Are Dividends From Index Funds Taxable?

If you’re investing in an index fund, you may be wondering if dividends are taxable. The answer is, it depends. Some index funds may be considered taxable dividends, while others may not.

Always consult with a tax advisor to get a more specific answer about your specific situation. However, in general, dividends from index funds are taxable. So, make sure to keep this information in mind when investing!

How Are Index Fund Dividends Paid?

If you’re like many investors, you’re probably wondering what index fund dividends are qualified for.

The answer may surprise you! This means that index fund investors don’t have to worry about having their money tied up in stocks for an extended period of time.

The dividend payments that they receive are always reinvested back into the fund, so you can rest assured that your investment is being managed prudently.

Additionally, the conditions under which these dividends are paid can be quite surprising, so it’s important to do your research first. Now that you know a little bit more about index fund dividends, it’s time to get investing!

Index funds: A quick look at the data

Over the course of a longer period of time, index funds frequently outperform actively managed funds.

Index funds can be purchased for significantly less money than actively managed funds.

Index funds, on average, present a lower risk profile than individual stocks.

How index funds are put to use

Investing in index funds is accomplished through the use of a passive management strategy as opposed to an active management strategy.

When an investment manager actively chooses when to buy or sell specific investments, this type of management is referred to as active management.

Actively managed investments typically have higher management fees than passively managed investments due to the presence of a third party that is responsible for selecting investments.

Active management strategies are utilized by a number of mutual funds.

On the other hand, passive management is a strategy in which a fund manager constructs a portfolio of investments that reflect an existing market index, such as the S&P 500.

This type of management is known as index tracking. There is no need for active management when using an index fund because its performance will automatically be very similar to that of the underlying index.

Why should you put your money in index funds?

Even though fund managers put in a lot of effort to “beat the market,” which refers to an index of the market, they are only marginally successful in doing so.

Even if they do, there is a very low probability that they will continue to outperform the market over the course of many years.

Only 29% of actively managed funds were able to outperform the S&P 500 in 2019, according to research conducted by SPIVA, which is a division of S&P Global.

Only 9% of those funds were able to continue to outperform their benchmark in 2021.

Because actively managed funds frequently underperform the market and index funds match it, passively managed index funds typically bring their investors better financial returns over the long term. This is because actively managed funds try to beat the market rather than matching it. In addition to that, their prices are lower.

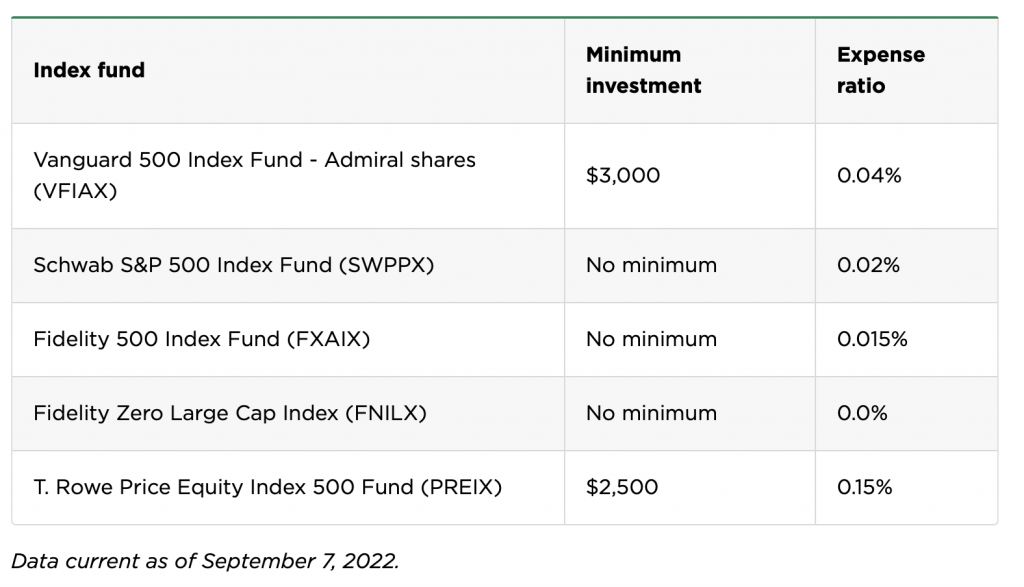

Which funds offer the best indexing capabilities?

The following is a list of some of the most successful index funds that are linked to the S&P 500.

The Facts And Features Of Earning Dividends From Index Funds

Index fund dividends could be a great way to income and grow your investment over time. To qualify, the company must be an “index member” of the index.

There are many different indexes available, so it’s important to choose one that best suits your investment goals and risk tolerance.

You don’t need to do anything special to receive these payments – they’ll come automatically in your account each month! So what are you waiting for?

Start investing in index funds today and start benefiting from their consistent returns!

Do Index Funds Pay Dividends?

Are index fund dividends qualified? The answer could surprise you! Index funds are a great way to invest, because they track the performance of a specific index. This means that they’re ideal for investors who want to focus on a single investment strategy with minimal risk.

Moreover, index funds pay out dividends every quarter, which provides extra income for investors. As long as your index fund qualifies for dividends, it’s a great way to make money over time.

Make sure to ask your investment advisor if your index fund is qualified for dividends before investing!

Qualified vs. Unqualified Dividends

Many people are familiar with qualified dividends, but may not be aware of what qualifies as an unqualified dividend.

Unqualified dividends are dividends that don’t meet the requirements of being paid from a publicly traded company. This information can be helpful when investing in index funds, as it can help you choose which funds to invest in.

If you’re looking for higher yields on your investment portfolio, consider investing in companies with qualified dividends. Finally, remember that unqualified dividends are considered lower-yield investments, so be sure to compare them before making a decision.

ETF Dividend Taxation

If you’re a dividend-paying investor, you may be surprised to learn that ETFs are tax-efficient! This is because the dividends paid out by ETFs are classed as income rather than capital gains, which means that investors who receive them will not have to pay any taxes on them – even if they’re resident in a high-tax country like the United States!

It’s important to be aware of this when making investment decisions, as dividend taxation loopholes exist that can offer tax advantages.

For example, many investors are aware of the tax-loss harvesting mechanism – which allows them to offset capital gains tax losses against ordinary income tax liabilities.

However, this article is not designed to provide tax advice, so be sure to consult with an accountant or tax advisor if you want to take advantage of these tax-advantaged opportunities.

When Are Index Fund Dividends Paid?

For many people, receiving index fund dividends is a regular occurrence. They’re usually tax-deductible, and the frequency of payment will also affect the timing of when the dividend is taxed – monthly payments will be treated as regular income while semi-annual or annual payments will be considered capital gains and taxed at a higher rate than that.

Overall, index fund dividends are often considered tax-friendly investments overall! That’s why it’s important to consult your tax professional if you’re unsure about whether or not your index fund dividend is qualified.

In the end, index fund dividends are a great way to add some extra income to your portfolio without much effort on your part.

Index Fund Dividends And Fees

Many people believe that index fund dividends are always qualified, but this is not always the case. It’s important to read the fund’s investor relations section for more information on this matter.

There are a number of factors that can affect whether or not a dividend is qualified, including the company’s financial condition.

If you’re uncertain about whether or not your index fund dividend is qualified, it might be best to consult with an accountant or tax specialist.

At the very least, you should be aware of the fund’s dividend policy so that you’re fully informed before investing.

Fact Check

We strive to provide the latest valuable information for our readers with accuracy and fairness. If you would like to add to this post or advertise with us, don’t hesitate to contact us. If you see something that doesn’t look right, contact us!