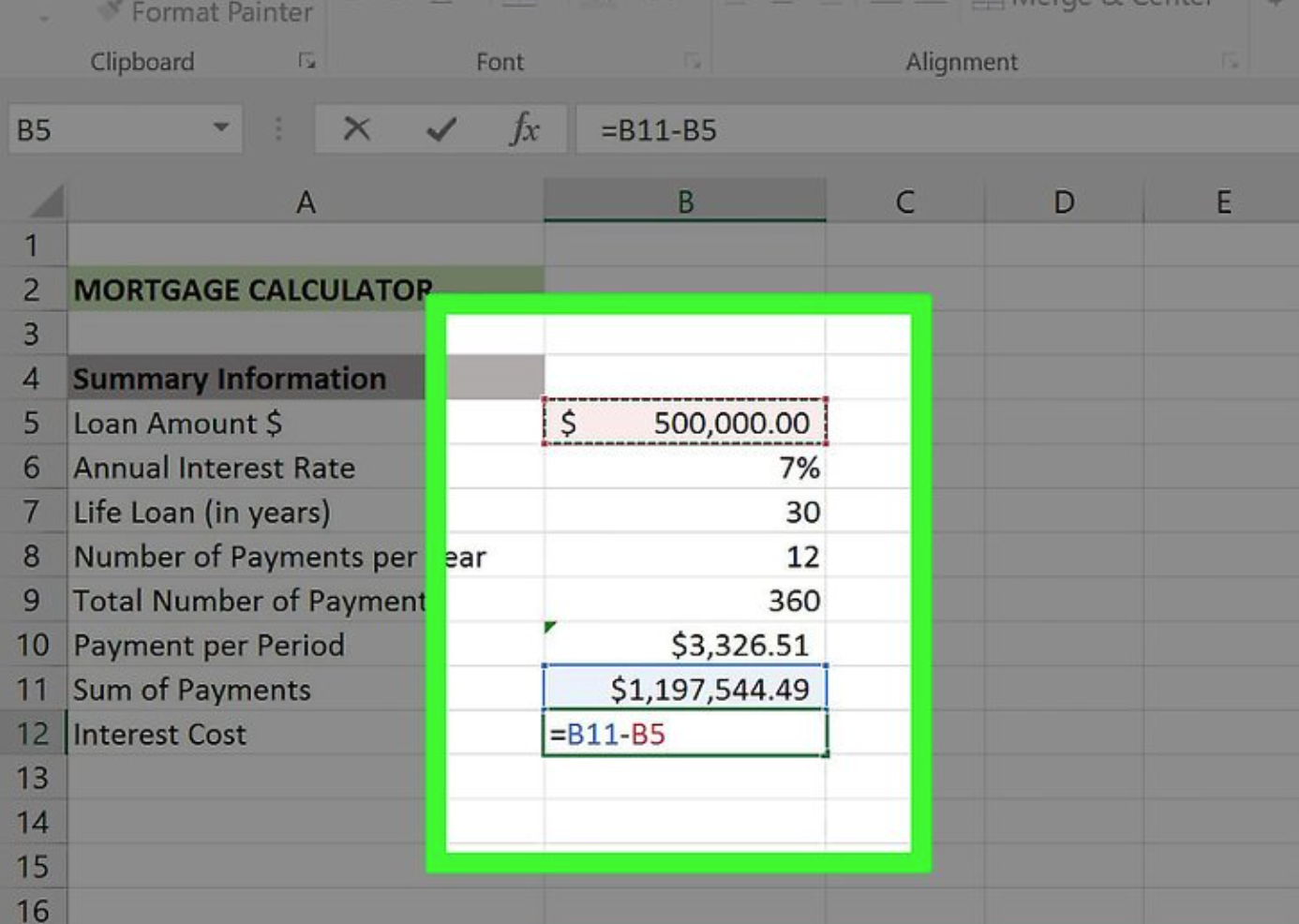

- Your Sum of Payments value covers the total cost of the loan.

- Your Interest Cost value determines the total cost of the interest over the course of the Life Loan value.

Calculate the total number of payments that will be made. It is not necessary to use a formula to compute this amount because it is equal to your Life Loan value multiplied by your Payments Per Year value.

You would enter “360” in this field if you were making a payment every month on a 30-year life loan.

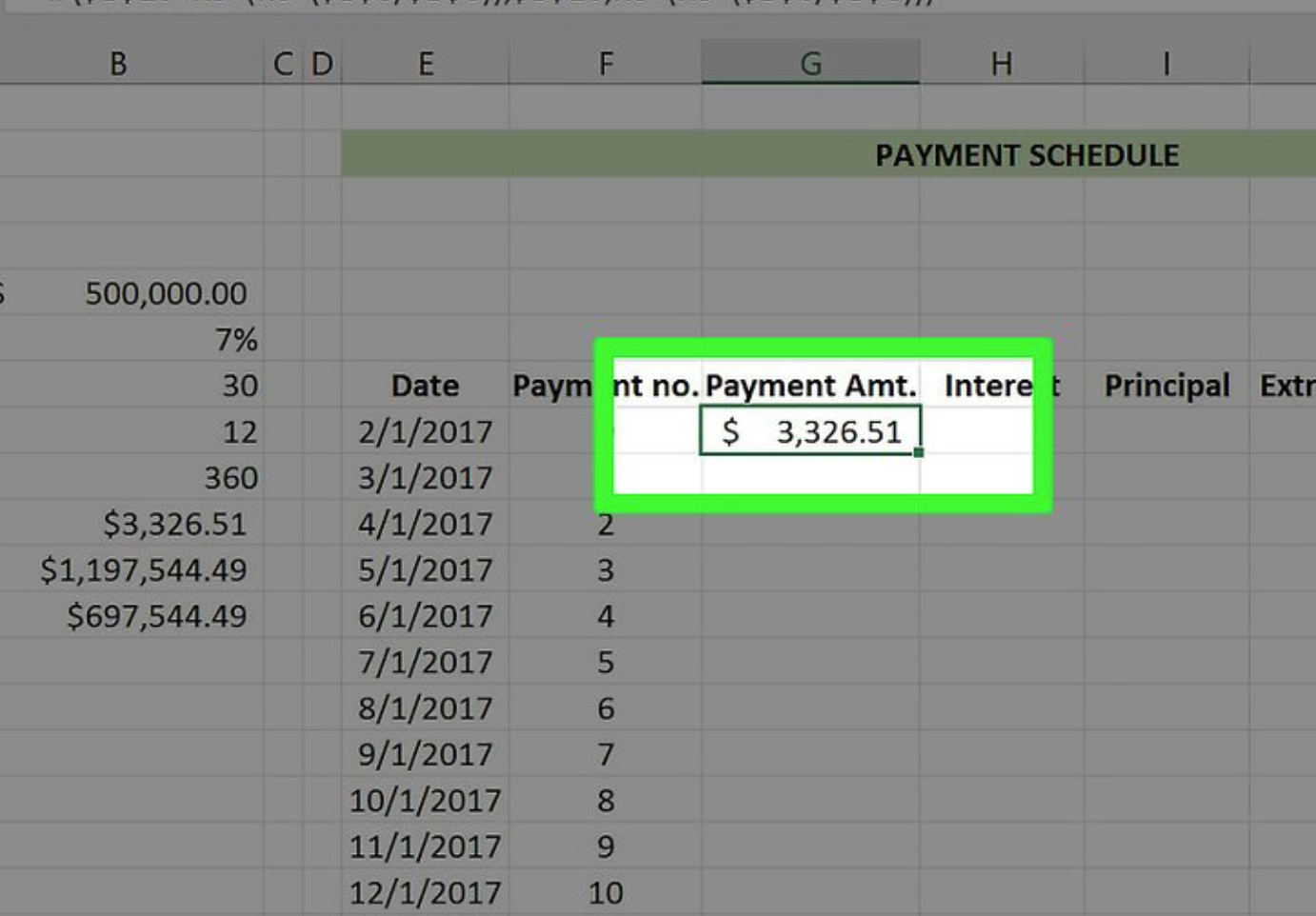

The formula is “-PMT(B6/B8,B9,B5,0)” in the screenshot supplied above. If your values are somewhat different from the ones in the table, enter them in the corresponding cell numbers.

When you place a negative sign in front of PMT, this means that PMT refunds the amount that will be taken from the amount owing to the company.

To do so, simply multiply the value of your “payment per period” by the value of your “total number of payments” value.

Consider the following example: if you make 360 payments of $600.00 each, the total cost of the loan will be $216,000.

Method 2

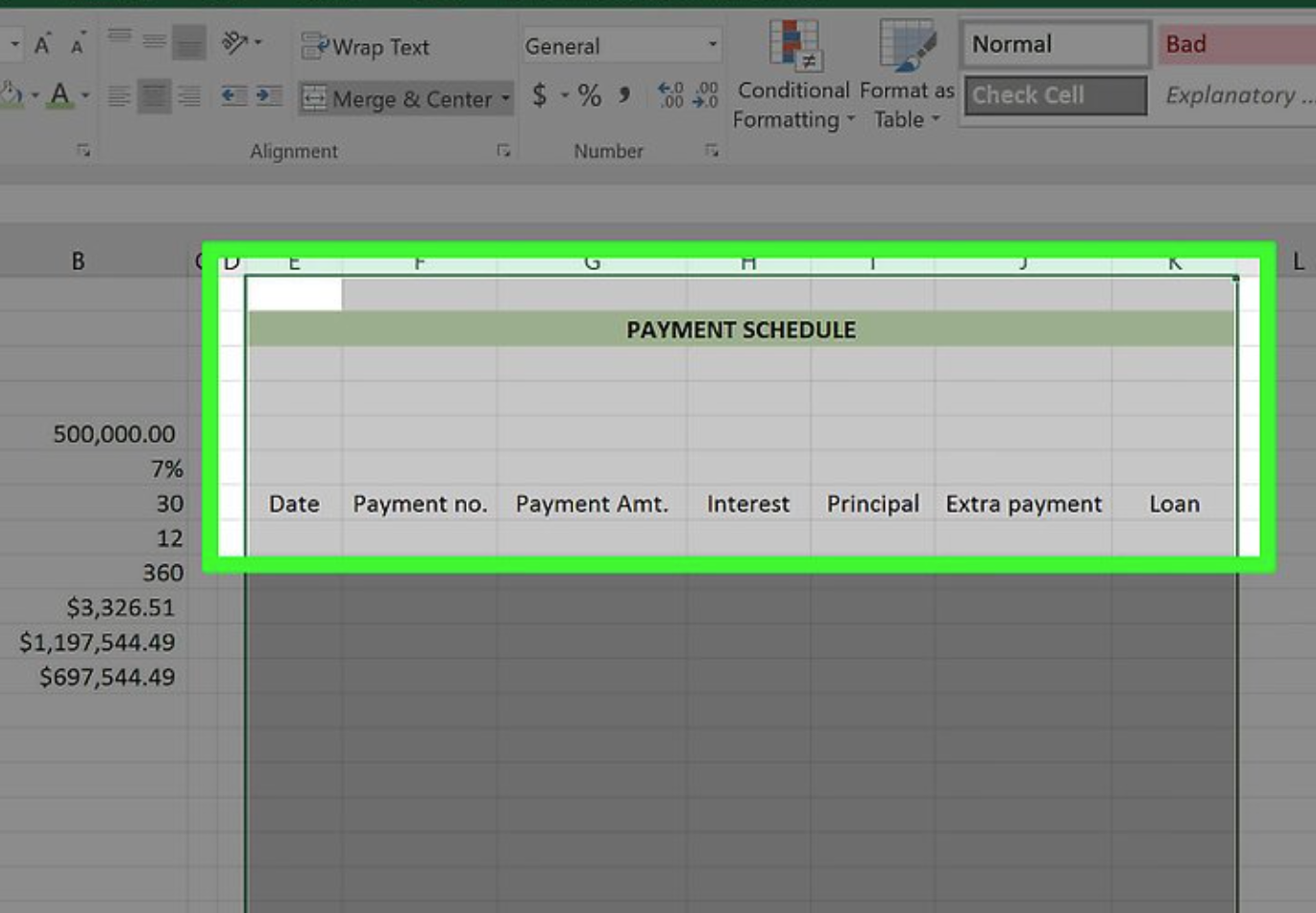

Making a Payment Schedule (Amortization)

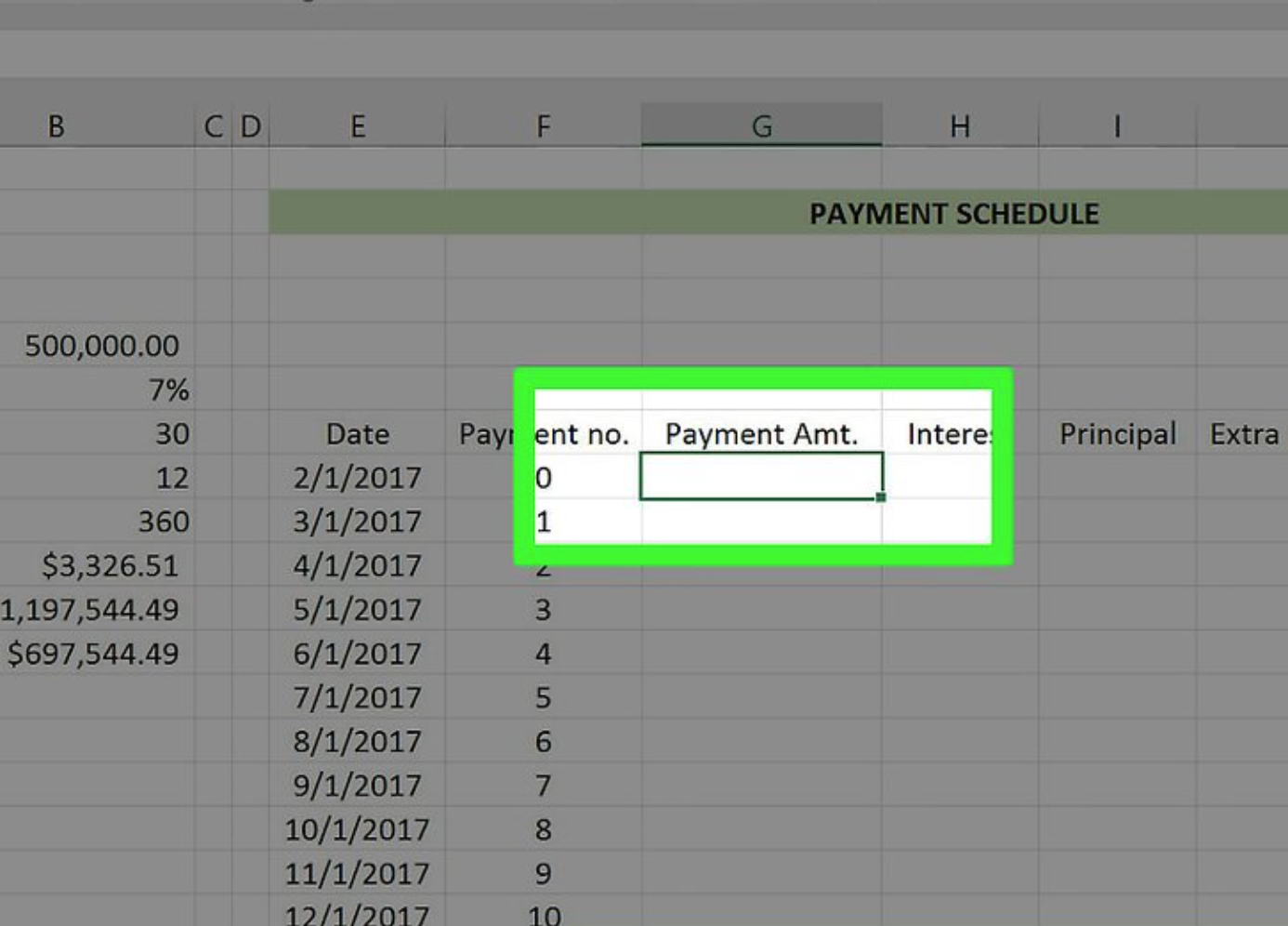

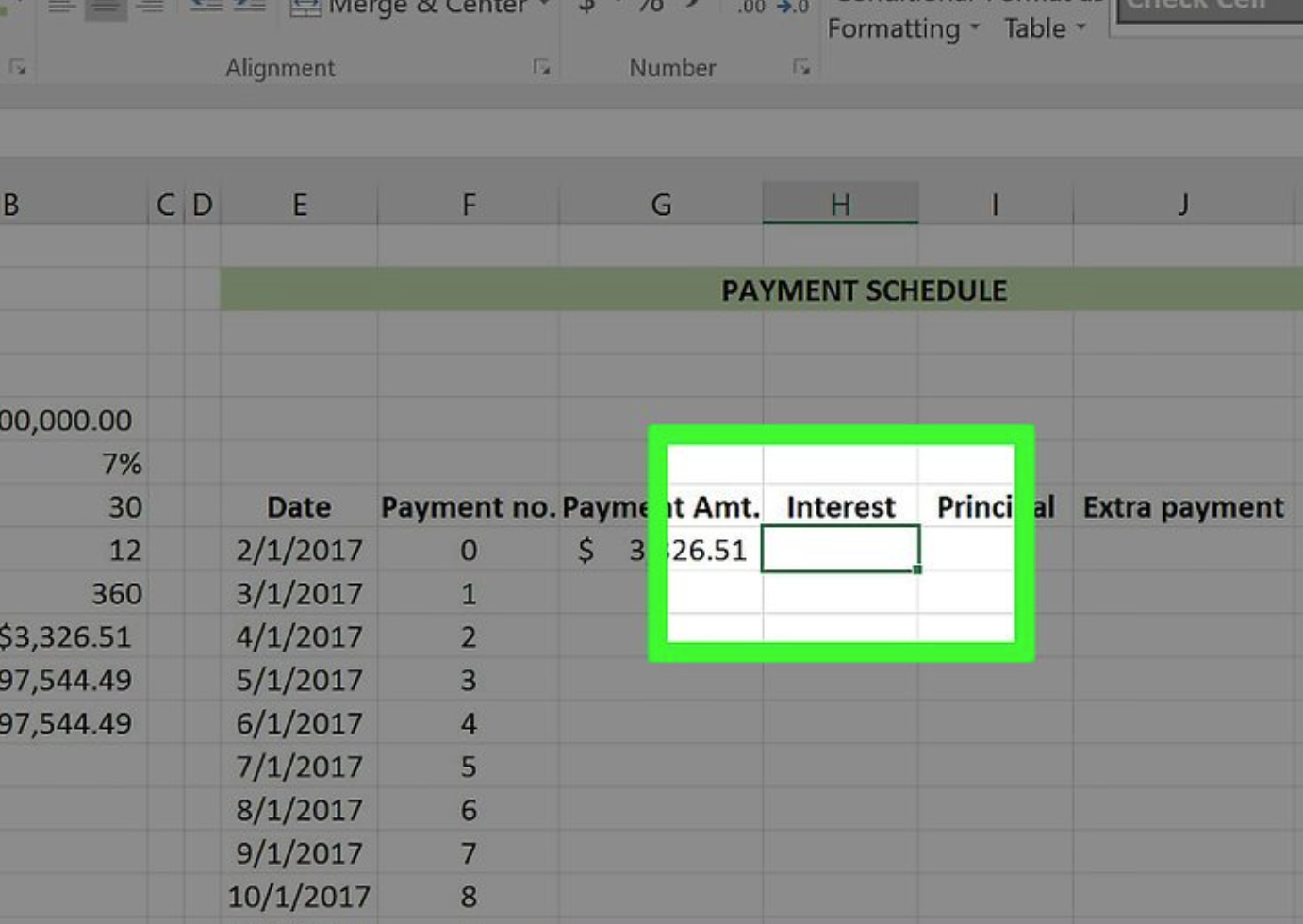

Because the Payment Schedule relies on the Mortgage Calculator to provide you with an accurate estimate of how much you’ll owe/pay off each month, both documents should be included in the same package. It is necessary to have a separate column for each of the following categories:

- Date – The date the payment in question is made.

- Payment (number) – The payment number out of your total number of payments (e.g., “1”, “6”, etc.).

- Payment ($) – The total amount paid.

- Interest – The amount of the total paid that is interest.

- Principal – The amount of the total paid with no interest (e.g., loan payment).

- Extra Payment – The dollar amount of any extra payments you make.

- Loan – The amount of your loan that remains after a payment.

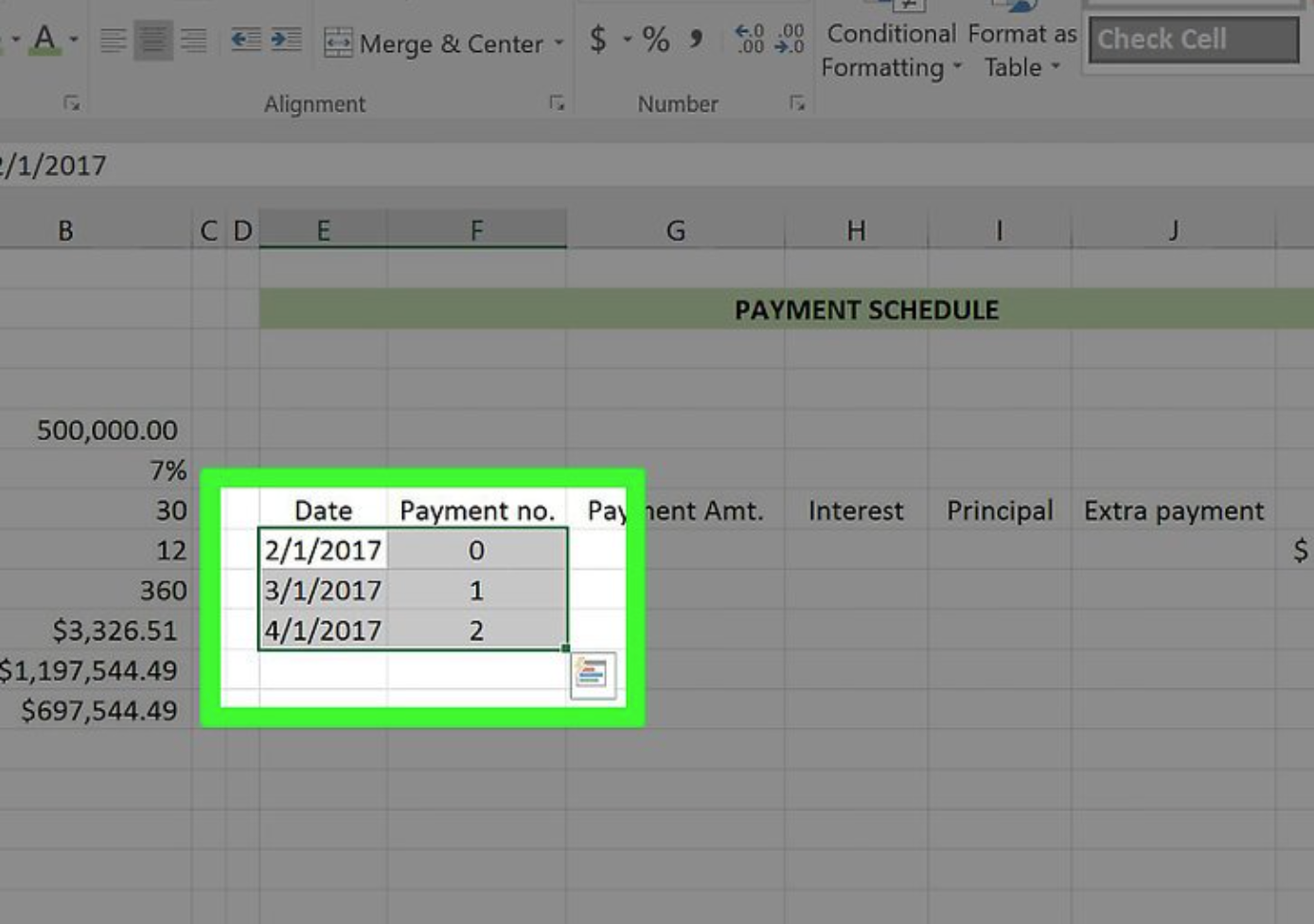

Set up the first three cells in your “Date” and “Payment (Number)” columns.

- Select the first entry in your Payment (Number) column.

- Try to drag your cursor down until you’ve highlighted the number that applies to the number of payments you’ll make (for example, 360).

- Since you have started at “0”, you’d drag down to the “362” row.

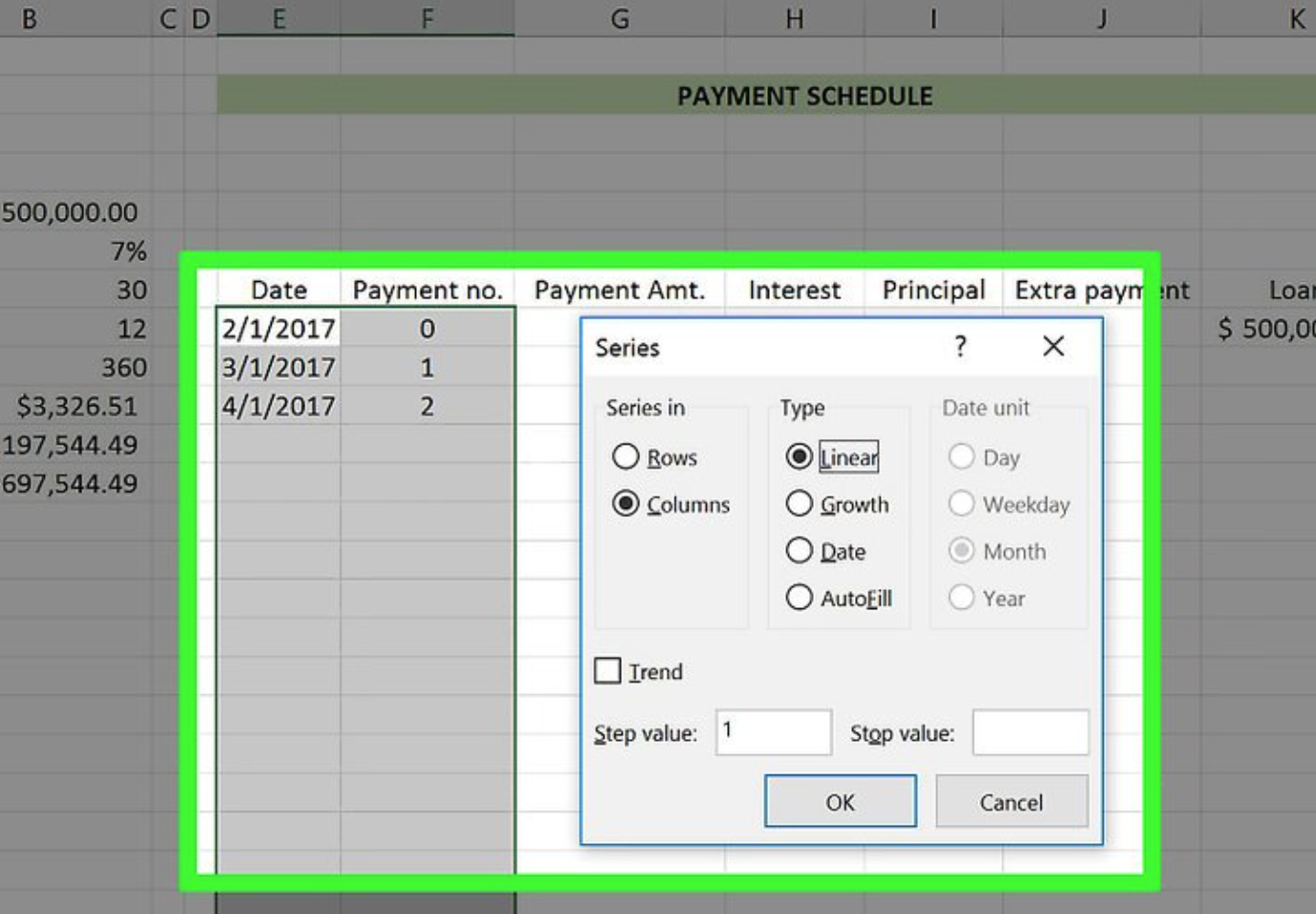

- Click Fill in the top right corner of the Excel page.

- Select Series.

- Make sure “Linear” is checked under the “Type” section (when you do your Date column, “Date” should be checked).

- Click OK.

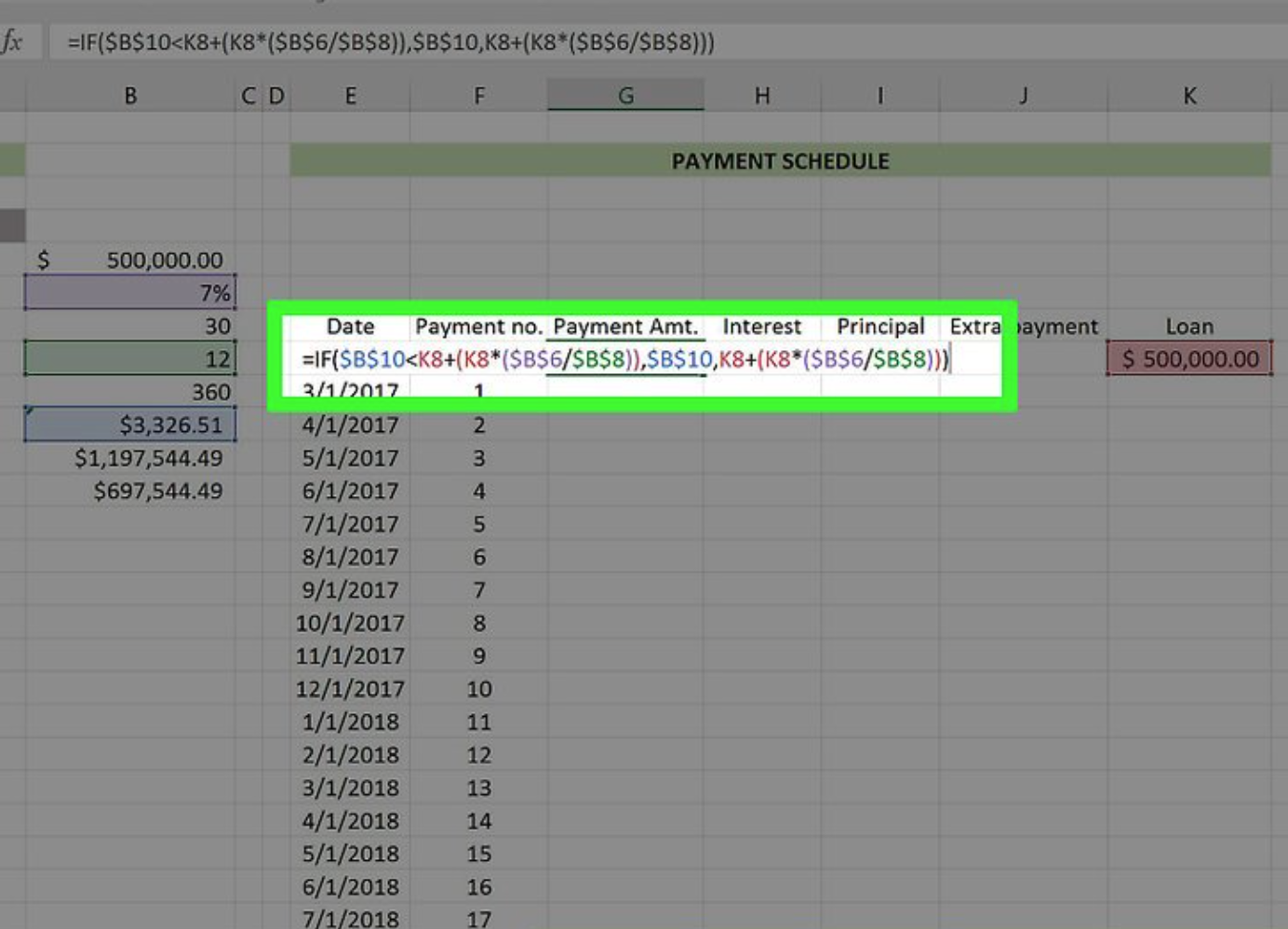

- You must preface this formula with the “=IF” tag to complete the calculations.

- Your “Annual Interest Rate”, “Number of Payments per Year”, and “Payment per Period” values will need to be written like so: $letter$number. For example: $B$6

- Given the screenshots here, the formula would look like this: “=IF($B$10<K8+(K8*($B$6/$B$8)),$B$10, K8+(K8*($B$6/$B$8)))” (sans the quotation marks).

This will populate the specified cell with the Payment per Period formula.

To ensure that this formula is applied to all consecutive cells in this column, you must employ the “Fill” option that you previously used.

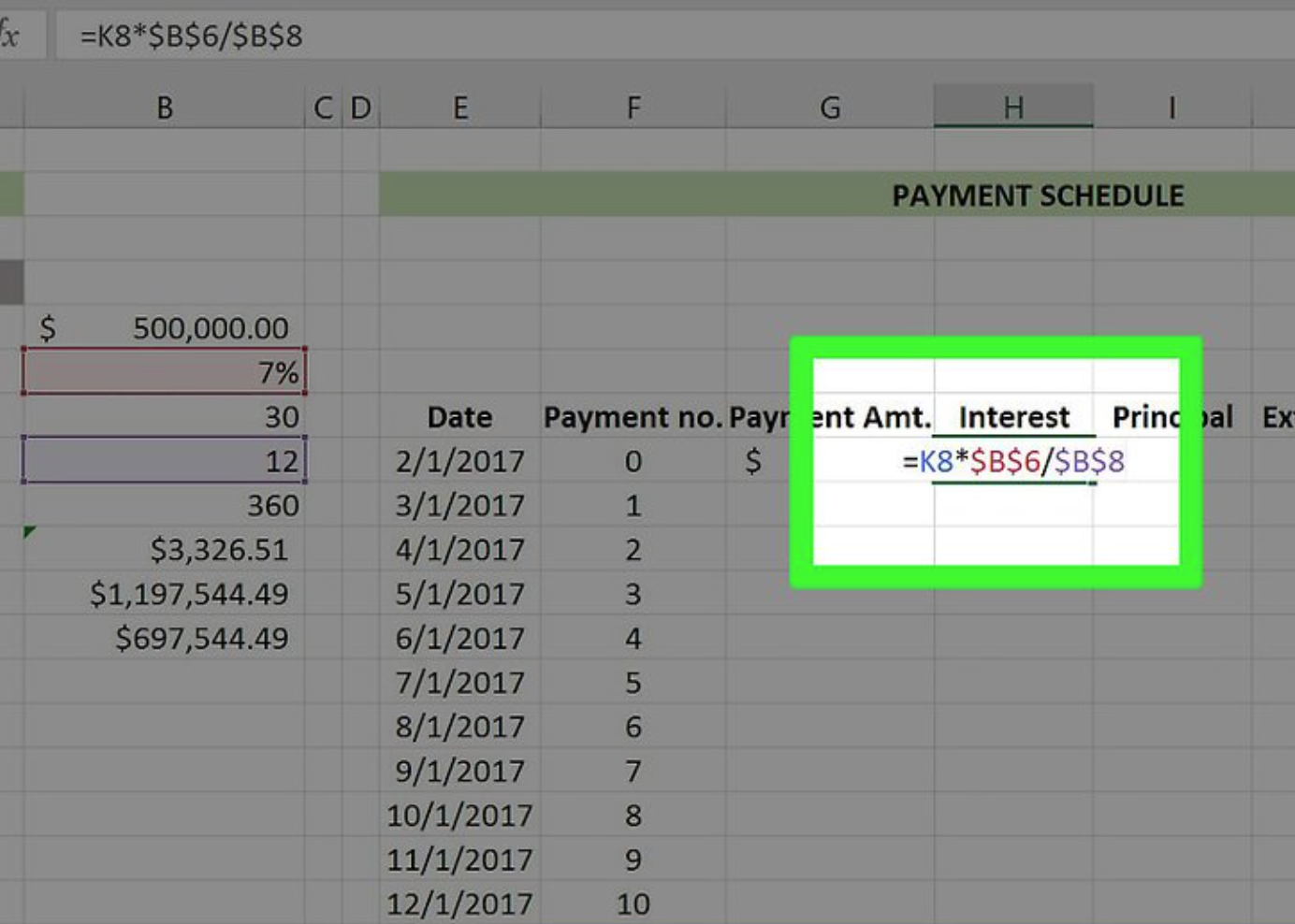

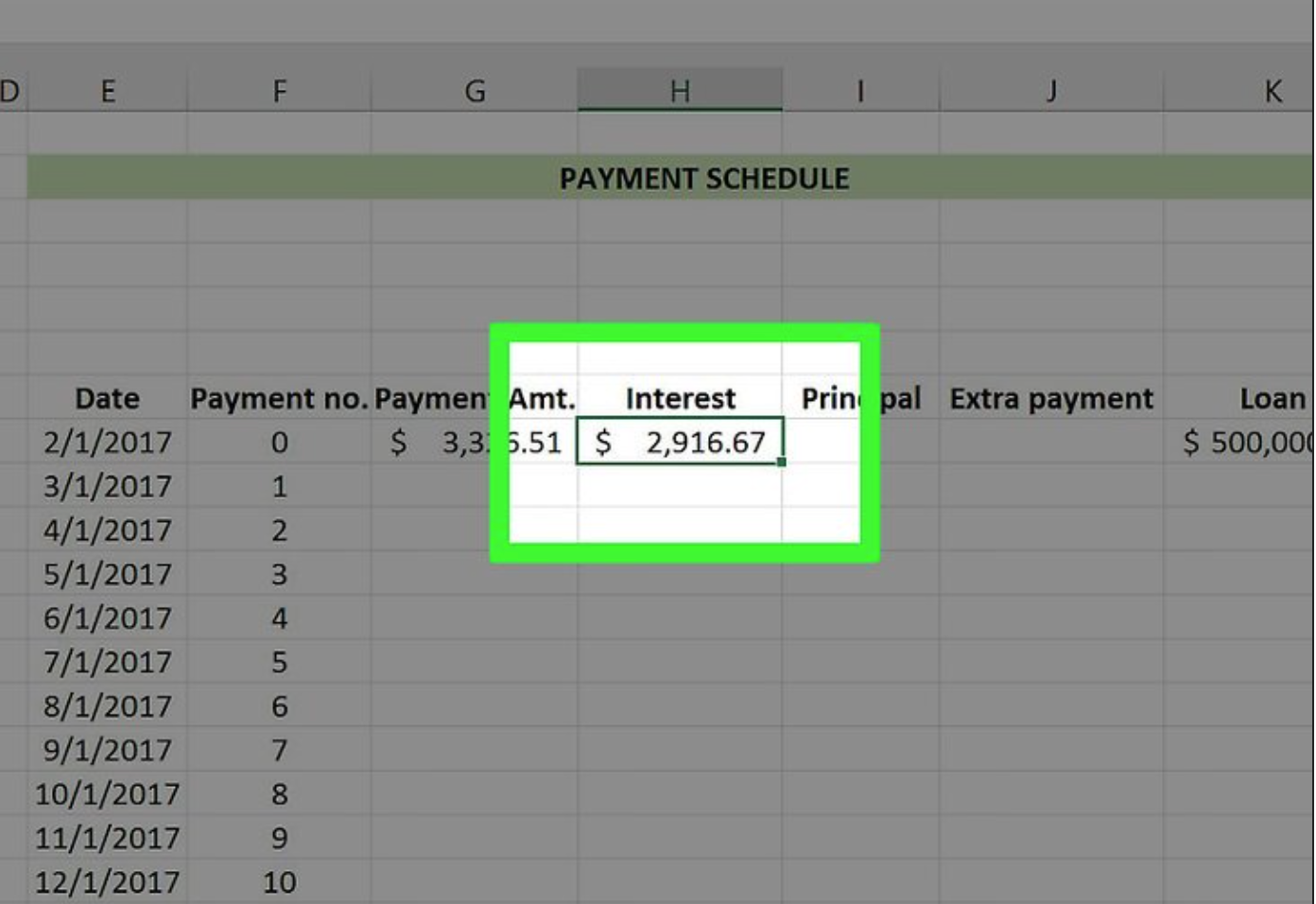

Enter the formula for calculating your Interest value.

- This formula must be prefaced with a “=” sign in order to work.

- In the screenshots provided, the formula would look like this: “=K8*$B$6/$B$8” (without quotation marks).

This will apply the Interest formula to the cell that has been selected.

To ensure that this formula is applied to all consecutive cells in this column, you must employ the “Fill” option that you previously used.

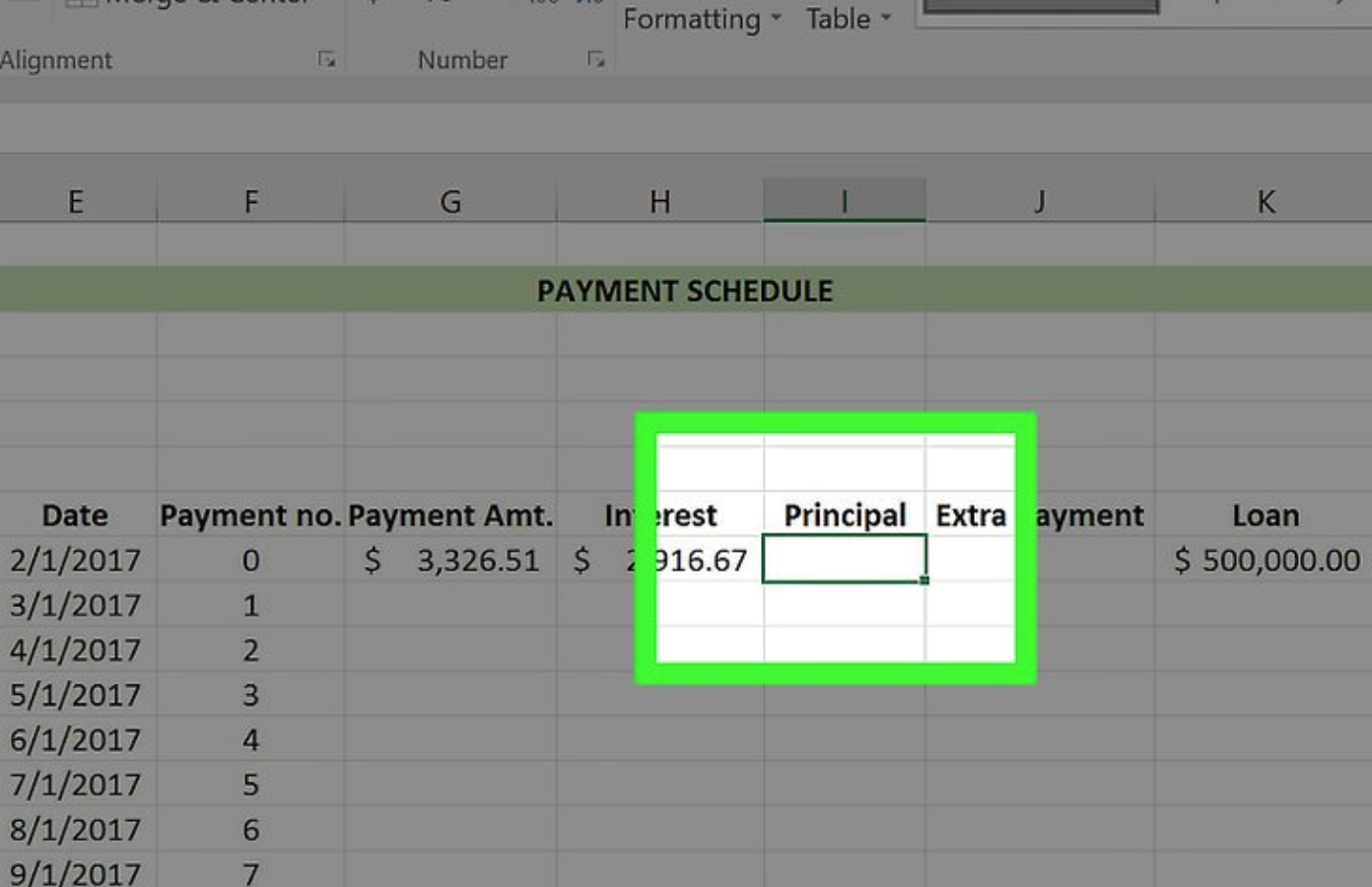

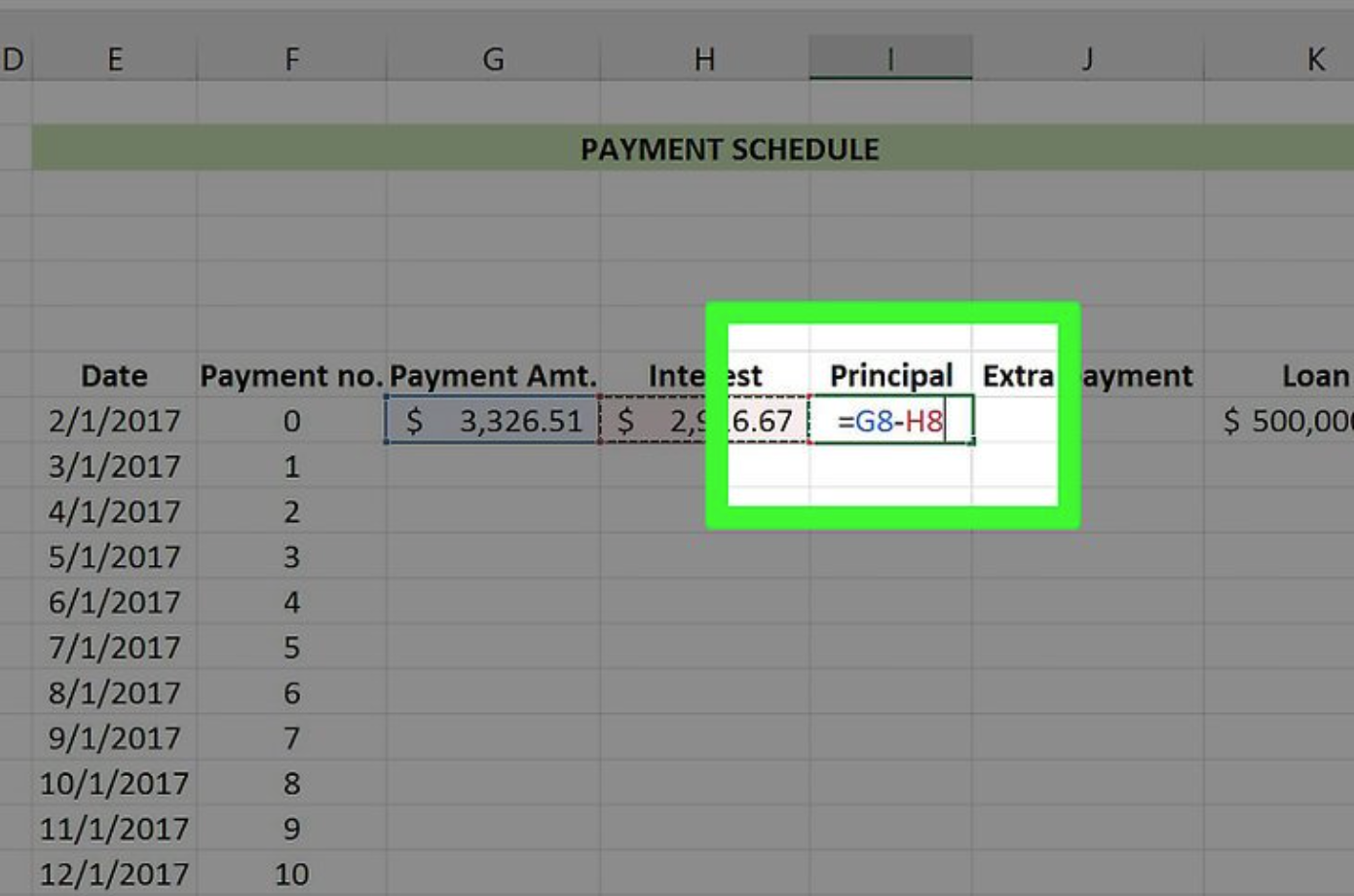

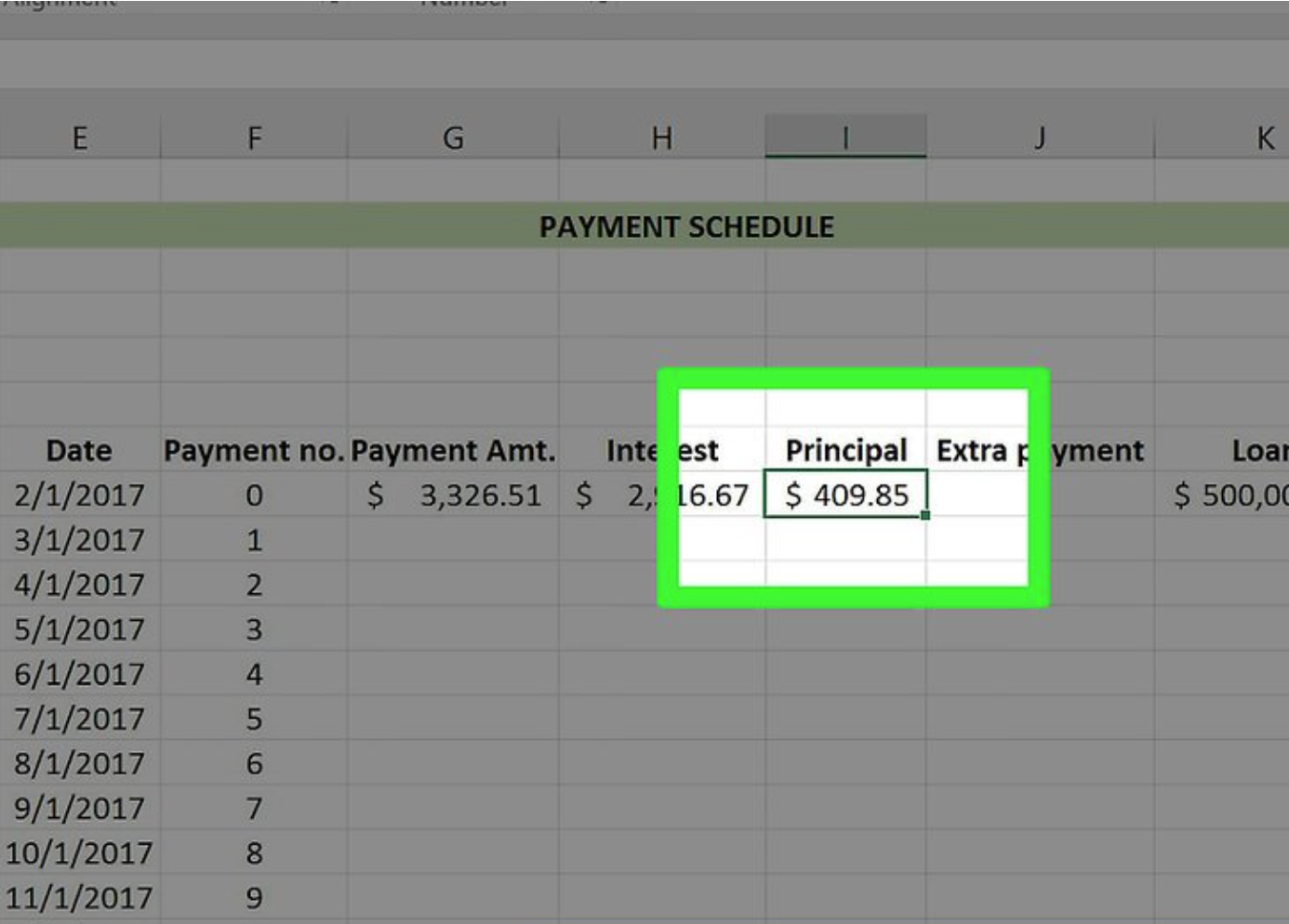

Enter the Principal formula.

- Simply deduct the “Interest” value from the “Payment ($)” value in this formula.For instance, if the “Interest” field is H8 and the “Payment ($)” cell is G8, you would type “=G8 – H8” without quotation marks.

This will apply the Principal formula to the cell that has been selected.

To ensure that this formula is applied to all consecutive cells in this column, you must employ the “Fill” option that you previously used.

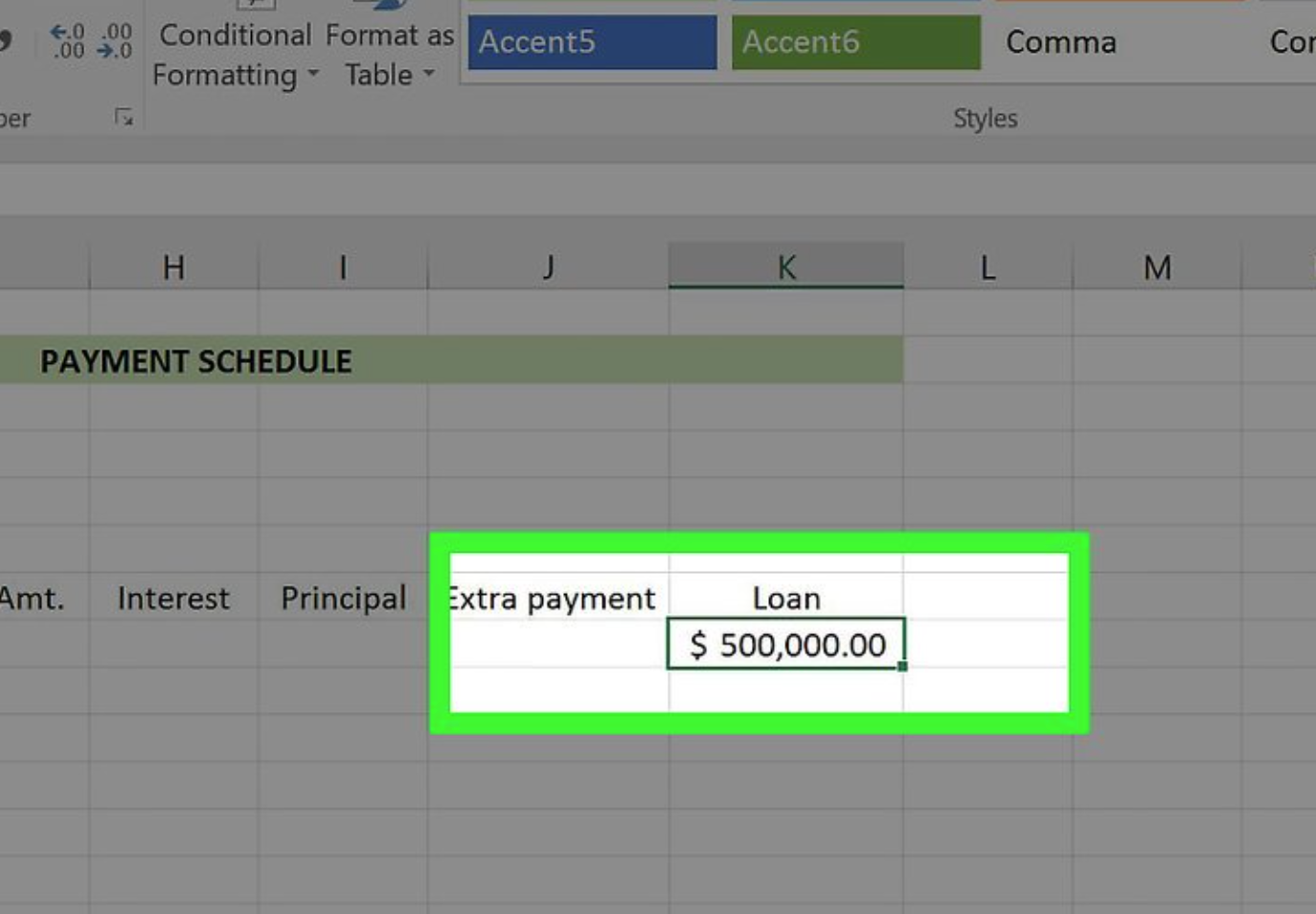

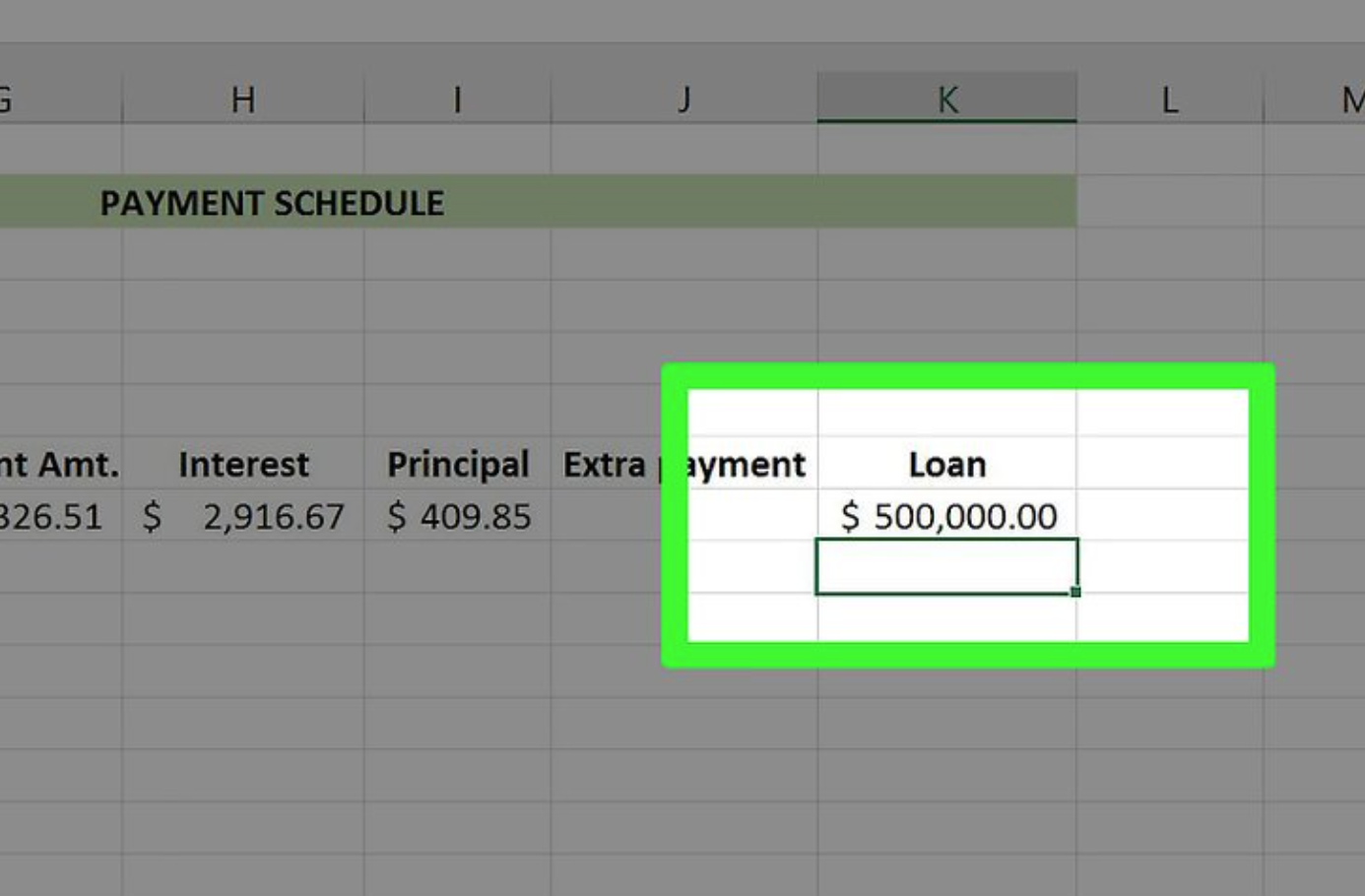

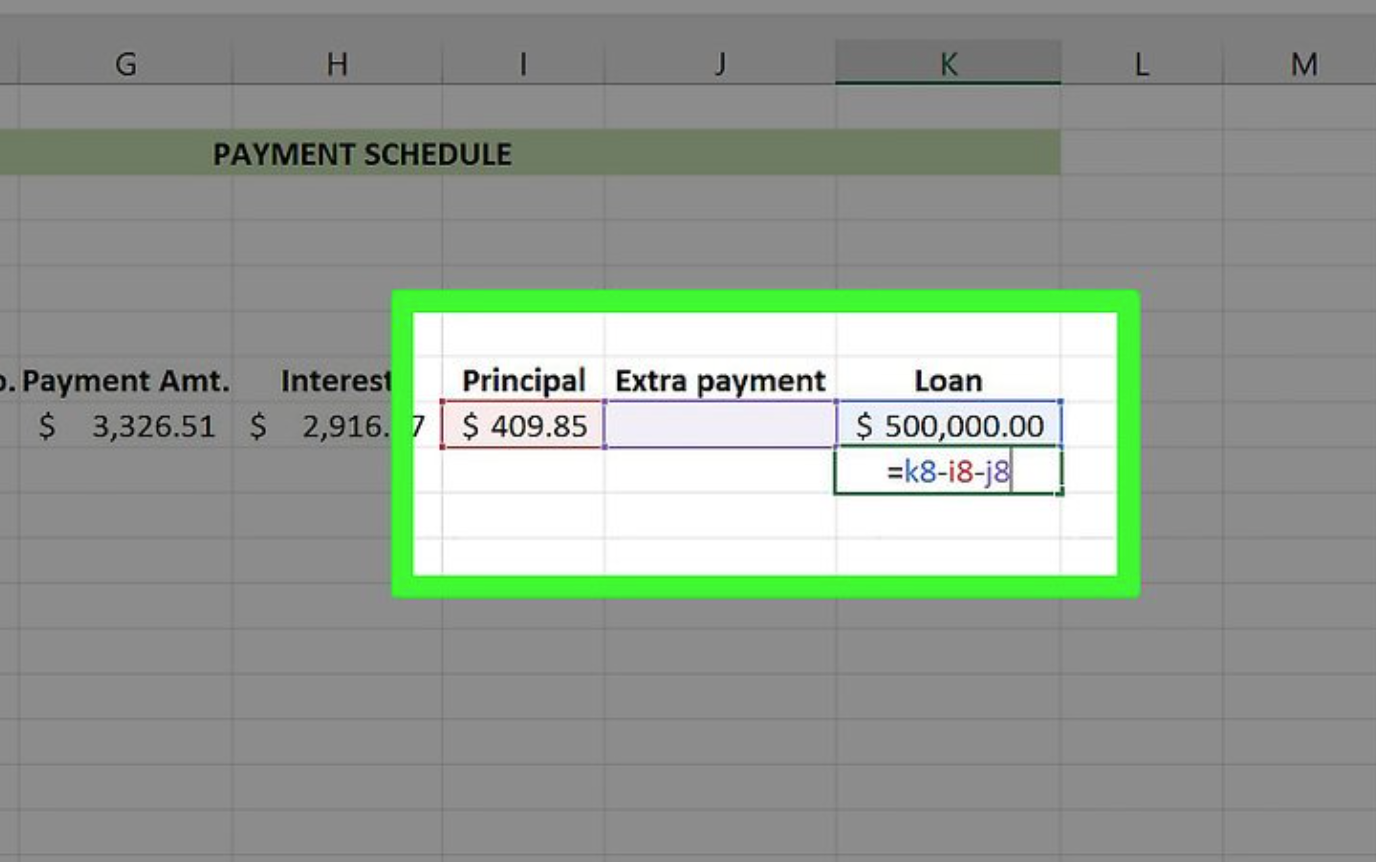

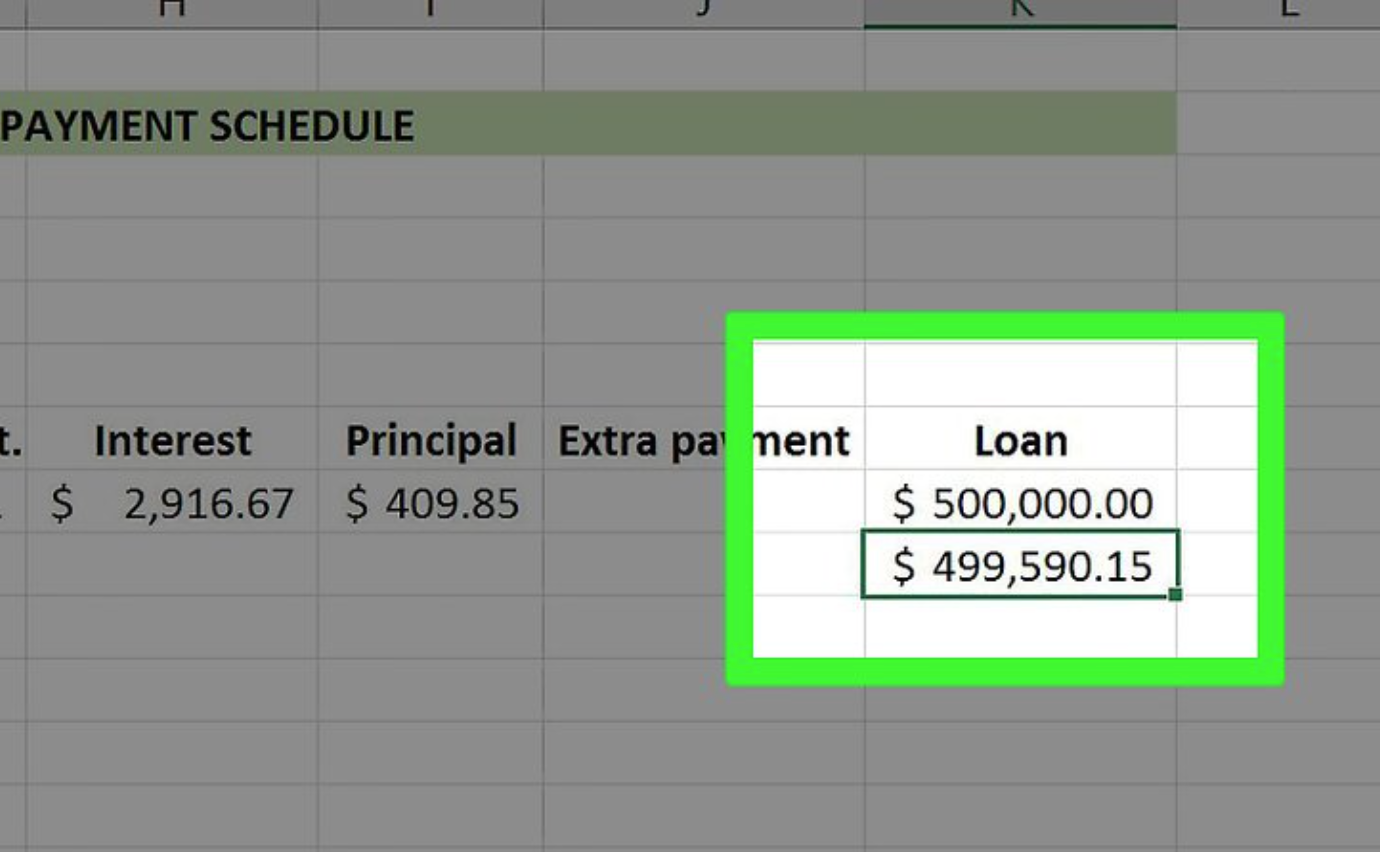

Incorporate the Loan formula.

The following formula is used to determine the loan’s worth: “Loan“-“Principal“-“Extra.”

For the screenshots that were provided, you’d type “=K8-I8-J8” without quotation marks.

This will apply the Loan formula to the cell that you have selected.

Use the “Fill” tool, which you previously used to apply this formula to all subsequent cells in this column, in order to apply it to all subsequent cells in this column.

Fill functions are used to fill in the blanks in your formula columns.

Your payment should be the same from the beginning to the end. The interest rate and loan amount should go down, but the values of the principal should go up in value.

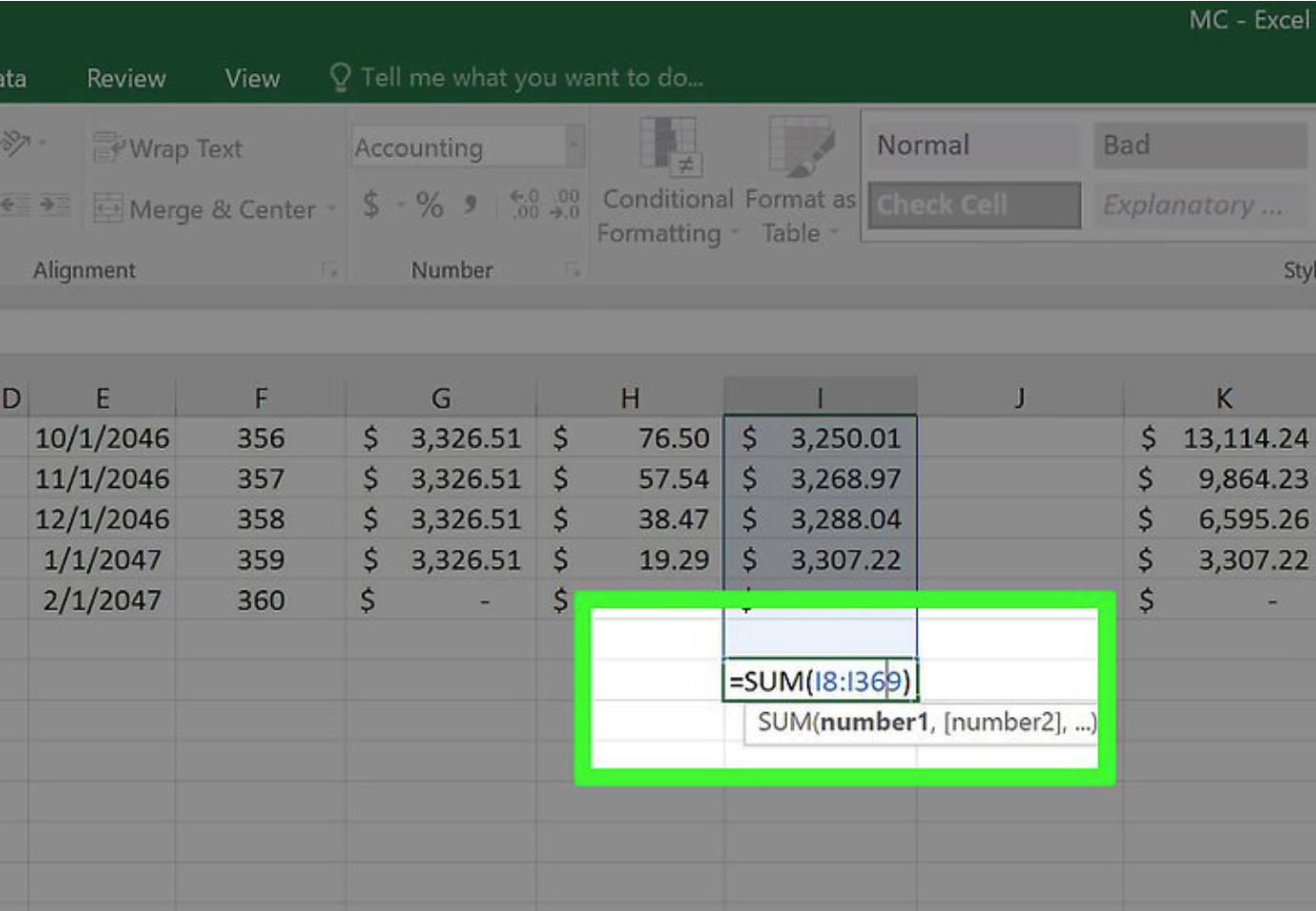

The payment schedule should be added up. The total of the payments, interest, and principal may be found at the bottom of the table.

Compare these figures to the ones provided by your mortgage calculator. If they are the same, you have completed the formulas correctly.

- The amount of your principal should be the same as the amount of the original loan.

- The overall cost of the loan, as calculated by the mortgage calculator, should be the same as your monthly installments.

- Your interest rate should be the same as the interest rate calculated by the mortgage calculator.

Fact Check

We hope you enjoyed this article… What are your thoughts?

Please feel free to share with us in the comments section below.

We strive to provide the latest valuable information for our readers with accuracy and fairness. If you would like to add to this post or advertise with us, don’t hesitate to contact us. If you see something that doesn’t look right, contact us!