What is online credit card generators and what are their Uses

Credit card numbers are physical or virtual, are not generated at random. To pass through the verification tests, they must follow a specific pattern that is being set for credit card numbers formation.

The credit card generator is the software or a tool used to generate these numbers. There is no difference in the process whether you’re generating real or fake credit card numbers.

If you need to create a bogus virtual credit card, you must generate the number in the very same way that authorized issuers to generate valid credit card numbers.

You can create your own bogus VCC numbers using any credit card generators available online and use them to guard your financial information on sites you don’t trust implicitly.

As the main mode of purchasing goods and services is online shopping, our personal information must be safeguarded against any fraudulent activity.

When you need to provide the card information to new vendors or retailers with a history of third-party breaches and glitches, it’s a good idea to use VCCs and fake credit cards.

What exactly is a Credit Card Generator?

A software that allows you to create standard credit cards is called a credit card generator. By following the instructions on the website you can also create your own set.

The Credit Card Generator generates standard credit card numbers for you. It creates a set of standard credit card numbers in the format used in the majority of credit card transactions. It is a tool for preventing identity theft. It is a protection system to avoid unauthorized credit card transactions online.

The Luhn Algorithm is used in the verification test that credit cards must cross to determine whether their number is correct. As a result, even forged credit card numbers can pass the validity check. The cash transaction is a completely different concept, and counterfeit credit cards cannot be used to make purchases.

What is the Luhn formula all about?

Credit card numbers can be validated using the Luhn formula. It is an algorithm for error detection and correction. Continue reading if you’re curious about the Luhn formula.

- Hans Peter Luhn, an IBM scientist, was the inspiration for its name.

- The authenticity of identification numbers is verified using a formula.

- It is how it works. The 16th digit should be omitted.

- The final digit is the check digit, which means the last one.

- Switch the numbers around.

- To find the answer, multiply the digits in the odd position by 2.

- Subtract 9 from the numbers that are greater than or equal to 9.

- Add up all of the individual figures.

- The result of multiplying the check digit by the checksum must be a multiple of ten.

How do these CC generators function?

These tools are a particular favorite of those who enjoy experimenting with new things. People are free to generate as many card details as they want and to use them however they see fit. Credit card generators are also known as card codes.

They are available for free and can be accessed from anywhere. These cc generators give you lots of unique card numbers that have the same framework as real credit cards, in addition to anonymous information.

If you want to enter any game trials or do random subscriptions these tools will come in handy.

After scanning for a sequence online, the CC generator uses an advanced programming language to generate specific lengths.

This entire process is guided by mathematical rules. If these algorithm standards are not met correctly, the number will be deleted.

What exactly is a valid credit card number?

A valid credit card number begins with the major industry identifier (MII), which distinguishes each credit card number based on its industry.

A valid credit card number must be 16 digits long and begin with a 5 for MasterCard, 4 for Visa, 6 for Discover, 35 for JCB, 34 and 37 for American Express.

Account numbers ranging from 6 to 9 digits are used to represent the cardholder’s account. The check digit is the last digit that verifies the authenticity of the credit card.

Cards are divided into two types:

-

Single credit card generator:

Use a single credit card generator if you want a single credit card number for all of your testing needs. You can generate more numbers by repeating the process.

-

Bulk credit card generator:

If you don’t want to handle the stress of manually generating credit card numbers every time you have to have one, use a bulk credit card generator. It will produce a large number of unique and yet valid credit card numbers.

What are the benefits of using credit card generators?

Credit card generators are online tools that can be used to generate bogus credit card numbers. These numbers are correct, but not the rest of the card’s information. These are numbers generated at random for testing purposes.

These are also precautionary measures for first-time credit card users to avoid scams. You will be able to change the expiration date, CVV, security codes, names, and so on.

Check out some of the benefits of credit card generators:

The primary reason for using credit card generators is for testing or checking. Online stores ask you to fill out credit card information.

Users have the option of transferring funds when they click on the checkout button. As they enter their credit card number, it will be done via credit card.

Buyers feel secure with the big names of online markets. The problem arises when they shop at small and start-up businesses.

Customers are typically reluctant to share their credit card information on such new marketplaces. As a result, they consider using a virtual credit card number rather than a genuine one.

Valid credit card generators typically include the valid issuers of cards and CVV. These could be used to determine whether or not a transaction’s procedure is genuine.

New cardholders’ training:

Another benefit is that they can be used for training new cardholders. The majority of new cardholders lack sufficient knowledge about credit cards. They have no idea how and when to use them for shopping online. The bank can provide people with training in this area. They depend more on these fake card generators than on real card numbers.

Safety:

The key reason for using generators is for security or financial safeguarding. The testing process can be used to determine the legitimacy of the website with which one is dealing.

This is the most secure method of preventing identity theft or financial fraud when using a credit card.

With the rise of cybercrime, credit card fraud has become a common problem. Many irresponsible people can use these cards without the card owner’s official permission. To commit money fraud, all they need is an address, a security code, or a number.

These programs can generate new credit card numbers that are very similar to your own. Using fake credit card generators, you can avoid such cyber fraud.

Here we will discuss one of the best CC generators we have online,

- Prepostseo CC generator:

This tool does have wonderful features that can help you with a variety of tasks, such as a plagiarism checker, a summarizer, and a paraphrase generator, but we’ll focus on its CC generator here.

Prepostseo credit card generator generates bogus credit card information like address, name, CVV, and number, among other things, enabling you to use without the worry of fraudulent activity.

These fake credit card numbers can be used for both internet gaming trials and professional purposes.

https://www.prepostseo.com/tool/credit-card-generator

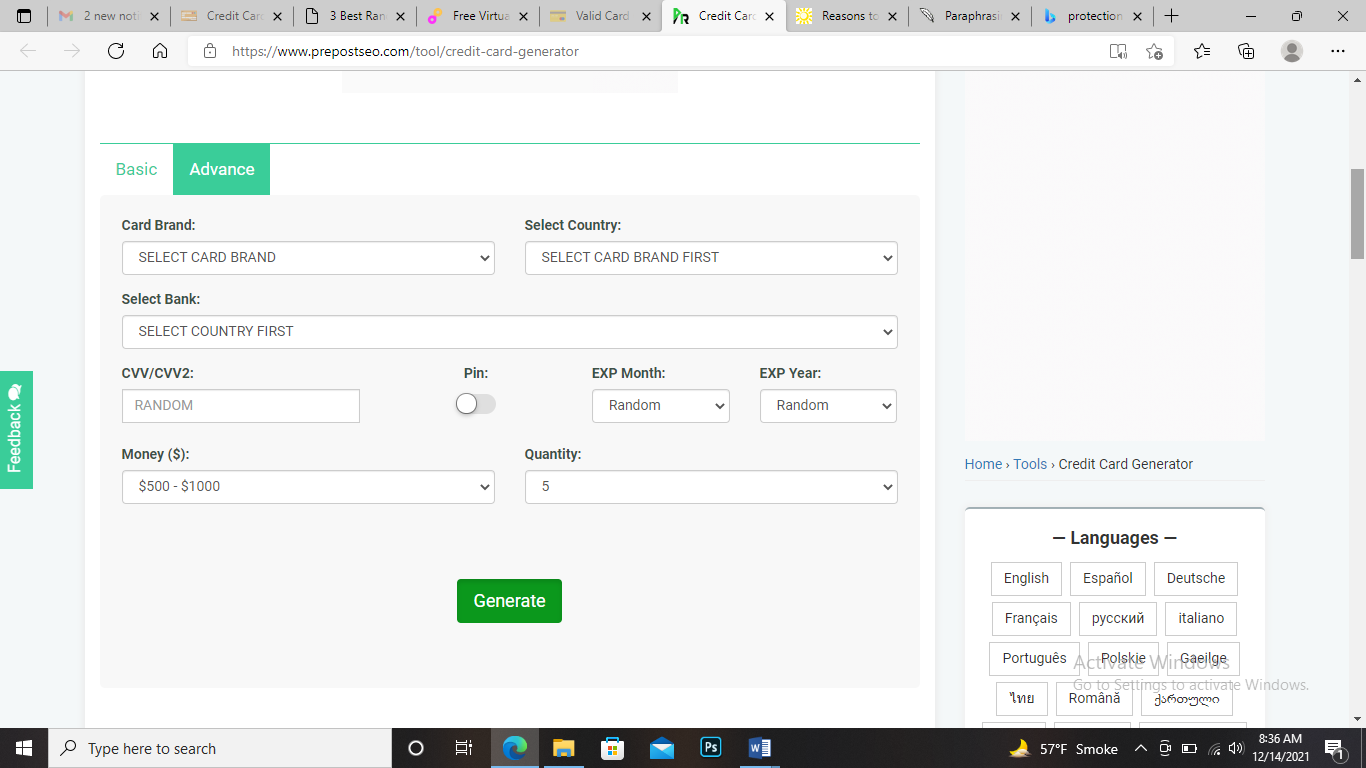

You have two options in this tool, basic credit card generator as well as advance credit card generator.

Image 1 (Basic)

Image 2 (Advance)

Usage:

- Enter a value and select an option from each block.

- After you’ve chosen your desired options, click the “Generate” button.

- Basic mode provides you with a few options such as card brand, expiry month and year, CVV/CVV2, and quantity.

- Moreover, the advanced mode requires you to select numerous options, including country, bank name, money, card brand, expiry month and year, and so on.

Conclusion

We hope you enjoyed this article… What are your thoughts on What is online credit card generators and what are their Uses?

Please feel free to share with us in the comments section below.

Fact Check

We strive to provide the latest valuable information for our readers with accuracy and fairness. If you would like to add to this post or advertise with us, don’t hesitate to contact us. If you see something that doesn’t look right, contact us!