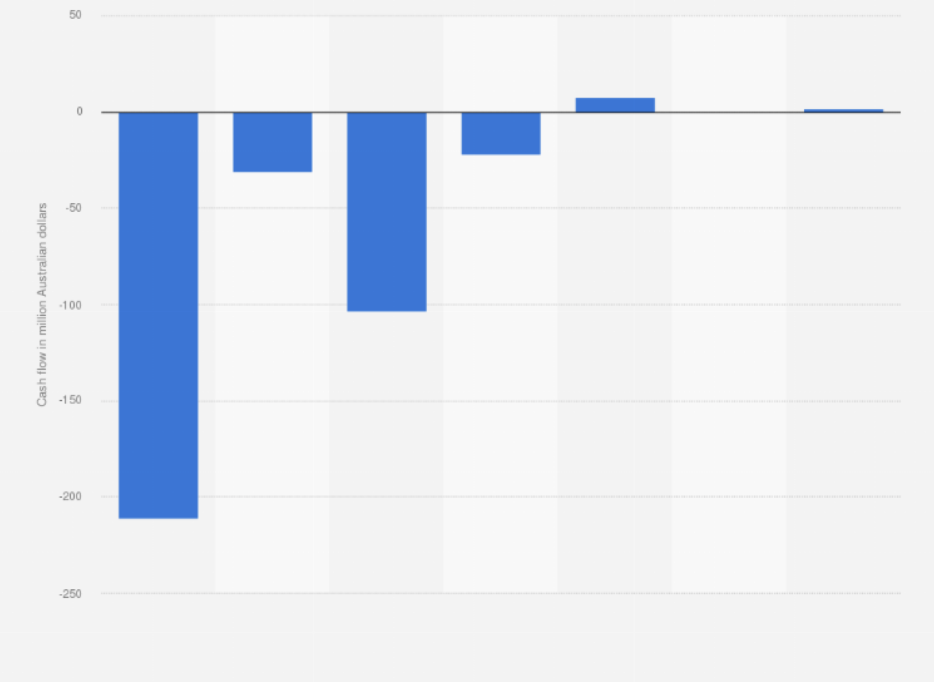

Cash Flow For Investing Activities

Cash flow for investing activities is an important measure of a company’s stability. While the number of new investments is a good indicator of the future stability of a company, many other factors need to be considered before going on a spending spree.

Innovation is the cornerstone of any successful company, and a company that fails to invest in future assets will fall behind its competitors.

Here’s how to determine if your company is making the right decisions when it comes to cash flow for investing activities.

Investing activities increase a company’s production capacity

Investing activities are cash business transactions that a company makes that affects the company’s long-term assets.

Changes to the Fixed Assets section of the balance sheet are common examples of investing cash flows.

Examples of investing cash flows include payments for the purchase of land, buildings, and equipment, and receipts for the sale of these assets.

The increased costs associated with new investments can squeeze a company’s profit margins or force it to raise selling prices.

Investing activities increase a company’production capacity in two main ways. First, they increase production capacity through ramp-up, which generally involves a large investment in physical assets.

Another example is hiring more people to meet expected demand, which often requires substantial capital investments. In this way, a company can increase its output in anticipation of a new product launch. But in the long run, it may have excess capacity.

Investing activities increase a company’s size

Investing activities are one of the most important line items on a cash flow statement because it can help determine the future growth of a company.

If investing activities are negative, this indicates that the business is investing in fixed assets, and future earnings will increase. Investing in capital assets is necessary for companies in capital-driven industries.

A positive cash flow from investing activities indicates that the business is growing.

Investing activities increase a company’sized by purchasing new equipment or making acquisitions. When a company purchases a new machine, it increases its production capacity.

Purchasing shares of another company increases the scale of operations of the company, which can lead to higher revenues and greater efficiency in operations.

This type of investing activity is one of the best ways to gauge the profitability of an investment. If it is profitable, investors may view a negative cash flow from investing activities as a positive signal of future growth.

Investing activities decrease a company’s production capacity

The net cash flow generated by a company’s investing activities depends on several factors, including the age and type of the business.

A young, fast-growing company may have a negative net cash flow, since its growth and capital expenditure will likely not result in higher profits.

However, investors can still see the benefits of a company’s investments, since their internal rate of return is a good indicator of future profitability.

The cash flow for investing activities is generated by payments into investment vehicles, loans to other entities, and purchases of fixed assets.

These outflows tend to peak right after a company has approved its annual capital budget and is ready to launch new products or services. A company may also incur cash flow losses when it sells fixed assets, such as machinery.

However, these outflows are not as severe as a negative cash flow generated by investing activities.

Long-term investments affect cash flow from investing activities

Cash flow from investing activities is important to your business for several reasons. While negative cash flow can be caused by long-term assets, this should be separated from financing activities.

While investing in long-term assets may temporarily reduce cash flow, they generally provide value over the long-term and are therefore an excellent investment.

Here are some reasons why. These investments can help you grow your business. However, you must be cautious when analyzing cash flow from investing activities.

The cash flow from investing activities of a company report the amount of money entering and exiting the company. The report also shows cash inflows and outflows from operations and financing.

These are important because these two sources can generate different amounts of cash. For example, a company may spend $30 billion on capital expenditures, buy $5 billion of investments, and pay $1 billion for acquisitions in the same period.

If the cash flow from investing activities is negative, this means that the company is investing in the long-term to support its business growth.

Conclusion

We hope you enjoyed this article… What are your thoughts on Cash Flow For Investing Activities

Please feel free to share with us in the comments section below.

Fact Check

We strive to provide the latest valuable information for our readers with accuracy and fairness. If you would like to add to this post or advertise with us, don’t hesitate to contact us. If you see something that doesn’t look right, contact us!