Economy of the World

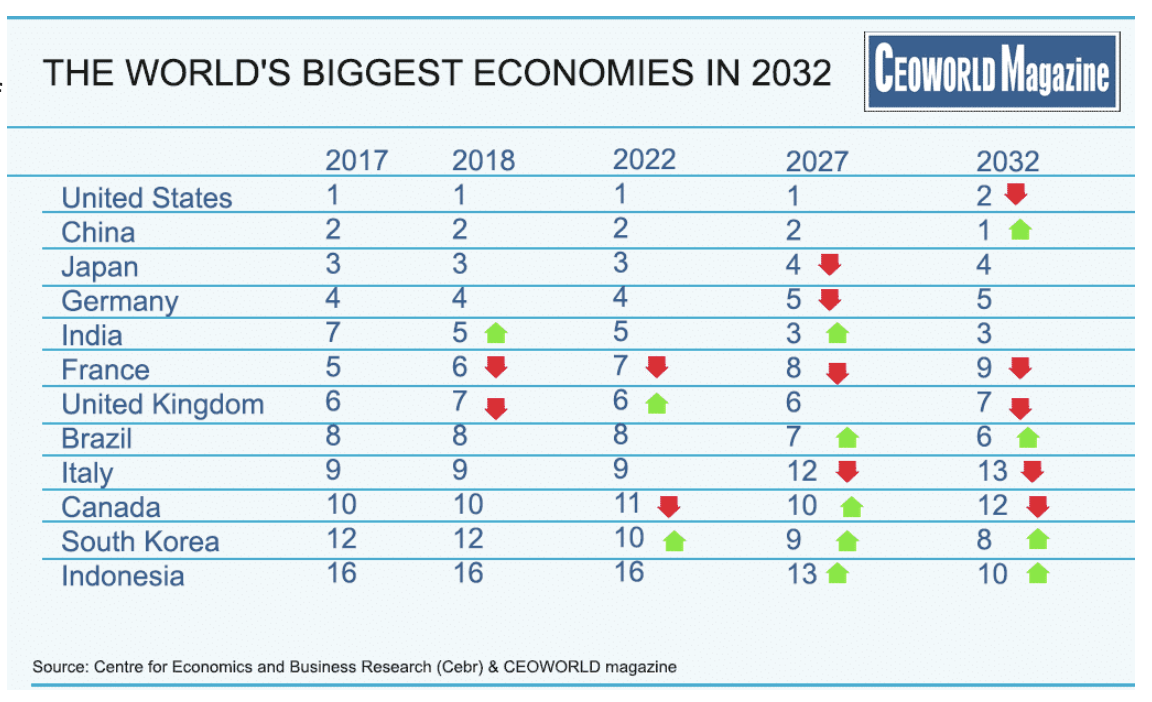

Which are the top economies of the world? According to the World Bank’s latest rankings, India is the fastest-growing developed nation. China is the largest economy in the world.

France is the second largest economy, while Germany is the largest in Europe. And who comes in last? Mexico comes in 94th. In the chart below, we’ll take a look at each country’s overall economic performance.

Hopefully, this will provide a starting point for our discussion on how we can all grow our own countries.

India is the fastest growing developed country in the world

India is one of the most rapidly developing countries in the world, with an annual growth rate of 7%, a number that continues to grow even as the economy is experiencing some slowdown.

India is also one of the world’s largest producers of coal, which accounts for over 40% of the country’s mined minerals.

In addition, it is a net importer of crude oil and has large deposits of gold, silver, and emeralds. Its largest export is cut diamonds, which are used in the jewelry and other goods produced in the jewelry industry.

India’s rapid economic growth will continue to accelerate in the coming years. In recent years, the country has had a number of problems – including the Covid-19 pandemic, which was devastating last spring – but infection rates have dropped precipitously.

Meanwhile, rising investment, consumption, and exports are expected to spur growth in the years to come. In addition, a supportive base effect will also play a role in the coming years, although the effects of recently announced structural reforms could derail the economic outlook.

China is the largest economy

It’s no longer news that China is the largest economy in the world.

The CIA and IMF both measure national economies, and the latest data show that China’s is a full-sixth bigger than the U.S.’s. By 2025, that number is expected to rise to forty percent. The Chinese economy will surpass the U.S. by purchasing power parity, which is a measure of consumer prices.

Besides being the largest economy in the world, China has also become a major trade partner and a huge holder of foreign exchange reserves. Its economic growth is now driven by domestic consumption, and China has a massive consumer market.

However, the status of the largest economy does not necessarily bring any automatic advantages. It could benefit countries dependent on China’s economy in other ways, such as through its Belt and Road Initiative, an ambitious nine-year-old effort to build trade routes throughout Asia.

Germany is Europe’s largest economy

Despite the global recession, Germany has continued to lead the way as Europe’s largest economy. Its industrialized economy has remained stable, and is one of the world’s most advanced economies.

Germany is undergoing a technological revolution, phasing out the use of nuclear power plants and replacing them with renewable energy sources. Read on to discover why Germany is leading the way. – What makes Germany such an innovative economy?

Despite the high unemployment rate, Germany continues to experience a balanced economy. It allows for a free market economy for business services and consumer goods, but imposes regulations and laws to protect its citizens. It also has a command economy for defense, which benefits everyone equally.

This country benefits from its membership in the European Union and adopts the euro currency, which spurs investment and employment.

In addition, Germany maintains a relatively low interest rate to encourage investment and growth.

France is Europe’s second largest economy

The economy of France is one of the largest in the world. It represents a fifth of the entire GDP of the Euro zone. Its economy is mainly based on services, with 70 percent of GDP coming from this sector.

France is a global leader in several industries, including the automotive, aerospace, railway, and chemical industries. It also boasts a highly educated labor force, with the highest number of science graduates per thousand workers in Europe.

In the 1950s, industry and agriculture were the dominant sectors, but today tertiary activities such as tourism, financial services, and manufacturing represent the largest percentage of national wealth.

Historically, the most rapid development took place in the heavily urbanized regions of northern and northeastern France. These regions, once the epicenter of development, have since lost jobs and population, resulting in a shift in contemporary growth to the south and west.

United States is the 12th largest economy

The gross domestic product (GDP) of a country is a measure of the size of its economy. Large countries, with high populations, tend to have large GDPs.

Canada, with a population of 38.0 million people, has little chance to match the combined economic output of 1.4 billion Chinese and 329.5 million US-Americans.

However, the situation is different when considering GDP per capita. In this case, the United States falls from the number one spot to the tenth, while China slips to the eighty-first place.

Meanwhile, Luxembourg, Liechtenstein, and the Principality of Monaco are at the top of the list, with each having a GDP of 116,015 US dollars.

The North-east states, like the northeast, have the largest economies, with GDPs that are similar to Japan’s. In contrast, Florida and Alabama have a combined economy worth $1.087 trillion, almost matching the $1.14 trillion of Mexico.

Brazil and Chile have large economies as well, with both being close to the U.S. in terms of GDP. The United States is the 12th largest economy in the world, and the top five cities in the U.S. are New York, Los Angeles, Chicago, and Houston.

Conclusion

We hope you enjoyed this article… What are your thoughts?

Please feel free to share this article!

Fact Check

We strive to provide the latest valuable information for our readers with accuracy and fairness. If you would like to add to this post or advertise with us, don’t hesitate to contact us. If you see something that doesn’t look right, contact us!