Credit Card Interest Calculator with interest

This credit card payoff calculator will show you the amount of interest you are paying and two ways to save thousands.

Credit cards can be a lifesaver when you need emergency cash, but they can also be a slow death for your finances.

Making minimal payments usually means paying more than twice the amount you initially charged on your credit card bill over a certain period of years.

Credit card companies will entice you with reward programs and low referral fees. Sure, everyone tells themselves they will pay off their card every month, but how often does that happen?

Card issuers are useless. Their business is attracting interest. Making the minimum payment of 2.5% on a $5,000 balance at 18% interest will take almost 20 years and cost you $6,500 in interest alone.

See also: How To Get Free Money Today: Top 10 Stress-free Ways

Using a credit card interest calculator to see the cost of those new designer jeans could be a wake-up call to pay off the card.

Not only will this tool help you calculate your credit card interest, but it will also show you how much you can save by either paying a little more each month or lowering your interest rate.

I’ve included detailed instructions below and how to get the most out of the credit card payoff calculator, so be sure to scroll down.

FAQ’s

How do you calculate the interest per month?

To calculate the monthly interest rate, simply divide the annual interest rate by 12 months. The resulting monthly interest rate is 0.417%.

The total number of terms is calculated by multiplying the number of years by 12 months since interest is compounded monthly.

How do I calculate the minimum payment on my credit card?

Some credit card issuers calculate the minimum payment as a percentage of the total balance on your statement, including interest and fees.

This is usually between 1% and 3%. For example, let’s say the minimum payment is calculated as 2% of the balance, or $5,000. You would owe the minimum payment of $100.

What is the formula for calculating simple interest?

Simple Interest Formula and Calculation: Using this simple interest formula, find the final invested amount, A, using the simple interest formula- : A= P(1 + rt) where the P is the principal amount invested at interest rate R. % per period per t period.

How do you calculate the annual interest?

Simple interest equation (principal + interest)

A = total amount accrued (principal + interest)

P = principal amount.

I = Interest amount.

r = Interest rate per year in decimal. r = R / 100.

R = Interest rate per year as a percentage. R = r * 100.

t = the period of time included in a month or year.

How to use the credit card interest calculator

It is the credit card companies’ job to keep you paying interest. They do this by hiding the actual cost of debt with low monthly payments, introductory rates, and cashback.

Using a credit card interest calculator can help you cut through the scams and see the actual cost of your card.

This credit card payoff calculator is designed to be as simple as possible while still providing you with usable information.

First, enter the amount you owe. This can be included on one card or all your credit cards together.

The annual interest rate will appear in the box as an integer without a percent sign. For example, an interest rate of 18% would be 18.

If you total the balances of all your credit cards, you will need to use a weighted average for the interest rates. This means multiplying the interest rate for each credit card by the percentage of total debt.

See also: Cash Advance Credit Cards: Fees, Alternatives, and Interest Explained.

.

For example, if you owe $3,000 on one card at 15% and $2,000 on another card at a rate of 18%, the weighted average rate would be 16.2%. That is ($3,000 divided by $5,000 total debt multiplied by 15%, and $2,000 divided by $5,000 multiplied by 18%).

If your debts are close to the same amount, you can also use the rate or average of one card.

Choose either the lowest payment rate or a fixed payment that you can pay each month. Most credit cards charge a minimum payment of 2% or $20 per month. This keeps your payments very low but also allows you to pay interest for as long as possible.

Click Calculate Credit Card Payoff

The interest calculator tool will show you how long it will take to pay off your credit card and the total interest you will eventually pay. This alone can be a big shock. You could end up paying off your card for years and losing thousands in interest.

The best part of the payoff calculator lies in the following two features. The interest calculator will show you how much interest you can save by adding as little as $50 to your monthly payment.

It will also show you how much you could also save if you were to reduce your interest rate by 5% on a consolidation loan.

Let’s look at an example using the credit card payoff calculator.

James has a total of $15,000 in credit card debt on three cards and pays an average of 20% per year. He didn’t intend to have that much debt, but shortly after losing his job, he had some emergency bills and needed his cards to pay for the expenses.

He would pay 5% of the balance each month and pay it off as soon as possible.

Jim is paying far more than the minimum payment, but it will take him 152 months, almost 13 years, to pay off the card.

He ends up paying $7,445 in interest. This is almost half of the amount he initially charged.

This is really not bad as far as the interest goes because he pays a hefty amount every month. Making the minimum payment of about 2% of the balance will take more than twice as long and cost more than twice the amount he charged.

Jim could save $4,311 in interest by adding $50 per month to his payments, but that may be difficult to do given that he is already making large payments each month.

Since the rate on his card is high, his better option might be to consolidate his credit card debt with a personal loan. By lowering the interest rate by only 5%, he can save over $5,000 on his credit card payments and pay off the loan in half the time.

Note: This is just an estimate of the amount of money you could save with a personal loan at the rate 5% lower than your current credit card rate.

The average consolidation loan rate is about 14%, but actual loan rates can be higher or lower than credit card rates.

I created this simple loan repayment calculator to help you find more accurate savings on loans for debt consolidation. You can also check the rates here to see exactly how much you can save by paying off your cards.

Credit Card Calculator With Interest

How do you calculate interest on credit cards?

Credit card interest is the amount of money you will be charged if you do not pay your credit card bill in full each month. It acts as a daily rate, calculated by dividing the annual percentage rate by 365 and multiplying the current balance by the daily rate. The amount will then be added to your bill.

How to get the most out of credit card payoffs

If your credit card has a balance of less than $1,000, you may be able to add a little extra to your monthly payment. Anything more than that, and you could be stuck making payments for a very long time.

Paying for these credit cards should be at the top of your personal financial goals, especially if the rates are above April 12%.

Whenever you pay so much in debt, it is just a bad situation, and that interest will squeeze you for years.

In addition to saving money, there are many other reasons to pay off credit card debt.

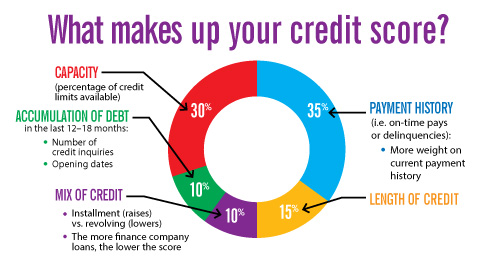

Credit cards are marked as a revolving debt on your credit report. This is a bad type of debt because the payment dates and payments are not fixed.

Consolidating with a personal loan or simply paying off your cards can boost your FICO by wiping out this bad debt.

You do not know how much you need to pay or even what your credit card charges are. If you miss a payment and your monthly payment goes up or down based on your balance, your charges could skyrocket.

Credit cards are used for emergencies and some business expenses, but otherwise, they are sealed up tightly. Credit cards are far too tempting and easy to overuse.

Credit cards can get you into trouble faster than you think, and it is challenging to keep track of the actual costs. Just one purchase can mean years of payments and double the cost of what you purchased.

See also: Top 6 Facts on How to Fill Out a Money Order Step by Step.

Paying off high-interest credit card debts on their terms is sometimes the best answer. Even paying the minimum payment plus additional fees can cost you years of payments and thousands in lost interest.

It is the credit card companies’ business that you make the payments, and they continue to collect the interest.

Consolidation loans for credit card payments are not for everyone, but they have the potential to lower your monthly payments and interest rates. That alone can save you thousands of dollars in interest on your credit cards. Still, there are several other benefits to consider as well.

Loans for consolidation have fixed monthly payments and are listed on your credit report as non-spinning debt.

It is a more appropriate type of debt because it has a repayment date and helps to increase your FICO.

Consolidating your credit card balances into one loan can help you manage your debt and remember to pay it. Fixed monthly payments also make monthly budgeting easier.

Interest rates on personal loans vary but are generally lower than those offered by credit cards. Personal loans will continue to appear on your credit report.

Still, you do not have to pledge collateral as you would with a mortgage or car loan. The term is usually three or five years, and the monthly payments are fixed.

Understand that a consolidation loan does not just cost you more space and money on your credit cards. It can get you into even more trouble and lead you down a path of never-ending interest.

Once you have paid off your high-interest loans, you can focus more on making your money work for you through investments.

Use these investment calculators to see how fast your retirement income can grow.

Credit cards can be a financial tool, but they can also be a quick financial trap. Paying off a credit card with minimal payments can mean thousands in interest and years of monthly payments.

This credit card interest calculator tool is your first step to understanding how much you pay and how much you can save.

Try Free Credit Card Calculator With Interest Here

See also: Top 10 Money Management Tips To Build Financial Security

Fact Check

We strive to provide the latest valuable information for our readers with accuracy and fairness. If you would like to add to this post or advertise with us, don’t hesitate contact us. If you see something that doesn’t look right, contact us!

Reference: Peerfinance101.com