Fundrise vs. CrowdStreet – Which One Is Right For You?

Fundrise is a Washington-based investing company that was founded in 2010. It focuses on real estate investments and was one of the first companies to implement a crowdsourced approach to real estate investments successfully.

This allowed them to keep minimum investments very low – just $10 -allowing anyone to gain exposure to this market.

Since launching its first product in 2012, Fundrise has become one of the biggest platforms, with a portfolio worth over $7 billion, and they have paid out over $194 million to investors.

CrowdStreet is a real Estate crowdfunding platform based in Austin, Texas. The main reason for co-founders Tore Steen and Darren Powderly to launch this platform was to offset the overreliance of investors on Wall Street when realizing investment opportunities.

Since its inception in 2012, CrowdStreet has traded over $3.93 billion worth of real estate properties and investments and completed over 661 deals.

CrowdStreet’s returns are some of the highest across real estate crowdfunding platforms and, consequently, has a very steep investment entrance: this platform is only available for accredited investors willing to make an initial deposit of $25,000.

In this quick Fundrise vs. CrowdStreet summary, I will go over all the best features of each platform and compare them side by side. If you want to read a more in-depth analysis, check out our full Fundrise vs. CrowdStreet review.

Fundrise & CrowdStreet Similarities

Starting with the similarities; both platforms offer access to:

- Real estate investments

- Residential and commercial properties

- Available for investors in the US

- No trading commissions

- Diversified investments

- Regulated by the SEC

One of the main differences between the two is that CrowdStreet functions as a marketplace where sponsors can list properties or projects, and investors can pick and choose their investments.

Fundrise offers diversified investments through its portfolio and direct investments in specific properties. For a deeper dive into their offerings and similarities, check out this post.

Fundrise vs. CrowdStreet – Side By Side

| Platform | Fundrise | CrowdStreet |

| Minimum Investment | $10 | $25,000 (may vary) |

| Management fees | 0.85% | Free (Investors) |

| Additional fees | 0.15% | 1%-5% (Sponsors) |

| Average annual returns | 5.5%-9.4% | Variable |

| Account tiers | Five tiers based on your initial investment | N/A |

| Trading Commissions | Free | Free |

| Available for non-accredited investors | Yes | No |

| Invest via IRAs | Yes. (Basic tier) | Yes |

| Auto-investing tools | Yes | No |

| Customizable portfolio | Yes. (Core tier) | Yes |

| Real estate focus | Residential and Commercial properties | Commercial |

| Regulated by the SEC | Yes | Yes |

| Insured | No | Yes. By the SIPC, for up to $500,000 |

The more prohibiting difference between these two platforms is that Fundrise takes a crowdfunded approach to their investments, which allows them to keep their minimum very low: you can start investing with just $10.

CrowdStreet, on the other hand, connects sponsors with investors, and since there is no pool of investors, their minimum investments are very high – around $25,000, depending on the listing.

These high fees and the fact that CrowdStreet is only available for accredited investors to make it a somewhat inaccessible option for the average investor.

Both have low management fees compared to the industry average; the main difference is that Fundrise charges a management fee (0.85%), while CrowdStreet charges sponsor for listing their properties or projects, not the investor.

Fundrise has five different account tiers based on your initial deposit, and some features are exclusive to the upper tiers.

For example, investing in the Fundrise portfolio is available for all investors, but investing in particular properties and eFunds is exclusive to Core, Advanced, and Premium users. Here’s a breakdown of the minimum investments you need for each tier:

- Starter ($10 minimum investment)

- Basic ($500)

- Core ($1,000)

- Advanced ($10,000)

- Premium ($100,000)

In this post, we go over the features of each Fundrise tier.

Compared to other real estate investing platforms, Fundrise and CrowdStreet both have a strong focus on commercial and residential properties, and you can expect returns ranging from 5.5%-9.4%. However, CrowdStreet investments can be more volatile if you invest in a single property.

Both Fundrise and CrowdStreet are registered and licensed with the SEC, but only CrowdStreet offers insurance for up to $500,000 through the Securities Investor Protection Corporation (SIPC). Here are some other key differences.

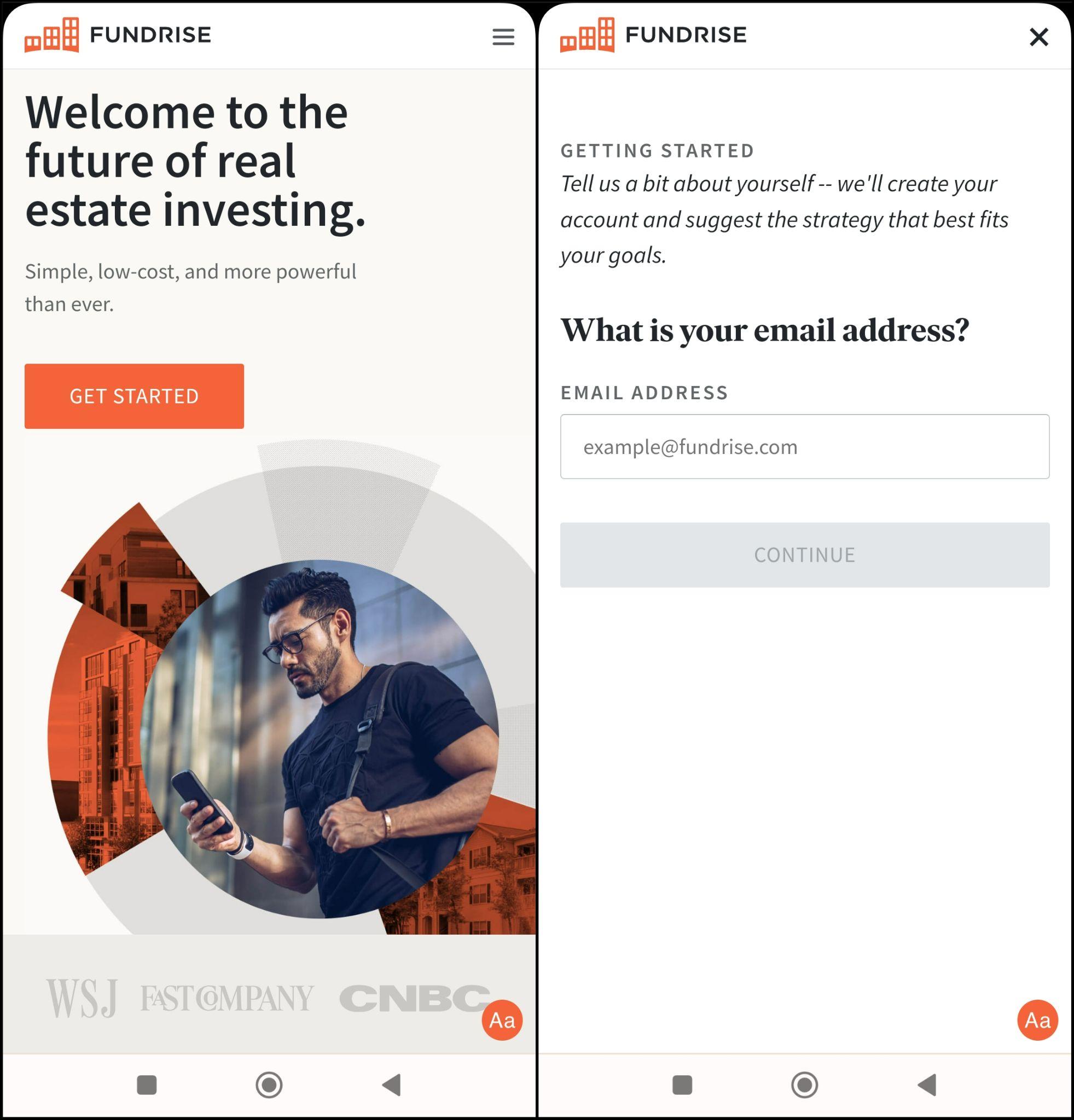

Sign-Up Process

Signing-Up With Fundrise

To sign up with Fundrise, you only need to be a US citizen (or permanent resident) and have a valid email address. No accreditation is required. Additionally, if you use this link to sign-up, you will get $10 worth of Fundrise Real Estate Interval Fund shares for free.

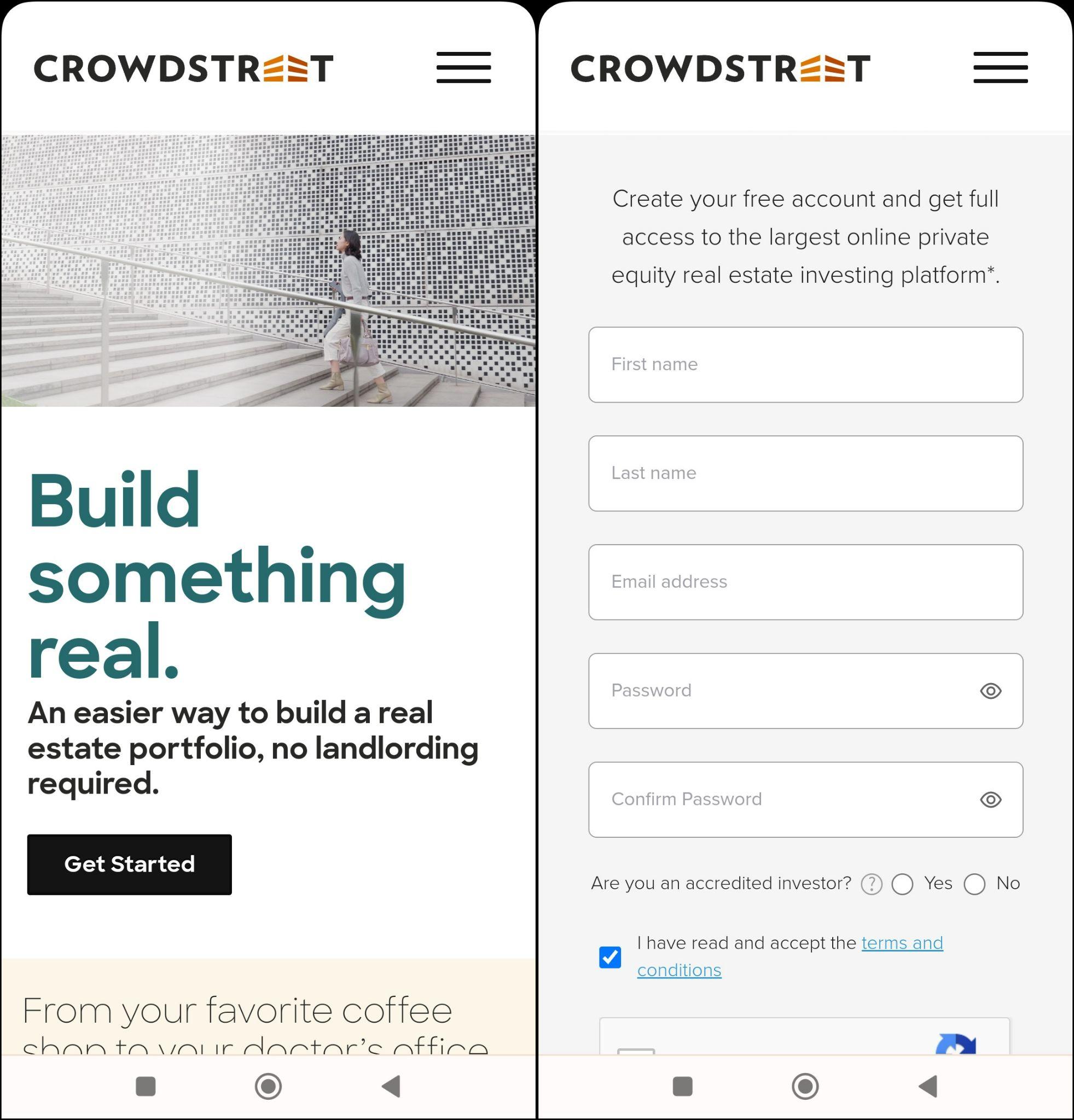

Signing Up With CrowdStreet

Signing up for CrowdStreet is easy, but you must meet some requirements. To apply, you must be an accredited investor with US citizenship, and your primary residence must be in the US.

To start the process, use our link to visit CrowdStreet’s page and fill in some of your basic information. Our promo code will be applied automatically, and you will receive a welcome bonus of up to $200, credited to your account. Keep in mind the welcome bonus may vary depending on their current offer.

Fundrise Fees vs. CrowdStreet Fees

Fundrise Fees

- Sales Commission: None

- Annual Advisory Fees: 0.15%/year

- Management Fees: 0.85%/year

CrowdStreet

- Investor Fees: Free

- Sponsor Fees: From 1% to 5% (additional fees may apply)

CrowdStreet doesn’t charge investors any fee – instead, the sponsor that lists their properties on the marketplace pays a fee.

Choosing Your Plan

If you’re still unsure which platform to pick, these are our recommendations.

- If you’re not an accredited investor and don’t have much experience investing, we recommend the Fundrise Starter or Basic tier for its premade portfolio and low minimums

- If you’re looking to start investing and want access to some basic, affordable investments, we recommend the Fundrise Core tier for its flexibility when choosing investments

- If you’re a knowledgeable, self-directed investor with ample experience in the real estate market looking for the most profitable properties and projects, we recommend CrowdStreet

Usually, it’s a good idea to start with the lower tiers, if applicable, when choosing an investing platform. It’s a great way to get a feel for the market, and you can always upgrade later.

If you want to read more about which platform is better suited for you based on your experience and long-term goals, check out our post, where we discuss all the details you should consider.

Conclusion

If you don’t have much experience investing, Fundrise is a great way to start earning a regular income and gaining exposure to a diversified real estate portfolio.

You only need $10 to get started, and you don’t need accreditation. If you have more investing experience and are looking for specific commercial or residential properties, CrowdStreet might be just for you.

It has somewhat high minimum investments, but its fee structure is very transparent, and you can invest in projects and earn large returns.

Fact Check

We strive to provide the latest valuable information for our readers with accuracy and fairness. If you would like to add to this post or advertise with us, don’t hesitate to contact us. If you see something that doesn’t look right, contact us!