How to make money online for free

There are many ways on how to make money online for free and fast; on moneyvest.com, you will find all the best ways to make money in your spare time while in college, based on your own experience. We will keep adding new ways to this page, so please bookmark it. And please, share your ideas in the comments!

Here are The Top 20 ways on how to make money online for free

1. No-risk matched betting

I will tell you the easiest way to make lots of money (well, without breaking the law). Many students have made over £100 from this technique. It’s completely legal, risk-free, tax-free, and in the UK, anyone over the age of 18 can do it (if you’re not in the UK, skip to number 2).

It works by taking advantage of the free bets offered regularly by betting sites by “matching” them on betting exchanges. Matched betting eliminates the risk (you bet on a specific outcome and against a specific outcome).

See also: Top 10 best forex trading apps for 2021

This will allows you to squeeze out free bets that could be as much as £100. Multiply this by how many betting sites there are, and you can easily make a profit of several hundred pounds.

Owen explains how to make your first £13 profit (using a real-life example) in this gem of a guide to matched betting. If you know of a better way to make £40 per hour at home, let us know.

2. Online surveys

An increasingly popular way for students to earn money is to fill out online surveys in their spare time. Survey companies are always looking for new members worldwide to fill out surveys and test new products.

With a few minutes of form filling, you can make 2 £ to be paid in cash or as a reward. Some surveys allow you to bag up to £3 ($5).

A few good ones to try are Toluna, Branded Surveys, LifePoints, InboxPounds, OnePoll, i-Say, Opinion Outpost, Populus Live, YouGov, Pinecone, Valued Opinions, The Opinion Panel, Prizerebel, Marketagent, Mingle, Opinion Bureau, SurveyBods, Panel Base, Survey Junkie.

Also, sign up for Swagbucks, which rewards you for various surveys as simple as surfing the web, watching videos online, and playing games.

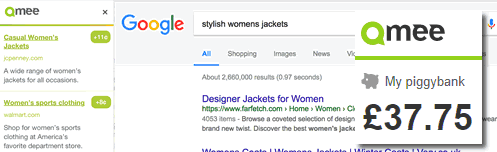

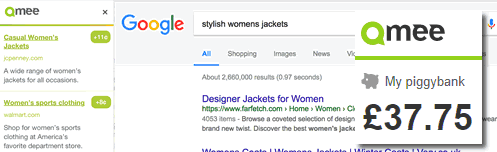

3. Paid for searching the web

Are you interested in earning cash to do what you are already doing online? This has to be one of the easiest ways to make money online without actually working hard or changing your behavior.

This innovative idea by Qmee.com rewards you with a search on Google, Bing, Yahoo, Amazon, and eBay. All you have to do is install a simple add-on to your browser, and when you run a search, you may see some sponsored results alongside your regular search.

Each Qmee result has a cash reward attached to it. If you are interested, click on it to collect your reward.

The best thing is that there is no minimum amount of cash out – our first one was 72p wired to our Paypal account. You also have the option to donate to charity.

Sign up now for free, and start earning from your searches! Click here to get started.

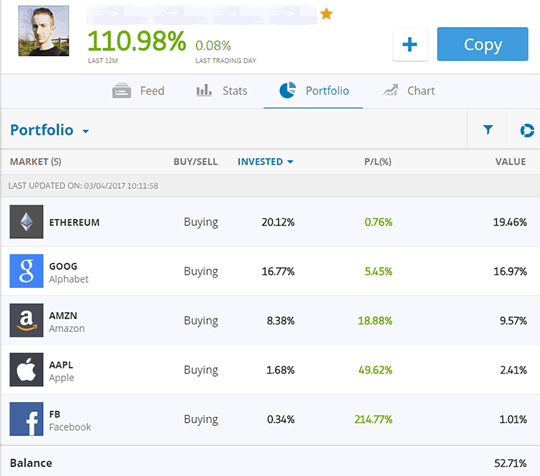

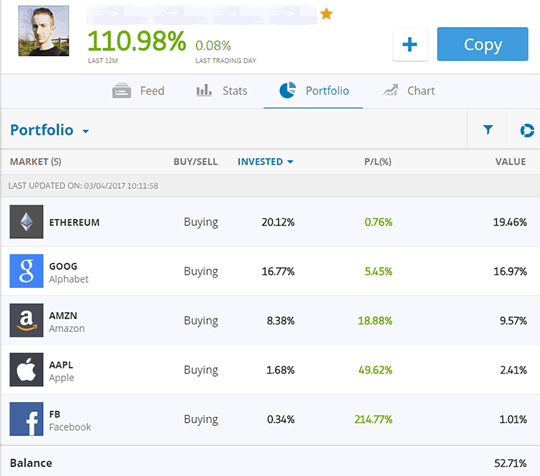

4. Online market trading

While this is not necessarily an easy way to make money, investing in the stock market can be lucrative if you learn to do it properly and safely. Likewise, if you don’t take it seriously, you could suffer significant losses.

Today, there is no need to fund a Wolf of Wall Street-style stock broker’s yacht. You can do it all by yourself with the help of online market trading platforms.

Having spent many hours researching this new opportunity, I have tried the popular platform eToro.com.

eToro has over 12 million users worldwide and offers a free practice account. It was featured in the BBC 2 documentary “Traders: Millions by the Minute” and sponsors several Premier League soccer clubs.

eToro stock trading is currently not available in the United States.

One of the best things about eToro is its CopyTrader feature. This allows you to see, track, and copy the investments of other top-performing traders.

For more information, follow George’s complete guide to trading with eToro. I think $200 is the right amount of money to try out a few different markets and get the most out of your learning curve. If nothing else, you will learn a lot about different investments and industries.

Keep in mind that all trading involves risk. eToro is a multi-asset platform that offers absolute asset ownership and high-risk leveraged “CFD” products. When trading CFDs with this provider, 67% of retail investor accounts lose money. You need to consider if you can afford to take the high risk of losing your money. This content is not financial or investment advice.

How to make money online for free

5. Start your own website

Are you interested in generating passive income? You need a website. It’s a way to make money while you sleep.

It takes less than 20 minutes to start a website using Bluehost, costs very little, and can be done by an 82-year-old. It only takes a few social media connections to get your first visit, and there are many ways to monetize your site.

Save the Student is just one example of a successful website that was started by Owen Burek during his first year in college and has since grown into a full-time, large-scale enterprise.

Read Owen’s step-by-step guide on how to start a website in 20 minutes. It really is one of the best assets you can have.

6. Review websites & test apps for cash

Okay, you seem to be pretty nifty with your web browser, so maybe it’s time to turn pro and view websites as a paying, fun job!

Introducing UserTesting.com – a new platform that pays everyday people to review websites of all kinds. Each review takes about 20 minutes and bags you $10 (£6.50) via Paypal.

Sign up here, complete a test review, and look forward to receiving websites in your inbox.

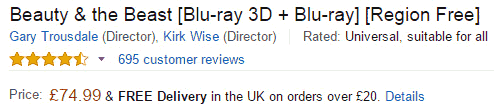

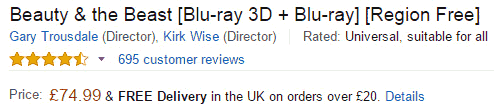

7. The ‘Disney Vault’ secret

To maintain high demand for generations to come, Disney Studios has carefully limited the supply of some home release classics. They will be locked away in a “vault” for 8-10 years and then released for an unspecified short period.

Buying them at standard retail prices during this window will allow you to make a nice profit when they are no longer available for another decade or so.

For example, in 2011, you can buy Beauty and the beast on Blu-ray 3D for just £24.99. In just a few years, it was on Amazon for a staggering £74.99!

For example, in 2011, you can buy Beauty and the beast on Blu-ray 3D for just £24.99. In just a few years, it was on Amazon for a staggering £74.99!

It’s important to note that not all Disney releases are eligible for the Vault, and only the true classics will maintain such demand.

Currently, there are only two titles on the vault, but I recommend snagging them. They are the Bambi Diamond Edition Blu-ray and The Lion King Diamond Edition Blu-ray.

8. ‘Get Paid To’ visit sites

This one is similar to making money from online surveys; GPT sites reward you with cash and vouchers for completing various offers and activities online. Get paid to sites is one of the good ways to how to make money online for free.

The most popular sites today for getting paid to sites are Toluna, Swagbucks, and InboxPounds.

9. Write and publish a Kindle eBook

If a student is good at anything, it is research and writing. With the Kindle Store, anyone can publish ebooks and make money on Amazon.

Also, the Kindle app is now available on almost every device (laptops, iPads, smartphones, and yes, the Kindle), so the global market is enormous.

List your book for £1.49-£6.99, and you will get 70% of the sales. Given that Amazon is the ultimate sales machine (and don’t forget that people want to use it), it’s a great deal.

The key to success with ebooks is to create value and write non-fiction. Simply bundling researched and edited information about a common problem (e.g., the “secret” to finding a job) and presenting it in an easily digestible format (eBook) will justify someone spending a few pounds on it.

Another important tip is to design an excellent cover that will stand out (see these). Also, once you have published your book on the Kindle store, it is vital to get reviews and appear at the top of the results. Encourage your readers to leave an honest review at the end of your book.

The best part about this lucrative idea is that if you invest the time (say, 20 hours), you will earn passive income for years to come.

For more tips, see our guide to making money from ebooks.

10. How to make money online for free – Affiliate marketing

Whether you have a solid social media presence or a blog or website, promoting all kinds of companies, products, services, and offers online can bring in money quickly.

You can Sign-up as a publisher on the Awin affiliate network, check the Offers blog, browse the Merchant List to find something you think your friends would be interested in, and then get and share your affiliate link.

If someone or a customer makes a purchase using your link (it could be up to 90 days), you’ll earn yourself a really nice commission.

To take the affiliate program it a step further, set up an excellent website or a topical Facebook page, invite all your friends, and post your affiliate links offer there.

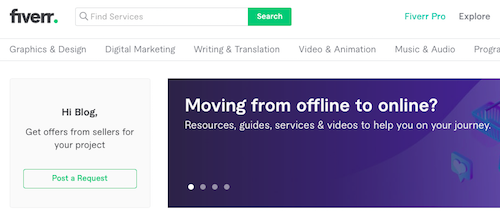

11. Sell your Gigs on Fiverr Platform

Fiverr is now considered the world’s largest marketplace for people to make cool money selling small services (also known as “gigs”).

The offerings can be absolutely anything, from writing and translating, posting to social media, playing pranks, teaching, creating music, voiceovers, and short video clips for people worldwide.

The default price is $5. But you can add additional services to your gig and make more money.

It may not seem like much, but it can add up very quickly, and there are plenty of examples of people making an excellent living from the site.

The key is to have a system in place that minimizes the amount of time you spend on each gig.

However, there is another way to get even more profit from Fiverr, potentially much less work. How? You can simply resell your gigs else-where.

For a simple example, find a decent logo designer and reply to a job posting on the Upwork platform or a local job board. A $5 expenditure can quickly turn into $50 or more and is repeatable.

If you’re not interested in selling at all, there are so many good things you can accomplish for yourself. Browse through and get inspired.

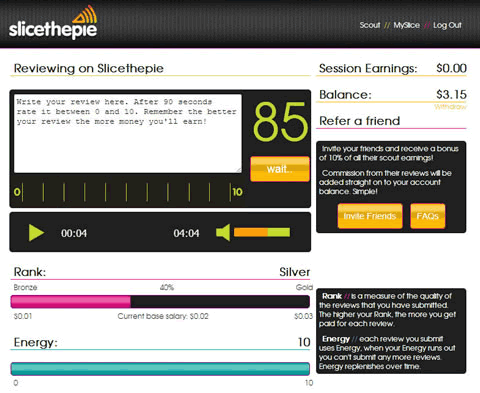

12. Review music for money

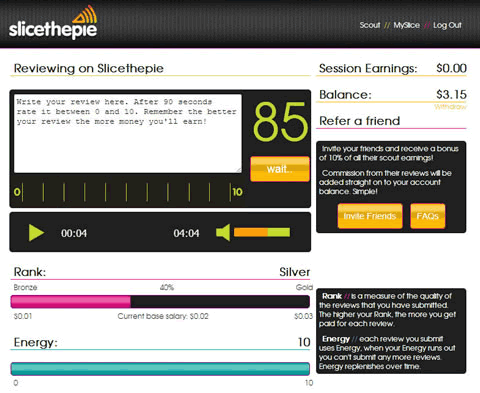

If you love music, make it your business by reviewing unsigned bands and artists online for cash with Slicethepie.

It could take a while to build up your reputation, but some site users have said that they earn £40 a month. This may certainly not sound like much to you, but if it’s something you would enjoy doing, it shouldn’t be considered hard work and another thing, it will give your C.V. boost

The money you earn will be in $US, but anyone can sign up and review. Reviewing music for money is one of the good ways to how to make money online for free.

To get started, head over to Slicethepie now or read our quick guide for more info.

13. How to make money online for free – Selling your notes

If you don’t mind sharing your notes with other students, it’s a great way to generate a little extra cash. There are sites out there that allow you to upload your notes along with your price, and then when other students download them, you receive payment.

Most of these sites, such as Nexus Notes and Stuvia, allow you to list your notes for free, but you don’t have to advertise your notes yourself, as they tend to cut their profits to handle marketing and such.

Most require you to upload a PDF, but it is worth returning and you can send handwritten notes, but you can make more money typing them.

14. Buying and Selling Domain Names

A domain name is just a website address (e.g., “savethestudent.org” or “mysite.co.uk”) and can have many extensions (.com, .net, .co.Uk, etc.).

It costs only $0.99 to register with GoDaddy.com, but premium domain names can fetch $1,000, if not millions, at the time of sale. In 2007, VacationRentals.com was $35 million!

Now, you probably won’t come across anything like that, but you can still make a quick profit with a bit of searching. The secret is to find available domain names with commercial value, snap them up, and list them for sale on sites like Sedo.com.

15. Sell your knowledge!

Becoming a tutor for other students is easier than ever. Until recently, your market was limited to local face-to-face sessions, but thanks to online tutoring sites, you can go global!

With Udemy, anyone can create an online course (literally anything!) and then sell it to other people. With Udemy, anyone can create an online course (literally anything!) and get paid forever when a user takes the course.

For one-on-one tutoring, list yourself on Superprof.com and UKTutors.

You can expect to earn more than £10 per hour, and you don’t need to be qualified to teach young GCSE or A-level students. Start with our guide to making money as a tutor.

How to make money online for free

16. Sell Your Photos

If you think you have a good shot and a bit of creativity, try uploading your photos to stock websites for free. A good starting point is AdobeStock or GettyImages.

17. How to make money online for free – Freelance Work

Maybe you enjoy writing and managing Facebook pages in your spare time or doing a little graphic design. There are plenty of freelance jobs that require only simple skills and time that someone else may not have.

And the best thing about freelancing is that you can work for clients in the UK and worldwide just by connecting to the internet from home to your own time while gaining valuable skills.

A great place to start is the leading freelance site Upwork.com. Or try using the student job search to find freelance jobs closer to home.

18. How to make money online for free: YouTube Video

YouTube logoRecent statistics show that people now watch more videos on YouTube than they do on Google.

And with the recently introduced YouTube Partner Program, you can profit from creating and uploading your videos. For every 1,000 views, you receive a percentage of the ad revenue collected.

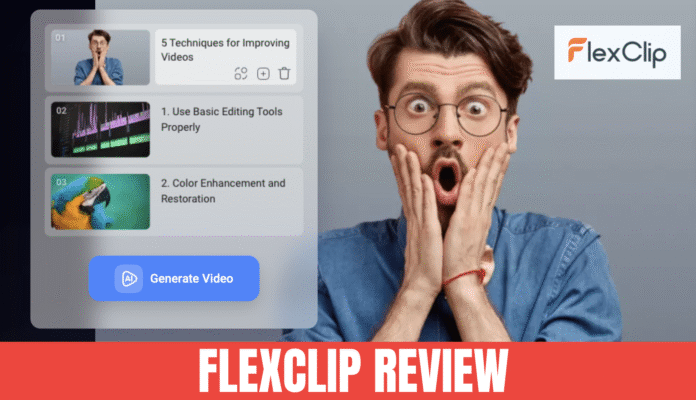

With the recently launched YouTube Partner Program, creators can monetize their videos through ad revenue. Enhance your content with FlexClip’s advanced features like AI text-to-video conversion, auto subtitles, and advanced editing tools such as Chroma Key and Reverse Video, Freeze Frame.

Depending on how successful you are (virality, subscriber base, topic), you can make a lot of money, and there are plenty of stories every week of more and more YouTubers making it their career.

For more tips, please read our guide to making money from YouTube.

19. Watch the video

If creating a video seems like a daunting task, getting paid to watch videos online has to be one of the easiest ways ever.

“Swagbucks and InboxPounds are the most popular websites, and they want you to watch things like ads and videos to go viral.

Consider typing subtitles for movies or writing movie reviews as a freelancer for more complex and rewarding opportunities.

If watching videos and movies is your goal and you want to increase your income, go to the complete list of ways to make money from watching videos.

20. Bitcoin and Cryptocurrency

Update. We are being asked more and more about making money from Bitcoin (and other cryptocurrencies). Given the ever-increasing hype and stories of kids making millions, this should not be a surprise.

Don’t rush to buy bitcoin to make money. It is vital to know what you are getting involved in. Read our how-to-buy bitcoin tutorial that explains everything you need to know.

See also: 52-week money savings challenge – ways to save lots of money.

Fact Check

We strive to provide the latest valuable information for our readers with accuracy and fairness. If you would like to add to this post or advertise with us, don’t hesitate to contact us. If you see something that doesn’t look right, contact us!

Reference: Savethestudent.org

For example, in 2011, you can buy Beauty and the beast on Blu-ray 3D for just £24.99. In just a few years, it was on Amazon for a staggering £74.99!

For example, in 2011, you can buy Beauty and the beast on Blu-ray 3D for just £24.99. In just a few years, it was on Amazon for a staggering £74.99!

![UK 2023 Homemover Behaviour - Open Property Group [Infographic]](https://moneyvests.com/wp-content/uploads/2023/08/UK-2023-Homemover-Behaviour-Open-Property-Group-Infographic-scaled.jpg)