Mortgage Calculator for New York City

The mortgage calculator for New York can assist you in estimating the costs of your mortgage loan application.

You will receive a detailed summary of your future mortgage payments, including taxes and insurance costs.

The housing market in New York

Unsurprisingly, New York, the Empire State, is one of the most costly states in which to own a property, with the average homeowner spending close to 24% of their salary on their residence.

In 2018, the median home value in the state increased by a very moderate 5.8 percent, with similar growth rates expected for the following year.

Buyers in New York City won’t have to worry about being taken by surprise by ghosts because sellers are obligated to disclose if a property has been suspected to be haunted by a ghost.

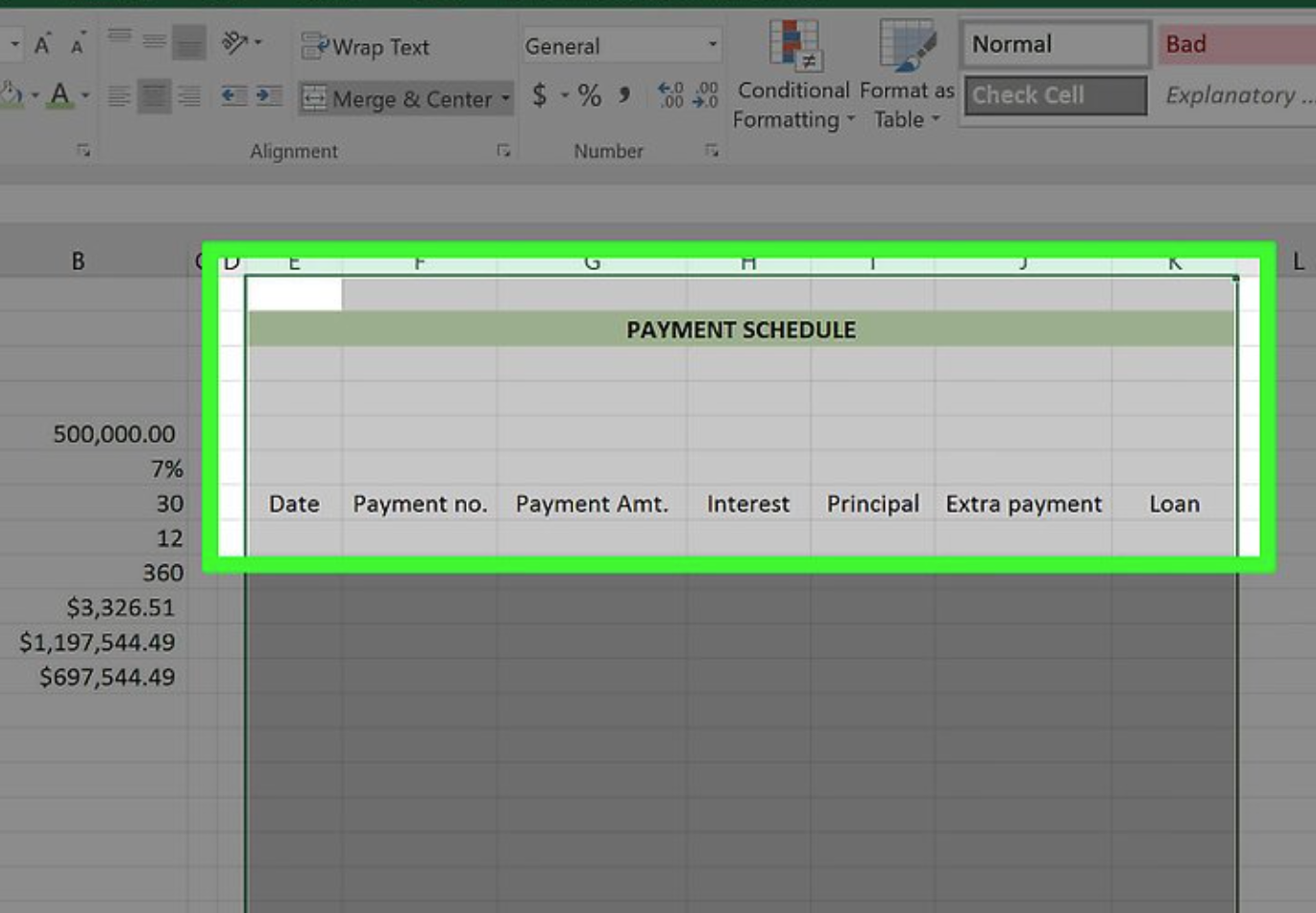

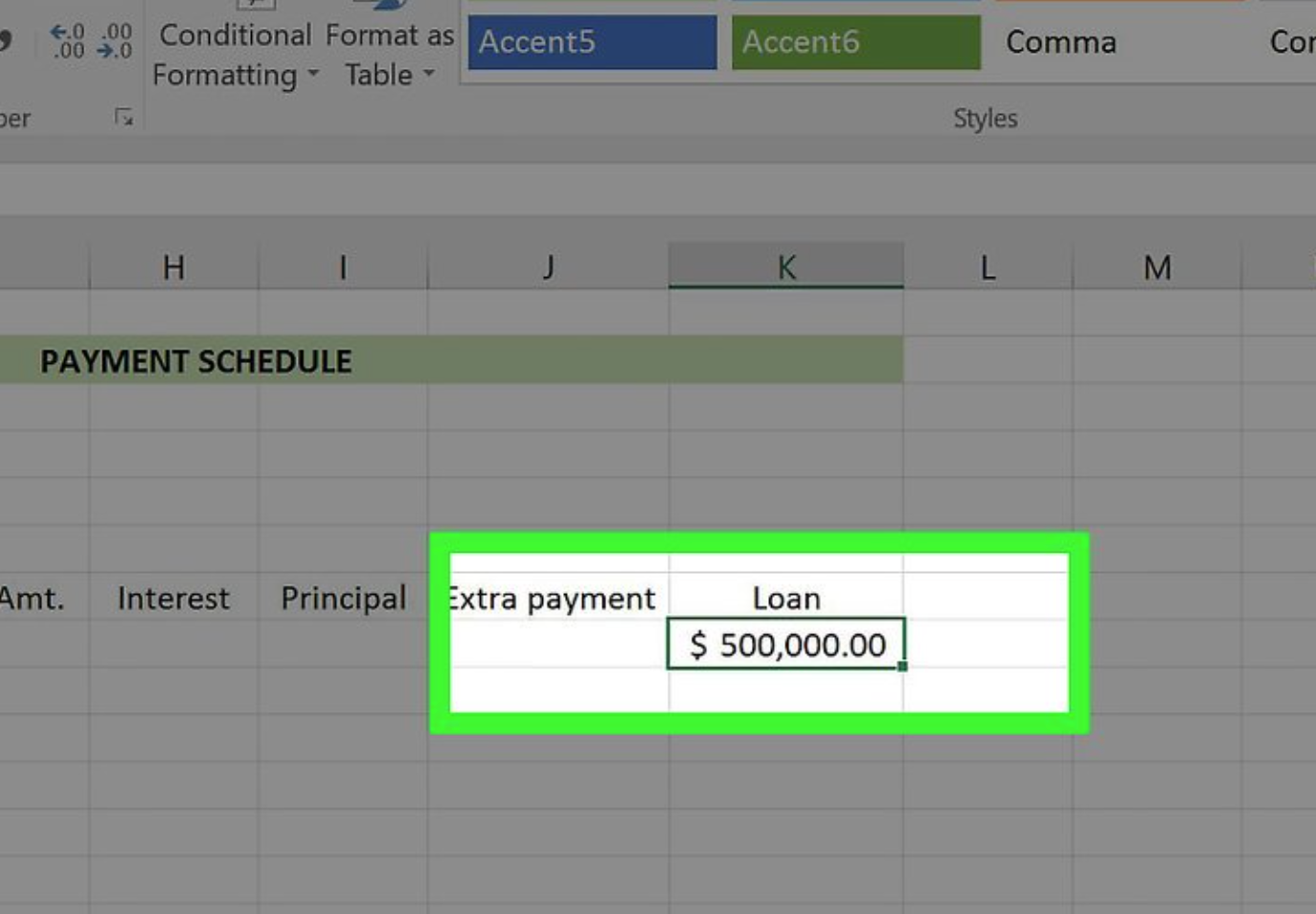

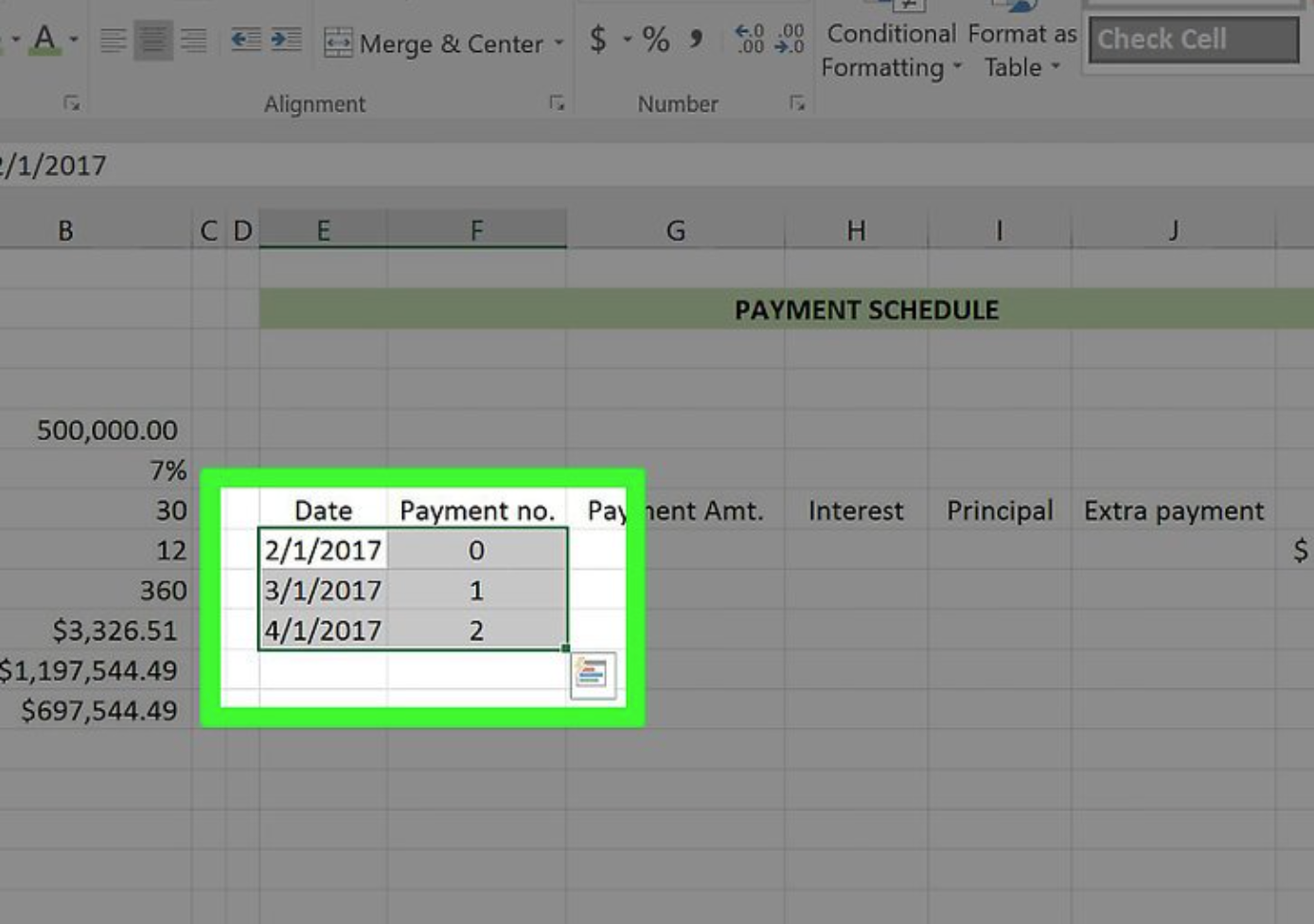

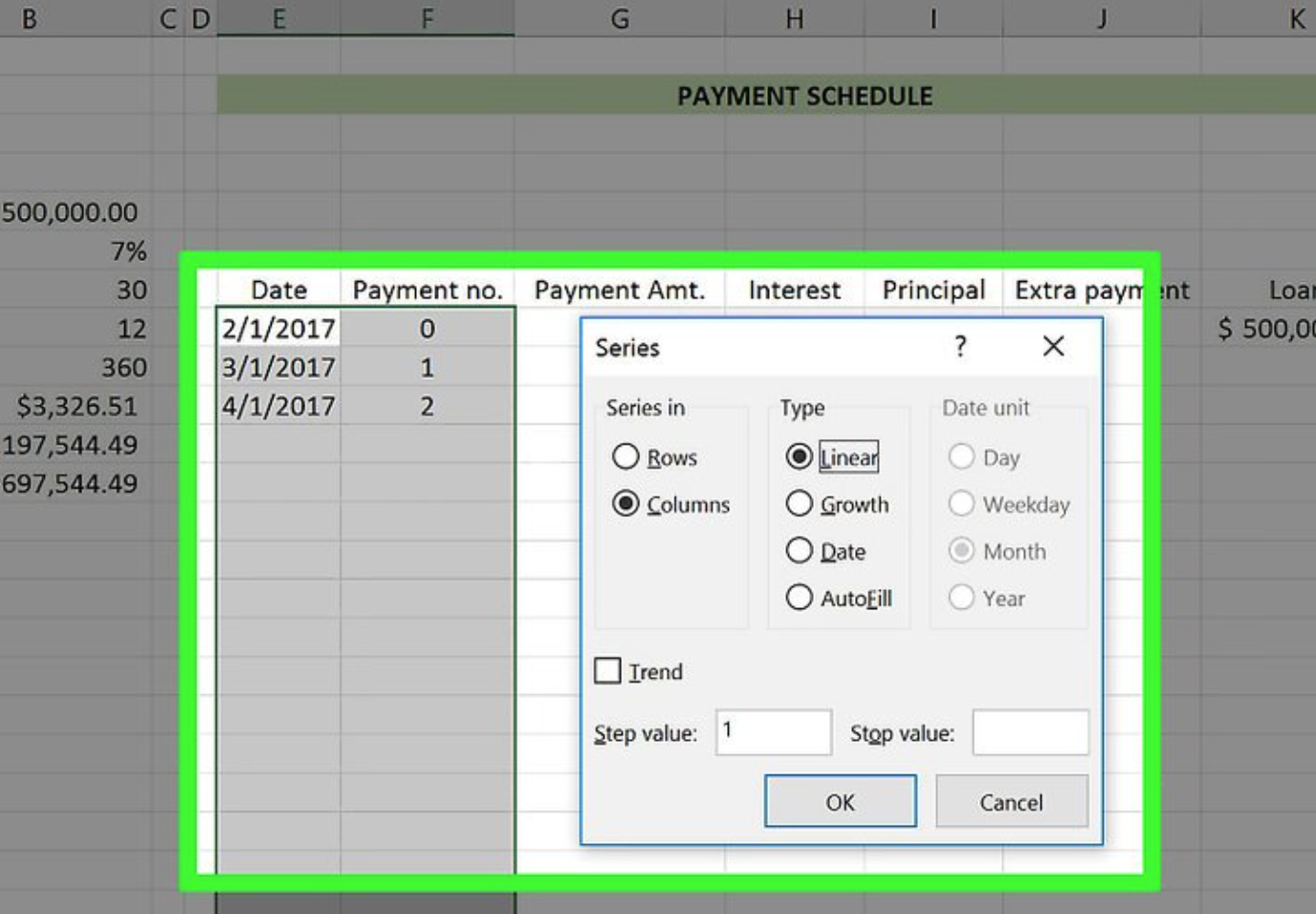

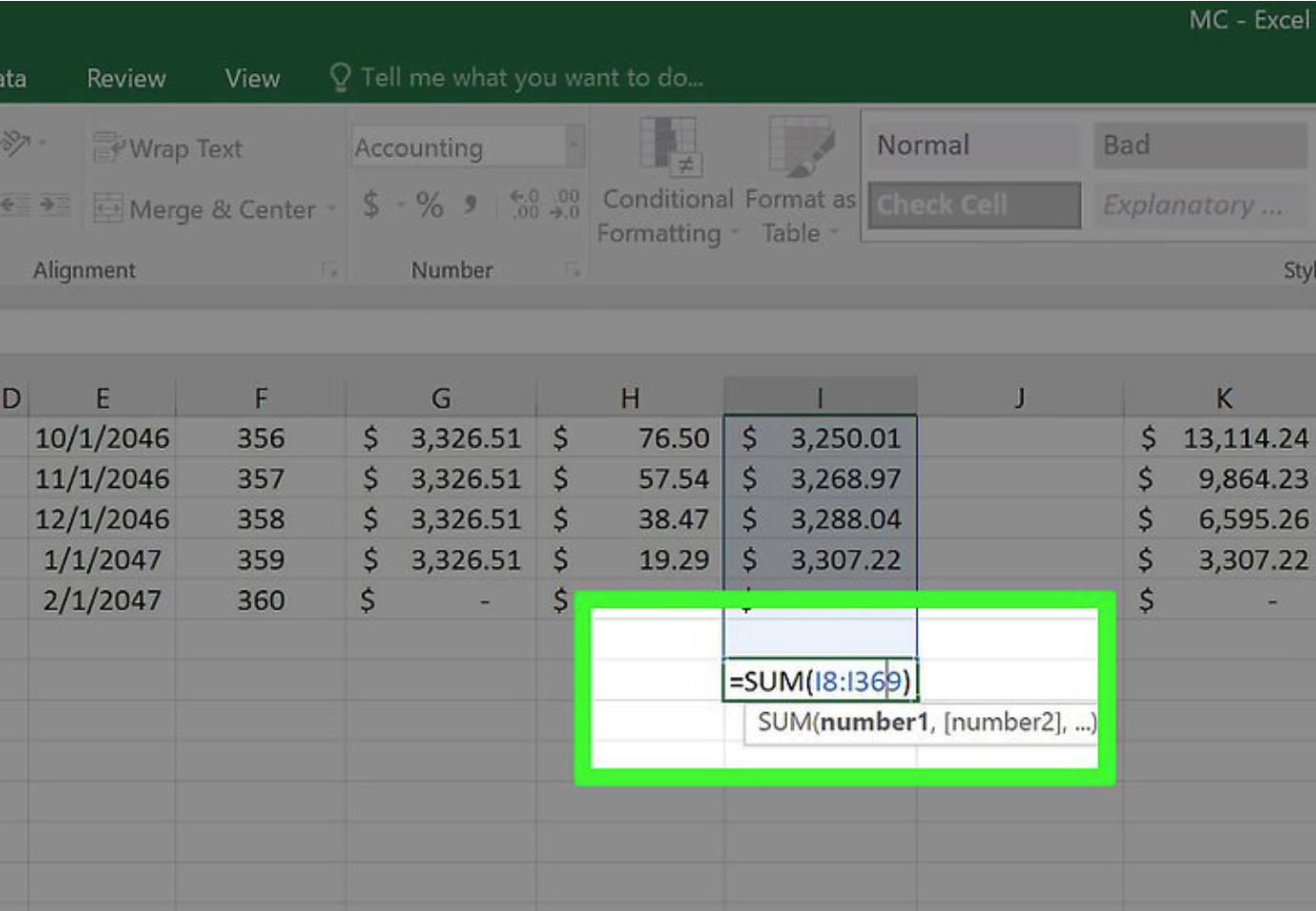

Calculate your monthly mortgage payment with the New York Mortgage Calculator.

Our estimated monthly payments include principal and interest, common charges and upkeep, property taxes, and homeowner’s insurance.

Over the course of 30 years, your mortgage payments will total $1,429,560.

Monthly payment estimate: $3971.

Since the real estate crisis, the majority of lenders have offered three primary types of mortgages: fixed-rate mortgages with terms of 5, 7, 15, 20, and 30 years, adjustable-rate mortgages, and ARMs with an interest rate that fluctuates over the life of the loan, and hybrid mortgages with a fixed-rate period of typically three to ten years followed by years with an adjustable rate.

Compare Types of Loan

Lenders most commonly offer fixed-rate mortgages with maturities ranging from 30 years to 15 years to their customers.

Depending on your financial condition, you may find that one term is more advantageous than another.

A 30-year fixed-rate mortgage has a smaller monthly payment, but you’ll end up paying more in interest over the course of the loan.

Even though you’ll have a higher monthly payment (since you’ll pay off the loan over 15 years instead of 30), a 15-year fixed-rate mortgage can save you thousands in interest over the course of the loan’s term.

| Loan Term |

30 Year Fixed |

15 Year Fixed |

| Monthly Payment |

$984 |

$1,454 |

| Mortgage Rate |

4.25% |

3.75% |

| Total Interest Paid |

$153,929 |

$61,451 |

Frequently Asked Mortgage Questions in New York City

We strongly advise you to obtain pre-approval from your preferred lender prior to placing an offer on a property in New York City.

After your offer has been accepted and the contract has been signed, it is time to complete your mortgage application package and select the appropriate home finance program.

These questions will assist you in making an informed mortgage decision.

Major Factors that influence your New York mortgage payment

Property taxes in New York are as different as the people who live there, which is a good thing in this densely populated state.

The amount of tax you pay can differ significantly from one county to the next.

Westchester County, which is located north of New York City, has some of the highest tax rates in the whole United States.

The average effective property tax rate in New York is 1.69 percent, which is lower than the national average.

You would assume that purchasing a home in one of New York’s boroughs will result in a significant increase in your property tax burden. It may come as a surprise to learn that tax rates in the city are more reasonable than those in the neighboring suburbs.

A residence in Brooklyn, which is located in the county of Kings, has an effective tax rate of 0.66 percent, which is incredibly low. Owning property in Manhattan will cost you only 0.95 percent of your income.

In contrast, if you relocate north to the suburbs, your effective tax rate rises to 1.89 percent in Westchester County and approximately 2.30 percent in Rockland County, respectively.

Unfortunately, the tax rates in some of the smaller communities do not improve as a result of this.

The effective property tax rate in Erie County, for example, is 2.58 percent, which is located in the northwest portion of the state (and is where Buffalo is located).

A large portion of the revenues is distributed to school districts around the county.

Interested in learning more about how New York’s property taxes are calculated? Your home is assessed by a local authority, often known as a town assessor, who determines its worth.

Most states have exams that are scheduled on a regular basis, either once a year or less frequently.

New York, on the other hand, is lagging behind in terms of officially codifying how frequently assessments are performed. Because of the mismatch between actual market value and an assessment that may have been done years ago, taxing authorities give residential assessment percentages to taxing jurisdictions (RAR).

It is the ratio between the assessed value and current market value that is represented by the RAR.

Your tax bill will be determined by the assessed value of your property as well as a variety of unique county factors, such as school district taxes and special projects, such as parks or libraries, that will be included in your statement.

Millage rates are used to establish tax rates in New York State. One Million is equal to one dollar of tax per $1,000 of the assessed value of the real estate.

The good news for New York homeowners is that there are a number of property tax exemptions available, including the School Tax Relief (STAR) program as well as exemptions for seniors, veterans, the disabled, and farmers.

In addition to high property taxes, homeowners insurance in New York is prohibitively expensive.

According to our Most Affordable Places to Live report, the annual premium for this community is an average of $912 per year on average.

If you’re looking at a home in the state’s southernmost region, you’ll almost certainly have to pay a mandated hurricane deductible as a result of the location. It’s important to keep this in mind while estimating prospective costs.

Another source of concern is flooding, which devastated the state during Hurricane Irene in 2011 and was exacerbated much further by Hurricane Sandy in 2012.

Because ordinary homeowner insurance does not provide coverage for floods, you’ll want to look into the National Flood Insurance Program (NFIP).

The website of the New York Department of Financial Services includes a section on homeowners insurance that includes advice for selecting a policy as well as determining how much coverage you need for your house.

The services of a financial advisor in New York can assist you in understanding how homeownership fits into your overall financial objectives.

Financial advisors can also assist with investment and financial planning – covering retirement, taxes, insurance, and other aspects of financial planning – to ensure that you are well prepared for your future.

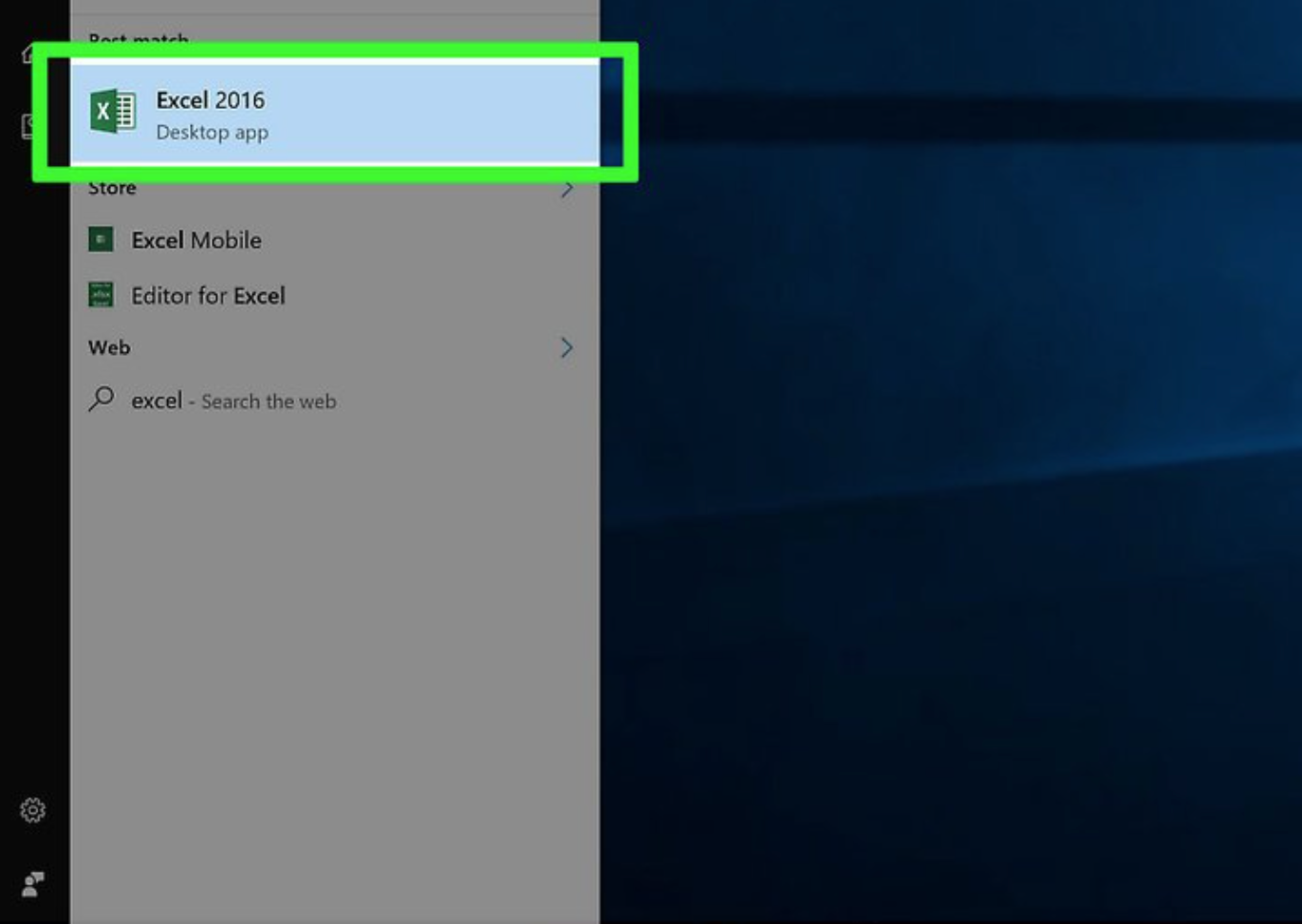

You can find Free New Your Calculator here

Expenses to Be Prepared For When Purchasing a Home in New York?

Before you even consider purchasing a home, you’ll need to schedule a home inspection. Despite the fact that seller’s disclosures are required in New York, you are still responsible for conducting your own due diligence on the condition of the property.

It will cost you between $400 and $500 dollars to have a house inspection performed in New York, with greater rates for multi-family properties and cheaper costs for condominiums.

Many homebuyers choose to have extra tests performed in addition to the standard house inspection, such as termite inspections, mold inspections, and radon testing, among others.

For the latter, the state of New York maintains a radon level map that depicts the level of danger in each of its counties.

As soon as the inspections are completed and your home’s closing date has been confirmed, you’ll want to set aside additional funds to cover the charges and fees that will be incurred when you close on your property.

A home’s closing costs will vary depending on its location and its monetary value at the time of purchase.

There’s also the possibility of negotiating with a seller to pay for a fraction of the items in question. If you are purchasing a home in New York, you should budget around 2.60 percent of the purchase price to cover these expenses.

The Average Closing Costs by County

| County |

Avg. Closing Costs |

Median Home Value |

Closing Costs as % of Home Value |

| Albany |

$7,667 |

$222,500 |

3.45% |

| Allegany |

$3,926 |

$76,400 |

5.14% |

| Bronx |

$14,605 |

$404,700 |

3.61% |

| Broome |

$5,412 |

$117,000 |

4.63% |

| Cattaraugus |

$4,452 |

$88,100 |

5.05% |

| Cayuga |

$5,479 |

$128,000 |

4.28% |

| Chautauqua |

$4,449 |

$88,000 |

5.06% |

| Chemung |

$4,856 |

$105,800 |

4.59% |

| Chenango |

$4,344 |

$98,400 |

4.41% |

| Clinton |

$5,583 |

$134,100 |

4.16% |

| Columbia |

$7,881 |

$233,600 |

3.37% |

| Cortland |

$5,406 |

$123,800 |

4.37% |

| Delaware |

$5,671 |

$139,300 |

4.07% |

| Dutchess |

$8,479 |

$282,000 |

3.01% |

| Erie |

$6,743 |

$153,400 |

4.40% |

| Essex |

$6,248 |

$153,600 |

4.07% |

| Franklin |

$5,137 |

$108,700 |

4.73% |

| Fulton |

$5,153 |

$109,600 |

4.70% |

| Genesee |

$5,595 |

$119,800 |

4.67% |

| Greene |

$6,684 |

$176,300 |

3.79% |

| Hamilton |

$6,127 |

$166,000 |

3.69% |

| Herkimer |

$4,603 |

$100,000 |

4.60% |

| Jefferson |

$5,527 |

$149,900 |

3.69% |

| Kings |

$23,018 |

$706,000 |

3.26% |

| Lewis |

$5,342 |

$120,200 |

4.44% |

| Livingston |

$5,503 |

$129,400 |

4.25% |

| Madison |

$5,332 |

$136,800 |

3.90% |

| Monroe |

$5,827 |

$148,400 |

3.93% |

| Montgomery |

$4,850 |

$105,400 |

4.60% |

| Nassau |

$12,210 |

$493,500 |

2.47% |

| New York |

$31,401 |

$987,700 |

3.18% |

| Niagara |

$5,438 |

$125,600 |

4.33% |

| Oneida |

$5,197 |

$127,700 |

4.07% |

| Onondaga |

$5,775 |

$145,400 |

3.97% |

| Ontario |

$5,704 |

$161,800 |

3.53% |

| Orange |

$8,172 |

$271,200 |

3.01% |

| Orleans |

$4,557 |

$98,400 |

4.63% |

| Oswego |

$5,064 |

$104,600 |

4.84% |

| Otsego |

$5,475 |

$146,400 |

3.74% |

| Putnam |

$9,754 |

$358,500 |

2.72% |

| Queens |

$18,474 |

$543,800 |

3.40% |

| Rensselaer |

$6,923 |

$188,700 |

3.67% |

| Richmond |

$17,425 |

$504,800 |

3.45% |

| Rockland |

$12,295 |

$443,400 |

2.77% |

| Saint Lawrence |

$4,419 |

$93,600 |

4.72% |

| Saratoga |

$7,235 |

$258,300 |

2.80% |

| Schenectady |

$6,188 |

$169,600 |

3.65% |

| Schoharie |

$6,079 |

$144,800 |

4.20% |

| Schuyler |

$5,566 |

$133,100 |

4.18% |

| Seneca |

$5,109 |

$107,100 |

4.77% |

| Steuben |

$4,807 |

$99,600 |

4.83% |

| Suffolk |

$10,434 |

$397,400 |

2.63% |

| Sullivan |

$6,243 |

$172,800 |

3.61% |

| Tioga |

$5,074 |

$119,700 |

4.24% |

| Tompkins |

$6,880 |

$204,600 |

3.36% |

| Ulster |

$6,822 |

$230,500 |

2.96% |

| Warren |

$7,073 |

$196,500 |

3.60% |

| Washington |

$5,837 |

$149,000 |

3.92% |

| Wayne |

$5,675 |

$123,800 |

4.58% |

| Westchester |

$15,602 |

$540,600 |

2.89% |

| Wyoming |

$5,517 |

$115,900 |

4.76% |

| Yates |

$5,620 |

$136,300 |

4.12% |

The Actual facts of the New York Housing Market

Many people who are unfamiliar with New York’s geography believe that the state is primarily composed of urban areas.

Those who live in the Empire State believe something entirely different. This is demonstrably false. Over 35,000 farms occupy seven million acres in New York, while the Adirondack Park, which covers six million acres, makes up the majority of the state’s rural landscape.

New York is the 30th-largest state in terms of land area. With 47,200 square miles, it ranks second only to North Carolina’s 48,700 square miles and first only to Mississippi’s 46,900 square miles.

It does, however, have the fourth-largest population in the United States, with an estimated 19.8 million people living there.

Until 2014, New York had the third-largest population in the United States, but Florida surpassed it.

Despite these figures, New York still has the largest city in the United States in terms of the total population.

New York City has a population of approximately 8.8 million people.

After the five boroughs of New York City, the majority of the population is concentrated in the counties around New York City and Long Island.

The western half of the state, which includes the cities of Buffalo, Syracuse, and Rochester, is the next stop on the tour.

On the basis of a variety of indicators, our Healthiest Housing Markets study found that Cheektowaga, West Seneca, Buffalo, and Tonawanda are the best places to live for homeowners in New York. ‘

The average number of years the homeowner had lived in the property, negative equity, the number of days the home was on the market, and a few other factors were taken into consideration in the study. Overall, the state came in at number 27 in our analysis.

According to Census data, the typical home value in New York is $338,700 for the state as a whole. That is an increase of 11% over the previous year, which is consistent with the state’s overall pattern of rising property prices since 2012.

However, as previously stated, purchasing a home in the Buffalo metro region is still a reasonably inexpensive option, with properties priced on average at $82,900.

In contrast, a home in one of New York City’s suburban communities, such as White Plains, which has an average home value of $550,000, demonstrates how much values differ across this diversified state.

Local Economic Factors Affecting the Economy in New York

Unfortunately, for people who are relocating from practically any other state in the United States, New York will appear to be prohibitively expensive.

Additionally, in addition to a state sales tax that hovers around 9 percent, New York imposes state income taxes that can amount to a significant portion of your paycheck.

Additionally, if you live in one of the city’s five boroughs, you will be subject to additional taxes that are exclusive to the municipality.

The good news about New York is that it has a superb system of public colleges, known as State Universities of New York, or SUNY, schools, which are located throughout the state.

In addition, the city is home to a network of state schools that are part of the City University of New York (CUNY) system.

Student households earning up to a particular amount of money were eligible to receive free state tuition beginning in 2017.

New York, in addition to having a great education system, boasts more than 3.9 million private-sector jobs in the city of New York alone.

To find out how much it will cost you to live in New York, you can compare the cost of living in your current location to the cost of living in the place you are considering. Consider the distance between Austin, Texas, and Albany, New York.

The cost of living is actually similar across the board, but it can be broken down into different components.

Despite the fact that your tax burden will be 28% more in New York’s capital than it will be in Austin, housing is on average 28% less expensive in the Empire State.

The average cost of food in Albany is only 5 percent higher than the national average. In contrast, if you are relocating from Boston, Massachusetts to Brooklyn, New York, your overall cost of living will increase by around 7%.

One of the drawbacks of living in New York is the high tax burden that you may have to bear. When you take into consideration the costs of property, sales, and income taxes, it is usually the state with the highest total tax burden in the United States.

Mortgage Legal Concerns in the State of New York

Despite the fact that New York has a lengthy history of being a “buyer beware” state, some of those concerns have been addressed over time.

Currently, sellers are required to complete a property condition disclosure statement, which has many pages of questions ranging from if the property is located in a floodplain to when the last sewage pumping was performed on the property.

The seller is simply required to reveal what she knows to the best of her knowledge, and she is not required to conduct an inspection to validate her representations.

Performing due diligence is the seller’s responsibility, and the seller is explicitly informed at the beginning of the paper that the disclosure “is not a substitute for any inspections or testing.”

You’ll still have to conduct your own investigation of the property. The disclosure is only one of the pieces of information that you have at your disposal.

When it comes to foreclosures in this state, you might be relieved to know that they are generally advantageous to homeowners.

The foreclosure process in New York is judicial, which means that the lender must file a lawsuit against the borrower in order to enforce their rights.

This is often believed to be more favorable for the homeowner than a non-judicial foreclosure, which means there is no involvement of the court system and a shorter time span from the time of start to the time of the home auction.

Foreclosure through judicial means that the bank has to win a case in order to be able to sell the property at auction. The homeowner is considered to be in foreclosure as soon as a lawsuit is filed against him or her.

In the state of New York, there are additional safeguards in place for homeowners.

A special notice must be sent to the borrower at least 90 days before the lender can file a foreclosure summons and complaint against the borrower.

The notice must include a list of at least five nonprofit counseling providers located within a reasonable distance of the borrower.

You can find information about foreclosure resources for homeowners on the New York State Homes and Community Renewal website, if you have any specific questions or concerns concerning foreclosure that you’d want to research.

According to the New York Attorney General’s office, one out of every ten mortgages in the state is at risk of being foreclosed upon.

Unfortunately, the number of people who are living in homes that are in danger of being foreclosed on exceeds the combined populations of Buffalo, Rochester, and Syracuse put together.

If you are in danger of losing your home, you can contact a non-profit housing counselor.

For honest and accurate information about mortgage modification and foreclosure through the Homeowner Protection Program, you can also visit the Attorney General’s website, which is maintained by the Attorney General.

Questions People Are Asking

Which type of mortgage do you propose for me?

Inquire about the advantages and downsides of accessible mortgage loans from your lender.

Is it possible to negotiate rates, conditions, fees, and closing costs?

Is it possible to use discount points to negotiate a lower interest rate? A point is equal to one percent of the mortgage amount, paid upfront, and is used to lower the interest rate during the life of the loan.

In some situations, lowering your interest rate might result in significant savings over the life of your mortgage loan. To break down projected closing costs, use our buyer’s closing cost calculator.

How do you feel about private mortgage insurance (PMI) and what does it cost?

PMI is often required if your mortgage exceeds 80% of the home’s worth. Most lenders will allow you to cancel your PMI once you have accumulated sufficient equity, but be careful to inquire about your lender’s policies.

How long is the duration of the rate lock?

In New York City, the rate lock term is often 30 days, 45 days, or 60 days. Additionally, depending on the loan arrangement, the rate lock term may be longer than 60 days.

Is it possible that my rate will decrease if interest rates fall during the rate lock period?

Even if interest rates rise during the rate lock period, the lender will honor the offered rate.

How much of a penalty will I incur if I am required to prolong the rate lock?

There may be instances where the Co-op board approval procedure exceeds your rate lock period, so understanding the penalty or whether to prolong is critical.

Is there a penalty if I repay the loan early?

If you intend to sell your house within the next three to four years, it is critical to understand the lender’s prepayment policy.

How long will the process of obtaining a mortgage take?

The average time required to close a loan is between 30 and 60 days.

Are you going to service the mortgage yourself or are you going to outsource it out to a third party?

What escrow requirements apply to my loan?

The majority of lenders pay your property taxes and homeowner’s insurance premiums with money received each month from your principal and interest payments and stored in an escrow account until the tax and insurance payments are due.

Fact Check

We hope you enjoyed this article… What are your thoughts?

Please feel free to share with us in the comments section below.

We strive to provide the latest valuable information for our readers with accuracy and fairness. If you would like to add to this post or advertise with us, don’t hesitate to contact us. If you see something that doesn’t look right, contact us!