[ad_1]

Newfound Analysis‘s Chief Funding Officer and Co-founder Corey Hoffstein sat down with Jack and Justin from Validea to speak about his personal portfolio and the way he manages his cash.

interview is one the place we’re capable of peel again the layers and be taught in regards to the nuances of investing and monetary planning. Corey is a really good man, however on this interview, you’ll understand that like many people, he makes his fair proportion of monetary planning errors.

We are able to additionally learn the way a quant will construction his personal portfolio. I significantly like how he describes on a excessive stage, his goal when crafting his portfolio and the tip consequence.

He additionally shared his philosophy in direction of portfolio building with leverage, the advantages of being open to studying, and why sub-optimal methods might typically be extra sustainable.

You possibly can watch the podcast right here:

What He’s Attempting To Obtain For His Investments

His purpose shifted over time:

When younger: Get to the purpose the place Corey is comfy with the belongings he has.

What’s sufficient:

Belongings Larger than Future Liabilities

Corey is a really massive believer in liability-driven investing (LDI) (Mainly, all of your future wants/targets are a legal responsibility that you may calculate a gift worth. Your belongings immediately must fund these liabilities)

At this level, Corey felt that his revenue and funding belongings outdated his future liabilities.

Now: What’s cash for?

Corey concluded that he:

- He doesn’t need to take into consideration cash.

- As a substitute of claiming cash can not resolve all issues, re-frame and think about that cash can de-stress a number of issues. (e.g. unencumber time)

- He’s going to have youngsters quickly, so training for youths is an enormous purpose. His mum or dad permit him to graduate with out debt, so he want to do one thing comparable if attainable.

Corey’s Retirement: Altering the Tempo of Life

Corey is 35 this 12 months and has been operating NewFound Analysis for 15 years. Entrepreneurship has been the quick tempo and hectic.

His purpose is to have the ability to take his foot off the pedal when he reaches 50 years previous.

He believes within the philosophy:

In the event you don’t use it, you lose it.

You want bodily and psychological sharpness, so Corey deliberately builds this into his life exploration.

He hopes in fifteen years’ time, he can decelerate and be current in his child’s life.

Corey shared his dad’s early retirement expertise (8 min 20 sec).

He hopes to gradual it down like his dad and never be as hands-on throughout the later years.

The Three-Legged Stool Portfolio

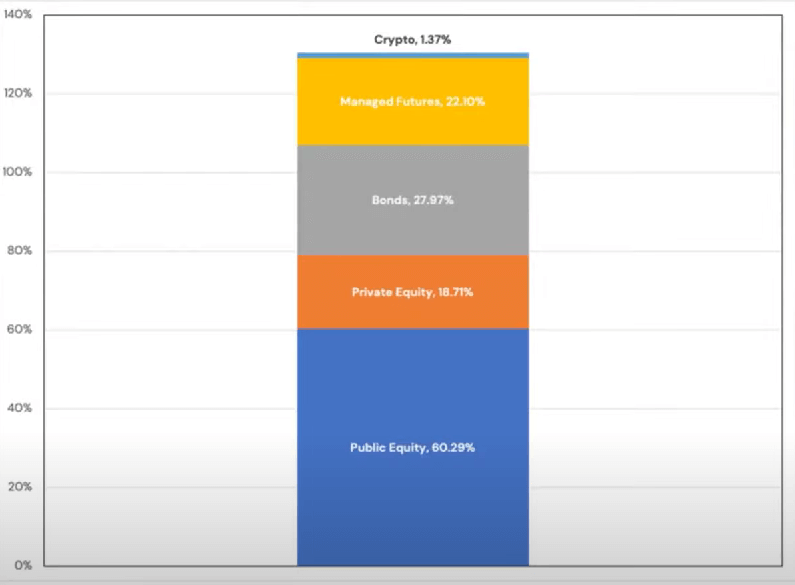

The next diagram illustrates Corey’s present asset allocation:

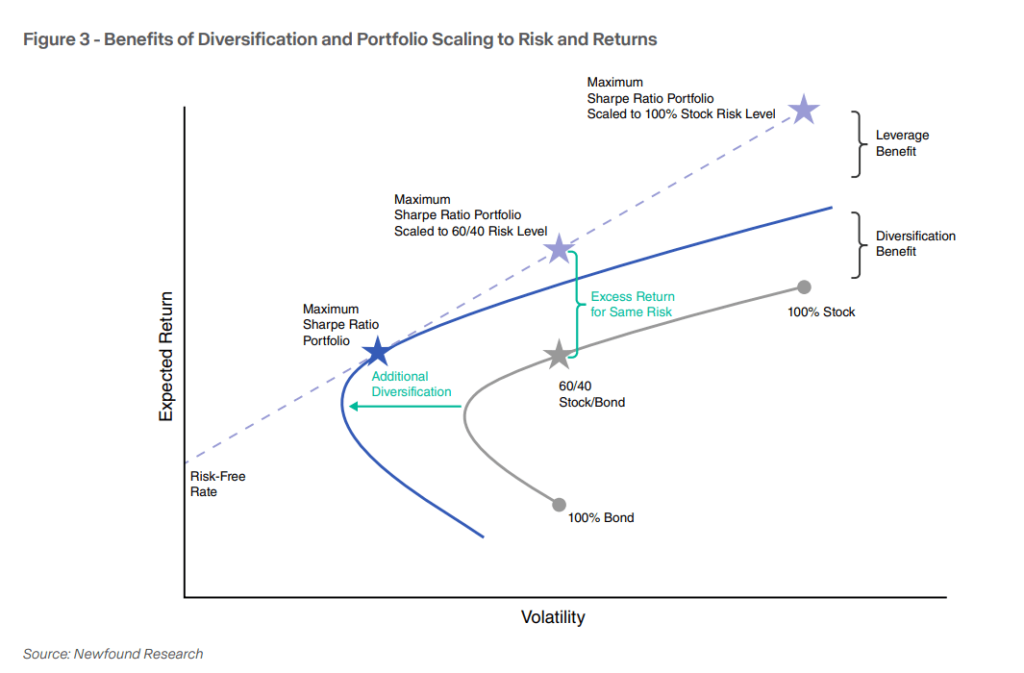

Corey explains that based mostly on trendy portfolio concept, and environment friendly frontier, we should always discover the portfolio with the perfect extra return per unit danger after which leverage it up.

However most individuals are afraid to do this of their investments however are very prepared to do it for actual property.

“You possibly can create a way more well-diversified, sustainable portfolio if you’re prepared to combine asset courses after which add on leverage to a danger stage you need.”

Corey revealed that as a finance individual, he’s consistently being scrutinized, and it’s difficult for him to manoeuvre buying and selling particular person securities with leverage. So he has spent a number of time packaging his concepts into funds in order that he can spend money on them.

“Warren Buffett was shopping for high-quality, worthwhile corporations, then leveraging them 1.6 instances.”

He crafted a Three-legged Stool Portfolio Technique:

- The primary is utilizing asset courses or methods to generate long-term compounded returns round danger premia.

- Then, we think about #1 along with the financial and inflation dangers in order that we’re not too uncovered in particular financial regimes.

- Danger can’t be destroyed can solely be transferred. Corey likens danger to an enormous bowl of playdough. If our portfolio could be very concentrated, our portfolio could be very concentrated within the regime of financial development. If the financial system suffers, your portfolio is in for a big drawdown. He’s attempting to remove dangers in that financial development regime and introduce dangers in different regimes. That is as if we’re smashing the playdough and spreading it out.

His portfolio is:

- Based mostly on three asset courses (Private and non-private fairness, bond futures, managed futures)

- Discover the important thing long-term return drivers. To get returns, it’s important to take dangers.

- Shares & bonds signify the 2 important “muscle actions.” concerning danger premia obtainable. Corey thinks it’s “extremely defensible” why it’s best to earn good returns by holdings shares and bonds.

- The massive danger of holding a shares and bonds-only portfolio is that each asset courses are extremely vulnerable to inflation shocks.

- We should always have a 3rd leg of a stool that does nicely in an inflationary surroundings. Corey doesn’t favour commodities as a result of commodities are inferior throughout deflation.

- Managed futures, which might go lengthy or quick world futures markets, traditionally exhibit low correlations with shares and bonds and have absolute return-like traits. Managed futures has additionally accomplished nicely throughout fairness disaster and inflationary intervals.

“Your human capital is like you might be lengthy a bond.”

Corey liken that the wage from our bond may be think about an inflation-protected, credit score bond.

In order for you, you’ll be able to mannequin your human capital, by calculating the web current worth of a stream of your future revenue.

For a teenager, they’ve an enormous human capital, which implies an enormous bond place.

They’ll afford to have extra fairness allocation.

There are white papers that argue it’s best to have a extra leverage fairness portfolio.

Conversely, as you become old, you won’t need to simply have shares in your portfolio.

Corey has a lot bonds (for a 35-year-old) as a result of as an entrepreneur, he struggles to “mannequin” his human capital.

“I need to construct my funding portfolio as “all-weather” as attainable. Proudly owning bonds permits me to seize the chance premium.”

What folks misunderstand about bonds is that your portfolio is much less dangerous due to the low correlation however that bonds are simply decrease risky then a number of different issues. We are able to obtain the identical impact if we use money as an alternative.

“Once you work a number of years longer, you might be including extra bonds to your portfolio, offsetting extra of your future liabilities.”

Corey makes use of a fund which spend money on bond futures to present him publicity to treasury bonds throughout a number of totally different durations.

“I tousled my equities allocation.”

Corey defined that he has the great fortune of capable of harvest a good quantity of taxable cash early in his profession and he resolve to spend money on particular person corporations which might be predominately tilted in direction of high-quality, worthwhile, dividend-paying.

The equities did so nicely that he misplaced his capacity to tax misplaced harvest.

Within the US, asset location is important. Once you promote, it’s essential to pay lengthy or short-term capital features tax. If in case you have losses, you’ll be able to harvest these losses to offset your tax invoice.

The fee foundation on Corey’s particular person shares is low, which signifies that the capital features that might be tax is substantial.

“If I have been to pinpoint my primary mistake, it was not considering ‘how would this be ten-years down the highway?’”

He lamented that if he has invested in a high-quality-based ETF, what he ‘owns’ technically may be reconstituted and rebalanced higher.

“Being knowledgable in a single space of funding doesn’t imply I’m educated in all areas of investments.”

At 23 min 15 secs, Corey explains his embarrassment of not profiting from sure tax-advantaged accounts.

He stresses {that a} good adviser can add alpha simply by their sophistication.

At this level of his life, he finds that his time won’t be nicely spent discovering approach to avert taxes versus rising his wealth higher.

Core Thought of Return Stacking

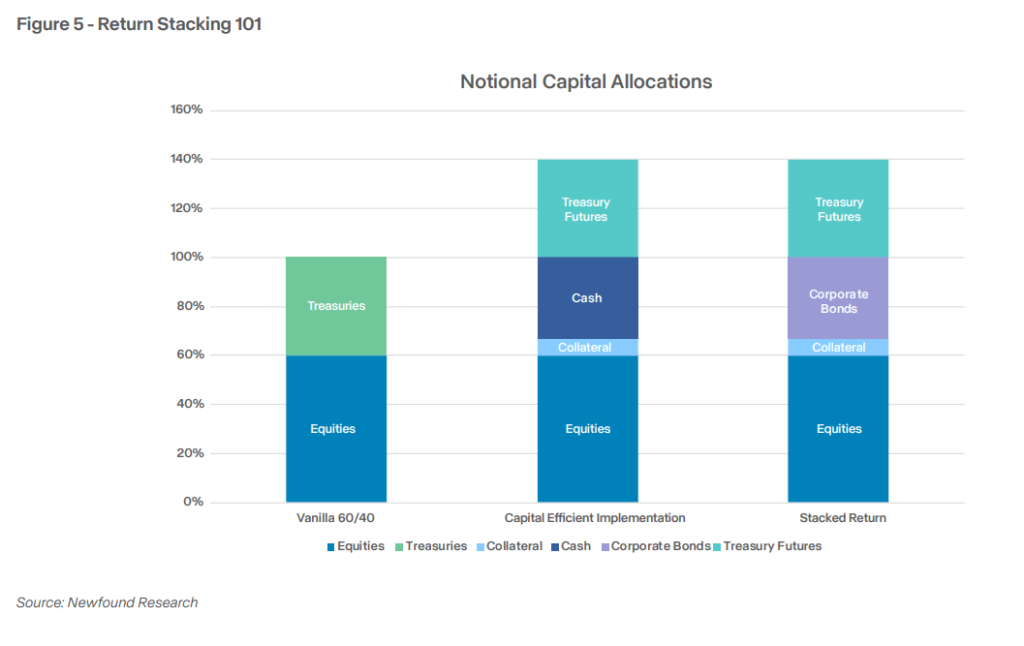

Corey wrote a paper about returns stacking, explaining what it means.

[White paper] Return Stacking: Methods for Overcoming a Low Return Atmosphere

To kind a extra well-rounded, much less correlated portfolio, we are able to add hedging methods to the portfolio.

Nonetheless, the portfolio may have decrease volatility and fewer danger. This implies the return might be decrease than equities.

So the normal technique has a funding drawback.

Return stacking introduces leverage to the portfolio. With leverage, the chance stage goes up, and we hope to have the ability to seize the returns that include the chance.

Newfound Analysis just lately launched a fund that, for each $100 invested, it offers you $100 bond publicity and $100 managed futures publicity. For a 60% fairness and 40% bond allocation investor, it lets you change 20% of the bond with this fund. This takes your allocation to 120% with extra diversification.

The Proper Quantity of Leverage to Apply to Your Funding Portfolio Might Want a Behavioural Layer

36 min.

Corey says that getting the correct amount is extra artwork than science.

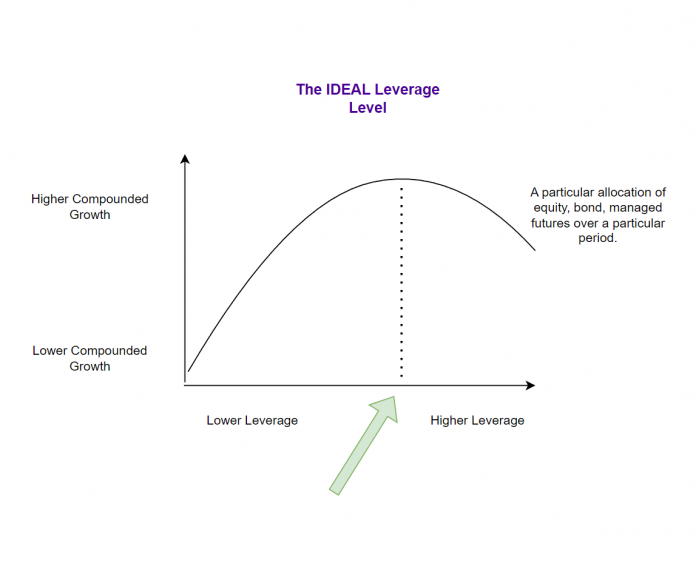

You possibly can take totally different portfolios and backtest totally different quantities of leverage utilized.

In the event you compute the totally different allocations, with totally different leverage stage, you will discover that the form of the chart resembles a hump. The height of the hump represents the perfect quantity of leverage with the best return. Earlier than that hump, you aren’t taking sufficient leverage; after the hump, you take an excessive amount of leverage.

The issue is that if the time interval you backtested is totally different, and the size of funding is totally different, the perfect leverage stage is DIFFERENT, If the interval has a 2008 GFC, the leverage stage can be method decrease.

“The artwork of what I attempt to do is I have a look at all of those subperiods, what stage of leverage do I believe is extra secure and sustainable over these shorter time horizons that, in concept, nonetheless will get me to that long-term optimum leverage stage. Once I plotted these charts over the long term (30 years), I ended up fairly far to the left of ‘the perfect quantity’. For instance, the perfect quantity would possibly say I needs to be 3 instances leverage however the higher quantity is 1.5 instances. that 1.5 instances is extra sustainable as a result of there may be a 90% drawdown that’s hidden at one level in that 3 instances leverage.”

“I’m attempting to maximise my returns, however respecting some drawdown constrains that make it extra sustainable.”

Kyith: To earn these nice returns, you will have to resist these high-leverage drawdowns first.

On Rebalancing

We should always regularly rebalance our portfolio just a little at a time.

The issue with many finance folks is compliance oversight constraining us. If we’re in particular person shares, we have to submit commerce requests earlier than we are able to do all these stuff.

Corey desires to slowly promote and transfer into the funds he crafted in order that rebalancing can happen throughout the fund.

He’ll have a look at his portfolio on an asset class stage as soon as a month to see if they’re out of whack, and make small modifications utilizing tax loss harvesting their place.

“I’ve some doubts about how my Non-public Fairness funding will work out.”

His non-public fairness investments don’t embody his firm Newfound Analysis.

- In early 2010, he invested in a fund that invests in seed-stage tech corporations all over the world.

- In 2014/15, he invested in a personal fairness fund. Corey clarify that within the PE area, only some companies do it nicely and he was lucky to have the ability to spend money on one in all them.

- He invests in secure notes, which is a typical construction to seed funding to start-ups of his associates’ corporations after they want capital. These are folks he works with, and he feels secure working with them to take a position his personal cash.

“I’m not positive whether or not I earn an sufficient premium within the non-public area. I believe if I taken the cash I had invested within the seed stage and put it into the Nasdaq, I might need the identical return however 100% extra liquid.”

“I’m up ostensibly 5 instances within the seed fund I invested in however there isn’t any liquidity at present so I’m not positive if I might be capable of get my cash out. They invested on this firm name Canva within the seed stage and Canva has gotten large. About 80% of the fund’s worth is in Canva, so now I’ve an enormous allocation to this firm referred to as Canva.”

Reflections on his Crypto Expertise and Portfolio Sizing

Corey was educated in laptop science and skim the white papers early on however solely obtained concerned in 2021 when a lot of the crypto infrastructure was already arrange.

He was lucky that he was residing in Cayman, which allowed him to commerce on worldwide exchanges.

As a quant, there have been many simple methods reminiscent of money & carry, which is lengthy underlying crypto and quick the futures. There’s a huge 20% annualized premium.

He was defi-yielding farming (in his phrase the platforms have been offering incentives to develop the community), flipping NFTs.

From a tax perspective, investing in crypto is a nightmare for Corey.

Corey doesn’t really feel that it’s wholesome NOT to take part in new applied sciences as a result of you’ll be able to develop dismissive about issues.

“For younger merchants, buying and selling NFTs is nice observe for buying and selling illiquid belongings, supplied they don’t get sucked in. You study caught stock, easy methods to work a market, easy methods to do issues OTC. When FTX was round, they will be taught to jot down buying and selling bots as a result of there have been API to do this. Simply watch out as a result of we are able to simply get sucked in.”

The Worth of Monetary Planning

Corey shared one thing that was weighing on his thoughts about his property planning:

- As a person, if he will get hit by a bus, his belongings will go to his dad, who will do no matter he desires with the cash.

- After he obtained married, if he will get hit by a bus, and his spouse continues to be round, the belongings will go to his spouse, and his dad, who’s versed in finance will be capable of assist determine it out because the directions are there.

- Now that he’s going to have a child, if he will get hit by a bus, and his spouse continues to be round, how can he construction his belongings in such a method that it makes his spouse’s life simpler?

- If each of them will get hit by a bus, how does he construction his property for the child?

He positively wants some property planning assist however am unsure if a monetary adviser will work for him as a result of he’s so well-versed investment-wise.

The host and Corey obtained right into a dialogue that their family members might must restructure their portfolios:

“I had an sincere dialog with my spouse the opposite day. The way in which I managed our cash is the best way I believe is perfect for us. However this is not going to make a lot sense to her (she doesn’t know what’s managed futures.). Even when the managed futures are in a fund, that construction is not going to assist her a lot.

If I took my belongings and put them in high-quality dividend-paying corporations as an alternative, which is a sub-optimal technique, she simply is aware of that each month, there might be cash that’s popping out and by no means have to the touch the portfolio.

There’s something to be stated about a sustainable funding technique that matches your life-style.

If I kick the bucket early, there may be some justification for her to restructure the portfolio moderately than having to go in and promote the portfolio just a little by little.”

If you wish to commerce these shares I discussed, you’ll be able to open an account with Interactive Brokers. Interactive Brokers is the main low-cost and environment friendly dealer I take advantage of and belief to take a position & commerce my holdings in Singapore, the US, London Inventory Trade and Hong Kong Inventory Trade. They assist you to commerce shares, ETFs, choices, futures, foreign exchange, bonds and funds worldwide from a single built-in account.

You possibly can learn extra about my ideas about Interactive Brokers in this Interactive Brokers Deep Dive Sequence, beginning with easy methods to create & fund your Interactive Brokers account simply.

[ad_2]

Source_link