Investment Tips

Are Dividends From Index Funds Taxable? Qualified vs. Unqualified

Table of Contents

Are Dividends From Index Funds Taxable?

If you’re investing in an index fund, you may be wondering if dividends are taxable. The answer is, it depends. Some index funds may be considered taxable dividends, while others may not.

Always consult with a tax advisor to get a more specific answer about your specific situation. However, in general, dividends from index funds are taxable. So, make sure to keep this information in mind when investing!

How Are Index Fund Dividends Paid?

If you’re like many investors, you’re probably wondering what index fund dividends are qualified for.

The answer may surprise you! This means that index fund investors don’t have to worry about having their money tied up in stocks for an extended period of time.

The dividend payments that they receive are always reinvested back into the fund, so you can rest assured that your investment is being managed prudently.

Additionally, the conditions under which these dividends are paid can be quite surprising, so it’s important to do your research first. Now that you know a little bit more about index fund dividends, it’s time to get investing!

Index funds: A quick look at the data

Over the course of a longer period of time, index funds frequently outperform actively managed funds.

Index funds can be purchased for significantly less money than actively managed funds.

Index funds, on average, present a lower risk profile than individual stocks.

How index funds are put to use

Investing in index funds is accomplished through the use of a passive management strategy as opposed to an active management strategy.

When an investment manager actively chooses when to buy or sell specific investments, this type of management is referred to as active management.

Actively managed investments typically have higher management fees than passively managed investments due to the presence of a third party that is responsible for selecting investments.

Active management strategies are utilized by a number of mutual funds.

On the other hand, passive management is a strategy in which a fund manager constructs a portfolio of investments that reflect an existing market index, such as the S&P 500.

This type of management is known as index tracking. There is no need for active management when using an index fund because its performance will automatically be very similar to that of the underlying index.

Why should you put your money in index funds?

Even though fund managers put in a lot of effort to “beat the market,” which refers to an index of the market, they are only marginally successful in doing so.

Even if they do, there is a very low probability that they will continue to outperform the market over the course of many years.

Only 29% of actively managed funds were able to outperform the S&P 500 in 2019, according to research conducted by SPIVA, which is a division of S&P Global.

Only 9% of those funds were able to continue to outperform their benchmark in 2021.

Because actively managed funds frequently underperform the market and index funds match it, passively managed index funds typically bring their investors better financial returns over the long term. This is because actively managed funds try to beat the market rather than matching it. In addition to that, their prices are lower.

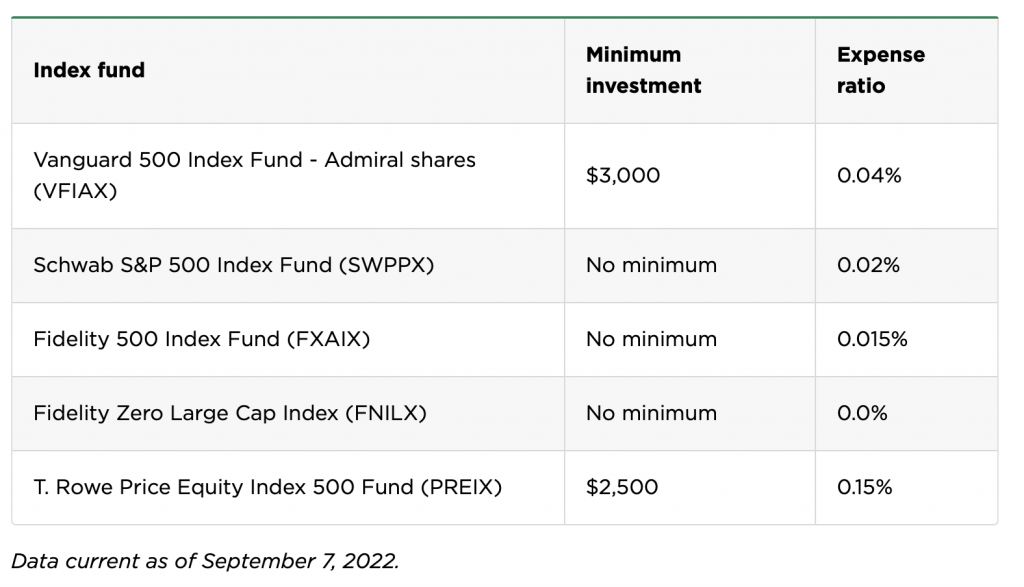

Which funds offer the best indexing capabilities?

The following is a list of some of the most successful index funds that are linked to the S&P 500.

The Facts And Features Of Earning Dividends From Index Funds

Index fund dividends could be a great way to income and grow your investment over time. To qualify, the company must be an “index member” of the index.

There are many different indexes available, so it’s important to choose one that best suits your investment goals and risk tolerance.

You don’t need to do anything special to receive these payments – they’ll come automatically in your account each month! So what are you waiting for?

Start investing in index funds today and start benefiting from their consistent returns!

Do Index Funds Pay Dividends?

Are index fund dividends qualified? The answer could surprise you! Index funds are a great way to invest, because they track the performance of a specific index. This means that they’re ideal for investors who want to focus on a single investment strategy with minimal risk.

Moreover, index funds pay out dividends every quarter, which provides extra income for investors. As long as your index fund qualifies for dividends, it’s a great way to make money over time.

Make sure to ask your investment advisor if your index fund is qualified for dividends before investing!

Qualified vs. Unqualified Dividends

Many people are familiar with qualified dividends, but may not be aware of what qualifies as an unqualified dividend.

Unqualified dividends are dividends that don’t meet the requirements of being paid from a publicly traded company. This information can be helpful when investing in index funds, as it can help you choose which funds to invest in.

If you’re looking for higher yields on your investment portfolio, consider investing in companies with qualified dividends. Finally, remember that unqualified dividends are considered lower-yield investments, so be sure to compare them before making a decision.

ETF Dividend Taxation

If you’re a dividend-paying investor, you may be surprised to learn that ETFs are tax-efficient! This is because the dividends paid out by ETFs are classed as income rather than capital gains, which means that investors who receive them will not have to pay any taxes on them – even if they’re resident in a high-tax country like the United States!

It’s important to be aware of this when making investment decisions, as dividend taxation loopholes exist that can offer tax advantages.

For example, many investors are aware of the tax-loss harvesting mechanism – which allows them to offset capital gains tax losses against ordinary income tax liabilities.

However, this article is not designed to provide tax advice, so be sure to consult with an accountant or tax advisor if you want to take advantage of these tax-advantaged opportunities.

When Are Index Fund Dividends Paid?

For many people, receiving index fund dividends is a regular occurrence. They’re usually tax-deductible, and the frequency of payment will also affect the timing of when the dividend is taxed – monthly payments will be treated as regular income while semi-annual or annual payments will be considered capital gains and taxed at a higher rate than that.

Overall, index fund dividends are often considered tax-friendly investments overall! That’s why it’s important to consult your tax professional if you’re unsure about whether or not your index fund dividend is qualified.

In the end, index fund dividends are a great way to add some extra income to your portfolio without much effort on your part.

Index Fund Dividends And Fees

Many people believe that index fund dividends are always qualified, but this is not always the case. It’s important to read the fund’s investor relations section for more information on this matter.

There are a number of factors that can affect whether or not a dividend is qualified, including the company’s financial condition.

If you’re uncertain about whether or not your index fund dividend is qualified, it might be best to consult with an accountant or tax specialist.

At the very least, you should be aware of the fund’s dividend policy so that you’re fully informed before investing.

Fact Check

We strive to provide the latest valuable information for our readers with accuracy and fairness. If you would like to add to this post or advertise with us, don’t hesitate to contact us. If you see something that doesn’t look right, contact us!

Real Estate

Are UK Homeowners Still Wanting To Move?

Are UK homeowners still wanting to move?

Press Release

Date: 19.07.2023

New Open Property Group research looks into where UK homeowners are moving to, and if there is a pattern between homeowners moving out of the city and into the countryside.

Out of 1.25 million homeowners surveyed:

- 357,244 stated that they ‘want to move’

- 251,705 stated that they ‘are moving soon’

- 242,711 stated that they ‘are settling in’

- 206,694 stated that they ‘just moved’

- 187,001 stated that they ‘are moving now’

Are homeowners still moving to the countryside since the surge in remote-working and the ever-growing desire for more green-space?

When surveyed, 39% of homeowners specified that wildlife and nature were “more important than ever” to their well-being, and 45% of adults are spending more time outside than they did pre-pandemic.

Despite this, recent data shows that people moving to sparse or remote villages actually dropped by 28%. Adding to this, from 2017 to 2023, the number of homeowners looking to move to remote or sparse settlements actually decreased by 13%

Open Property Group Managing Director, Jason Harris-Cohen said:

“The UK’s property market is undergoing another reset,” says Jason. “There is a definite shift in home moving activity, with the West of the country surging in popularity.

Historically, better value for money has been found outside of London, the South East and the big five cities, and I think that’s what is driving home movers towards Wales and the West coast.”

“The desire for affordability in a cost of living crisis is being compounded by the current relationship between inflation, the Bank of England base rate and mortgage rates.

The rates attached to new home loans, remortgages and additional finance are seriously squeezing buyers’ budgets but there is still a strong desire to move – people are just having to moderate where they look and what they buy.”

“Semi-rural and rural locations will continue to be cheaper places to buy than urban and inner city areas. This will be especially so in the coming months as more people return to offices for work and potentially relocate to reduce commuting times – aspects that will cause metropolitan house prices to rebound .

While the statistics show the trend for rural living has actually declined over the last six years – we may see a surge as purchasers pursue well priced properties.

We’ll also see borrowers taking out mortgages over 30 years – or even enquire about interest-only mortgages – to negate the effects of higher repayment rates.”

“Of course, there will be a large contingent of homeowners who are biding their time before they move – the 357,244 who have indicated they ‘want to move’. This group will be waiting for mortgage rates to fall and house prices to drop before they progress their plans.

In the meantime, they may choose to improve their properties – enhancing their living environment for the present and adding value at the same time. It’s not unimaginable that these delayed movers will fuel a property peak in late 2024/early 2025.”

For more information please visit www.openpropertygroup.com

About Open Property Group

Open Property Group are a professional house buying company who help people sell their properties quickly. They buy all types of properties (including vacant or let), throughout England and Wales.

Open Property Group specialise in buy to let property purchasing which suit landlords who want to cash in property quickly without disrupting the tenants.

Homeowners benefit from selling their house fast, with a completion date fixed to the owners’ requirements. By selling directly, you pay no agent fees, and can plan ahead with certainty. We also pay your agreed legal costs too.

![Are Uk Homeowners Still Wanting To Move? 48 UK 2023 Homemover Behaviour - Open Property Group [Infographic]](https://moneyvests.com/wp-content/uploads/2023/08/UK-2023-Homemover-Behaviour-Open-Property-Group-Infographic-scaled.jpg)

Fact Check

We strive to provide the latest valuable information for our readers with accuracy and fairness. If you would like to add to this post or advertise with us, don’t hesitate to contact us. If you see something that doesn’t look right, contact us!

Real Estate

How to Get the Best Market Value for Your Tenanted Property

Table of Contents

How to Get the Best Market Value for Your Tenanted Property

Selling a tenanted property can be a smart move for buy-to-let investors looking to maximize their returns. By selling with tenants in place, landlords can attract a broader pool of potential buyers, maintain rental income during the sales process, and potentially achieve a higher market value for their property.

If you’re considering selling your tenanted property, here are some key strategies to help you get the best market value:

1. Showcase a Well-Maintained Property

First impressions matter, so it’s essential to present your tenanted property in the best possible light. Ensure that the property is well-maintained and in good condition.

Conduct a thorough inspection to identify any necessary repairs or improvements and address them before listing the property.

A well-presented property will attract more potential buyers and create a positive perception of its value.

2. Highlight the Rental Income Potential

One of the advantages of selling a tenanted property is the potential for immediate rental income for the buyer. Emphasize the property’s rental income history and highlight its attractiveness as an investment opportunity.

Provide potential buyers with detailed information about the rental agreement, current rental income, and any potential for rental growth. This will appeal to investors looking for income-generating properties and can positively impact the market value.

3. Offer Flexible Viewing Options

Allowing potential buyers to view the property at convenient times can help generate more interest and potentially lead to higher offers.

Coordinate with your tenants to establish a viewing schedule that accommodates both their needs and the prospective buyers.

Flexibility in arranging viewings demonstrates your commitment to a smooth sales process and encourages serious buyers to consider the property seriously.

4. Provide Detailed Documentation

To reassure potential buyers and help them make informed decisions, provide comprehensive documentation about the property. This includes the tenancy agreement, inventory reports, gas and electrical safety certificates, and any relevant building permissions or certifications.

Transparency and thoroughness in providing documentation will build trust and confidence in the property, potentially leading to higher offers.

5. Consider Selling to an Investor

When selling a tenanted property, consider targeting investors specifically. Investors are often more inclined to purchase tenanted properties as they recognize the benefits of an immediate rental income stream.

Approach local property investment companies or work with an estate agent experienced in selling to investors. By targeting the right buyer pool, you increase the likelihood of receiving offers closer to or even above the market value.

6. Seek Professional Advice

Selling a tenanted property can be complex, so it’s advisable to seek professional advice from an experienced estate agent or property consultant. They can guide you through the sales process, help you determine the optimal pricing strategy, and market your property effectively to attract potential buyers.

Their expertise and knowledge of the local market can be instrumental in achieving the best market value for your tenanted property.

In conclusion, selling a tenanted property can be a lucrative opportunity for buy-to-let investors to maximize their returns.

By showcasing a well-maintained property, highlighting the rental income potential, offering flexible viewing options, providing detailed documentation, targeting investors, and seeking professional advice, you can increase your chances of achieving the best market value.

Remember, a well-informed and strategic approach is key to successfully selling your tenanted property and reaping the rewards of your investment.

Real Estate

The Top 15 Benefits of Living in a Detached House

Table of Contents

The Top Benefits of Living in a Detached House: Why It’s the Ultimate Dream Home

Living in a detached house can be the epitome of comfort, privacy, and independence. It’s a dream for many homeowners, and there’s no denying that it comes with a myriad of benefits.

Today, we’ll delve into the Top 15 Benefits of Living in a Detached House and why it could be the perfect choice for you. Let’s explore!

1. Privacy and Freedom Galore

One of the most significant benefits of living in a detached house is the unparalleled privacy it offers. With no shared walls or neighbors in close proximity, you can enjoy the peace and quiet without worrying about disturbing others or being disturbed yourself.

2. Personalize Your Space

Detached houses provide the ultimate canvas for you to customize your living space to your heart’s content. From landscaping and gardening to renovations and extensions, you have the freedom to create the perfect environment for you and your family.

3. No Shared Maintenance Responsibilities

- Say goodbye to shared maintenance costs and responsibilities.

- Enjoy total control over your property’s upkeep.

- Make decisions that directly impact your home without consulting others.

4. Potential for Future Expansion

Detached homes offer the possibility of expanding your living space in the future. As your family grows or your needs change, you can add rooms, a garage, or even a backyard oasis, all without affecting neighboring properties.

5. Higher Resale Value

Detached houses typically have a higher resale value than other types of properties, making them a solid investment for your future. As demand for detached homes continues to rise, you can be confident that your property’s value will appreciate over time.

6. The Joy of Outdoor Living

- Make the most of your outdoor space with a detached house.

- Host barbecues, garden parties, or simply enjoy a quiet evening under the stars.

- Build a play area for your children, a vegetable garden, or a relaxing retreat.

7. Reduced Noise Pollution

With no shared walls or ceilings, detached houses offer a quieter living experience. You’ll no longer have to deal with noisy neighbors or be concerned about your own noise levels impacting others.

8. Foster a Sense of Community

Detached homes often foster a stronger sense of community, as residents have more opportunities to interact and engage with their neighbors. This leads to lasting friendships and an enhanced sense of belonging.

In conclusion, living in a detached house comes with a multitude of benefits that cater to various lifestyles and preferences.

From increased privacy and freedom to personalization and future expansion potential, a detached house can be the ideal home for those seeking the perfect balance of comfort, convenience, and community.

9. Safety and Security

Another advantage of living in a detached house is the increased safety and security it provides. You can install your own security system and take measures to protect your property without having to coordinate with neighbors or a homeowners’ association.

10. Architectural Variety

Detached homes come in a wide array of architectural styles and designs, offering more opportunities for you to find a home that suits your tastes and preferences. From charming cottages to modern masterpieces, the choices are endless.

11. More Space for Hobbies and Interests

A detached house often comes with extra rooms and outdoor spaces that can be used for various hobbies and interests. Whether you’re a fitness enthusiast, an artist, or a budding chef, having more space allows you to pursue your passions without feeling cramped or restricted.

12. Better Energy Efficiency

With no shared walls, detached houses can be more energy-efficient than other property types. Proper insulation and modern construction methods help reduce energy consumption and keep your home comfortable year-round.

13. A Sense of Accomplishment

For many people, owning a detached house represents the ultimate symbol of success and accomplishment. It’s a tangible reminder of your hard work and perseverance, making it an even more enjoyable place to call home.

14. Long-term Stability

Detached homes often provide a sense of long-term stability for families. When you invest in a detached house, you’re creating a foundation for your family’s future, allowing you to create lasting memories in a space that truly feels like your own.

15. Pet-Friendly Environment

For pet owners, a detached house offers the ideal environment for their furry friends. With a spacious yard and no shared walls, your pets can enjoy the freedom to roam and play without disturbing neighbors or posing any restrictions.

In summary, the benefits of living in a detached house are vast and varied, catering to a wide range of needs and desires.

From privacy and personalization to long-term stability and pet-friendly living, a detached home offers a unique and fulfilling living experience that’s hard to match.

So if you’re considering investing in a detached house, rest assured that you’ll be making a decision that will enhance your life in countless ways.

What are some pros of living in a detached house?

Here are some pros of living in a detached house:

More privacy: You have more privacy since there are no shared walls with your neighbors.

More control over your own property: You also have more control over your own property since you are not subject to the rules and regulations of an HOA or other organization.

Nice yard: Detached homes generally have a front- and backyard2. This can be great for gardening, playing with kids or pets, or just enjoying the outdoors.

Freedom to do what you want: When you buy a single-family detached house, the property is yours. You can make changes to it as you see fit without having to get approval from anyone else.

More space for your family: Detached homes generally have more space than townhouses or condos. This can be great if you have a large family or just want more space.

What are some cons of living in a detached house?

Here are some cons of living in a detached house:

Maintenance: You are responsible for upkeep and repairs1. This can be time-consuming and expensive.

Cost: Detached homes generally cost more than townhouses or condos1. This can make it difficult for some people to afford a detached home.

Isolation: Detached homes can sometimes feel isolating, as you are not connected to any neighbors.

Fewer amenities: Condominium and townhome developments often have significant amenities such as swimming pools, fitness centers, and tennis courts3. Detached homes may not have these amenities.

FAQ’s

Q1: What are some of the main advantages of living in a detached house?

A1: Some of the main advantages of living in a detached house include increased privacy, freedom to personalize your space, reduced noise pollution, potential for future expansion, higher resale value, and fostering a sense of community.

Q2: How does living in a detached house affect privacy?

A2: Detached houses offer unparalleled privacy due to the absence of shared walls and neighbors in close proximity. This allows residents to enjoy their space without worrying about disturbing others or being disturbed themselves.

Q3: Are detached houses typically more energy-efficient than other types of homes?

A3: Detached houses can be more energy-efficient than other property types because they don’t have shared walls. Proper insulation and modern construction methods help reduce energy consumption and maintain a comfortable living environment throughout the year.

Q4: What makes detached homes a good investment?

A4: Detached homes are considered a solid investment because they typically have a higher resale value than other types of properties. As demand for detached homes continues to rise, property values are likely to appreciate over time.

Q5: How can living in a detached house foster a sense of community?

A5: Detached homes often create a stronger sense of community, as residents have more opportunities to interact and engage with their neighbors. This leads to lasting friendships and an enhanced sense of belonging within the neighborhood.

Q6: Why are detached houses a suitable option for pet owners?

A6: Detached houses provide a pet-friendly environment due to their spacious yards and lack of shared walls. Pets can enjoy the freedom to roam and play without disturbing neighbors or facing any restrictions typically imposed by shared living spaces.

Q7: What kind of architectural variety is available in detached homes?

A7: Detached homes come in a wide array of architectural styles and designs, offering numerous options for homeowners to find a home that suits their tastes and preferences. From charming cottages to modern masterpieces, the choices are endless.

Fact Check

We strive to provide the latest valuable information for our readers with accuracy and fairness. If you would like to add to this post or advertise with us, don’t hesitate to contact us. If you see something that doesn’t look right, contact us!

-

Banking3 years ago

Banking3 years agoWhy investment banking best answers – 7 Tips to Remember

-

How to Make Money1 year ago

How to Make Money1 year ago10 Finest Apps Like OfferUp in 2023

-

Business Tech3 years ago

Business Tech3 years agoTop 10 Reasons Why CompTIA Security+ Training is Right for You

-

Law3 years ago

Law3 years agoHow to Find a Trustworthy Lawsuit Funding Company

-

insurance2 years ago

insurance2 years agoHow to Avoid Financial Ruin from Unexpected Car Repairs

-

Crypto2 years ago

Crypto2 years ago0x Protocol and ZRX Cryptocurrency

-

Affirmations3 years ago

Affirmations3 years agoTop 15 Bob Proctor Money Affirmations for Attracting Money and Wealth

-

Education3 years ago

Education3 years agoWho Invented Homework for schools? Top 10 Facts about Homework