Forex

Carry Commerce in Foreign exchange: Definition, Charts & Technique Information

[ad_1]

The Carry Commerce technique was invented within the 80s after the Jamaican system launched trade charges actions. The essence of this buying and selling technique is to purchase the foreign money of a rustic with a low rate of interest and put money into property with the next return on investments – currencies with a excessive carry rate of interest, securities, and so forth.

After studying this text, you’ll know what the Carry Commerce technique is and what its benefits are. Learn to use it to earn a living on the international trade market, all of the whereas minimizing the dangers typical for this buying and selling technique.

The article covers the next topics:

It is going to be helpful and fascinating!

Table of Contents

What’s Carry Commerce? Definition & That means

Carry Commerce in easy phrases is when an individual borrows an affordable useful resource as a way to purchase an costly one. Their buying and selling positive aspects are the curiosity differential between the yield of the costly useful resource and the mortgage fee.

Instance of a carry commerce: The S&P500 returns 30% per yr. You’re taking a mortgage from a financial institution at 10% every year and put money into futures, incomes 20% of internet buying and selling positive aspects. In fact, the index’s secure yield of 30% over the previous three years doesn’t assure that it’ll proceed. If on the finish of the yr the index yields lower than 10%, you’ll incur a loss.

As a substitute for the S&P500 index, you’ll be able to put money into a much less dangerous asset that has a assured return. Traders usually select authorities bonds for these functions. However the price of return for the bonds of particular person nations is 2-3%, so the investor wants to seek out the most cost effective attainable approach to borrow cash.

The effectiveness of the carry commerce technique depends upon a number of components:

-

Mortgage price. The upper it’s, the upper must be the return on the asset wherein this borrowed cash will probably be invested.

-

Carry commerce profitability. It must be sufficient to cowl the prices of the mortgage and help of the transaction. The yield will be mounted, for instance, on bonds, or floating, rising relative to the acquisition worth of a inventory quote.

- Volatility of the funding asset. Excessive return means excessive threat. Due to this fact, with excessive volatility, an investor can get each extra curiosity earnings and a loss. In the event that they select risky property, they should continuously monitor market sentiment to shortly promote quotes within the occasion of a worth reversal.

Necessary! The Carry buying and selling technique doesn’t in any manner restrict the dealer in selecting a rustic or an asset. In principle, they will take a mortgage from a financial institution in a single nation and put money into an asset in one other. However the meant goal of borrowed cash, losses on conversion, transaction servicing and fee make this not value it. Due to this fact, generally of carry trades, such transactions are carried out by non-public merchants on trade and over-the-counter markets, on digital platforms.

Predominant Parts of Carry Commerce

The principle elements of gaining curiosity earnings with the Carry Commerce technique:

-

Key carry rate of interest of the central financial institution. That is the speed at which central banks lend to industrial banks. They, in flip, set deposit and lending rates of interest. The low cost price displays the worth of cash. With the speed unchanged, the dealer’s revenue or loss displays the curiosity differential between them.

-

Alternate price change. If it grows, the investor will get a revenue along with the distinction in low cost charges.

The aim of Carry Commerce on the Foreign exchange foreign money buying and selling market is to open a promote place within the foreign money with a low rate of interest and a purchase place within the foreign money with the next rate of interest. Let’s contemplate an instance of the Japanese yen carry commerce (JPY is traditionally a preferred instance of funding foreign money in carry trades resulting from being a low rate of interest foreign money). For instance, when opening a protracted place within the AUDJPY pair, a dealer buys the Australian greenback for borrowed cash within the Japanese yen. To make a revenue from the yen carry commerce, the JPY key rate of interest should be decrease than the AUD price.

Let’s contemplate Carry Commerce buying and selling on the Fx market with foreign money pairs utilizing particular examples.

How does the Foreign money Carry Commerce Work? Defined with Actual Examples

The important thing precept of carry commerce in Foreign exchange foreign money buying and selling is to borrow a cheaper foreign money and use it to purchase a dearer one, thus incomes curiosity earnings. Instance:

-

Within the AUDJPY pair, the JPY is a low rate of interest foreign money with a reduction price of 1%, the AUD low cost price is 4%. With a purpose to purchase the Australian greenback for the Japanese yen, a yen carry dealer should borrow it — open a brief place with this funding foreign money.

-

The dealer opens a protracted place within the pair AUDJPY carry commerce.

- A yr later, the dealer receives +4% for investing within the AUD and pays 1% for utilizing the JPY. The dealer’s internet revenue from this foreign money carry commerce, supplied that the AUDJPY price has not modified over the yr, is 3%.

What occurs if the AUDJPY goes up? For comfort, let’s take an rate of interest of 1:2.

-

The investor borrows 100 JPY at 1% to purchase foreign money within the quantity of fifty AUD.

-

Different buyers observe the identical foreign money carry commerce technique. The fast progress in demand for the AUD results in a rise in its worth as much as 1:3.

- A yr later, the investor receives 3% revenue from this foreign money carry commerce because of the distinction in low cost rates of interest. They usually promote 50 AUD for 150 JPY. 100 JPY goes to repay the mortgage, 50 JPY is the investor’s internet revenue along with carry buying and selling.

In follow, this mechanism is applied by accruing swaps when transactions are rolled over to the subsequent day. When opening AUDJPY yen carry commerce, the dealer truly sells JPY to the dealer and buys AUD at their expense. On the identical time, the yen carry dealer pays curiosity on the offered foreign money and receives it on the bought foreign money. And this proportion is tied to low cost charges. On the finish of the day, the carry commerce dealer recalculates all positions, taking into consideration its fee.

What you might want to find out about swap in Foreign exchange buying and selling:

-

Swap is a charge for rolling an open place over to the subsequent buying and selling session in accordance with the contract specification. If the swap is constructive — the dealer is credited with the distinction between the low cost charges, taking into consideration the buying and selling circumstances of the dealer. Detrimental swap is written off.

-

The swap is completely different for every foreign money pair (asset) and is about by the dealer primarily based on the rate of interest differentials.

-

Swaps for lengthy and quick positions are completely different.

-

The swap worth is about within the specification within the buying and selling circumstances of the dealer or on the buying and selling platform.

The worth of the swap must be taken under consideration within the calculation of potential revenue, no matter whether or not the technique used is carry commerce or incomes on the distinction in charges.

Carry Commerce Examples

The variety of foreign money pairs with a constructive swap (set on the bottom of rate of interest differential) is comparatively small. The selection is sophisticated by the instability of the biggest variations in low cost charges — nations with excessive charges can decrease them in order to not restrain the event of the worldwide economic system, however nations with low rates of interest, quite the opposite, can increase them. Due to this fact, it is sensible to chase not a lot a excessive rate of interest distinction, however quite the soundness of the rate of interest and the route of the pattern.

Necessary! Swap can be utilized for each lengthy and quick positions. Two factors are necessary:

Solely open a place within the route of the constructive swap.

To ensure that a constructive swap to not be negated by the international trade loss, the speed should be in flat or larger/decrease for a protracted/quick place. The longer it stays on this state, the extra the dealer will earn on the each day accrual. This concern is solved partially by setting a cease loss on the breakeven stage.

Let us take a look at just a few examples of making use of the Carry Commerce technique within the international trade market:

1. EURMXN

For this pair, the constructive swap is for a brief place: the low cost rate of interest for the nation’s quoted foreign money (Mexican peso, MXN) is larger than for the bottom foreign money (EUR). Due to this fact, it’s extra worthwhile to promote the euro and purchase the peso.

The long-term carry commerce affords nice potential buying and selling alternatives – there are protracted sections of a downtrend. And if the carry commerce place is insured with a cease order, a pointy improve in quotes isn’t an issue.

2. USDZAR

One other pair comparatively appropriate for brief positions. Regardless of the excessive volatility, there are clear downtrends on lengthy timeframes.

Foreign money pairs with RUB (EURRUB, USDRUB) have been probably the most enticing asset for Carry Commerce in 2021, overtaking the Argentine and Mexican pesos by way of prospects. However because of the excessive volatility of 2022, the periodic strengthening and weakening of the ruble, it isn’t really helpful to work with this foreign money utilizing carry commerce technique in the intervening time.

One other unsuitable pair is USDTRY. It has a constructive swap on quick positions, however there’s an uptrend. It’s attainable to catch a downward motion on quick intervals, however the potential revenue isn’t definitely worth the unfold and time.

Necessary! These examples present the precept of selecting a foreign money pair and discovering an acceptable chart for the technique. If rate of interest differential adjustments, swaps will change, and therefore the attractiveness of sure currencies for carry buying and selling.

Leverage Carry Commerce Examples

Leverage carry commerce technique has a critical disadvantage – its comparatively low carry commerce profitability. To calculate the potential revenue, this system is used:

Revenue = level worth × swap × variety of days

-

Level worth is its worth in financial phrases. It depends upon the foreign money pair and the amount of the commerce. You may learn extra about calculating the worth of some extent within the evaluation “What’s a Foreign exchange foreign money buying and selling lot and tips on how to calculate it”.

-

Swap is for the swap dimension set within the specification.

-

Variety of days is the period of holding a commerce available in the market. Swap is charged on an open place on the finish of every day, triple for weekends.

Instance. Enter information for the foreign money pair: level worth — 0.01 USD for a commerce quantity of 0.01 heaps and 5-digit quotes, swap — 1.156. The whole revenue of a dealer on a place with a minimal quantity for 1 day will probably be 1.156 × 0.01 = 0.01156 USD.

A dealer can maintain the place for a yr. If low cost charges stay unchanged, they will earn 0.01156 × 365 = 4.2194 USD on this commerce. However a dealer may use leverage – borrowed cash from a dealer, which is able to improve the amount of the commerce. For instance, a leverage of 1:100 lets you open a commerce with a quantity of 0.01 × 100 = 1 lot. Accordingly, the price of some extent will improve by the identical quantity — as much as 1 USD. Annual earnings implementing leveraged carry commerce will probably be nearly 422 USD.

Notice! A lower in the important thing price on the funding foreign money will result in a lower in profitability. Thus, earlier than utilizing leverage it’s suggested to conduct thorough monetary planning.

Constructive Carry Commerce

Constructive Carry buying and selling is a technique for earning money on the distinction in low cost charges. An investor borrows a foreign money of tfhe nation with low curiosity and buys a foreign money with the next curiosity low cost price. On the finish of a hard and fast interval, they make a revenue within the type of the distinction between them. Carry trades work for foreign money pairs with a constructive lengthy or quick swap. The worth of a constructive swap on Fx signifies that on the finish of the buying and selling session, the revenue is credited to the dealer’s steadiness.

Contract specs can be discovered within the consumer’s cupboard within the “Instrument info” part.

Detrimental Carry Commerce

Detrimental Carry Commerce is when the price of proudly owning an asset is bigger than its return. Which means that investments are unprofitable so long as their primary worth stays unchanged or falls. In Foreign currency trading, a unfavourable swap interprets into further prices. It’s not charged if the commerce is closed intraday and is robotically charged when an open commerce rolls over to the subsequent buying and selling session.

Why Carry Buying and selling is so In style?

The recognition of carry commerce is considerably exaggerated. There are just a few causes:

-

Small earnings. Non-public merchants who attempt to keep away from dangers function with quantities as much as 1,000 USD. Based mostly on the chance, it’s attainable to calculate the allowable quantity per commerce, and therefore the purpose worth. Realizing the purpose worth, you’ll calculate the swap revenue. This revenue, taking into consideration the chance and the time spent, isn’t value it.

-

The dangers of leveraged carry trades. With leverage, an investor’s return from carry commerce on a protracted timeframe appears tangible, however that is illusory. With a purpose to make a revenue, the speed ought to certainly not go beneath the leveraged carry commerce opening stage, which is uncommon on a protracted timeframe. If the speed goes down, you might want to perceive what the purpose worth with the utmost leverage is. And the way giant of a deposit you might want to have in order that the commerce isn’t closed by stop-out. And when you have such a deposit, does it make sense to freeze it for the sake of a carry commerce? Notice that leverage all the time requires sturdy monetary planning.

-

Small choice of property. There are comparatively few foreign money pairs with a constructive swap. If we weigh all the professionals and cons, it seems that it’s sooner to earn a living on basic volatility, for instance, the EURUSD pair, than to give attention to the cross price and construct a separate buying and selling system for it on each day timeframes.

Carry Commerce is a technique that’s complementary to the primary speculative operations. If the swap is unfavourable and there is a chance to earn on the distinction in charges, it shouldn’t be a motive for abandoning the technique. If the swap is constructive, the extra revenue is a plus.

What Dangers are Concerned

Foreign currency trading dangers utilizing the Carry Commerce technique:

-

Worth moving into the other way to the opening of the commerce. You opened a protracted place, however the worth of the foreign money pair instantly went down – the commerce was closed by a cease out. You made cash on the swap however misplaced on the unfold and price distinction.

The foreign money threat is neutralized if the worth strikes within the route of the commerce and the cease loss is moved to the breakeven stage.

-

Change in low cost charges. With their assist, central banks modify the inflation price. Due to this fact, in creating nations with unstable economies, low cost charges can change ceaselessly by loads, and never all the time in favor of the dealer. Examples of things affecting charges and market sentiment: monetary crises and the state of the worldwide economic system, home financial coverage to keep up the soundness of the nationwide foreign money, the financial exercise of the biggest monetary market gamers, and so forth.

The danger is offset by fixed monitoring of basic components that have an effect on the low cost price.

To reduce dangers, I like to recommend diversification. For instance, a mix of probably the most and least worthwhile pairs. Probably the most worthwhile pairs have a bigger rate of interest differential, but additionally the next threat {that a} nation with an funding foreign money can minimize it to stimulate the economic system. You’ll be taught extra about threat administration strategies within the evaluation “Danger administration in buying and selling for knowledgeable and novice merchants”.

Professionals and Cons of Carry Buying and selling Right now

Algorithm for trying to find foreign money pairs with a constructive swap in MT4:

1. Open the desk of low cost charges of banks. You could find it, for instance, on the analytical portal Investing. Within the desk, take note of the pairs with the biggest distinction in low cost charges.

Just a few necessary factors:

-

It’s best if the checklist covers as many nations as attainable. The checklist of Central Financial institution charges on Investing isn’t full, however it’s the most handy instance.

-

For a protracted place, the bottom foreign money should have larger rate of interest than the quoted one. The bottom foreign money is the primary, the quote foreign money is the second. This situation won’t assure a constructive swap, however will pace up discovering the correct pair. For a brief place, the situation is reversed – the low cost price for the quoted foreign money should be larger.

-

The pair composed in accordance with this precept should be among the many dealer’s buying and selling devices. Cross charges usually go well with the necessities, however not all brokers have them.

The traditional pair USDCHF suits the given circumstances. The USD price is “0.5%”, larger than that of CHF – “-0.75%”.

In MT4 do the next:

On this case, the swap for lengthy positions is bigger than zero. You should buy it.

Notice! The distinction in low cost charges between the bottom and quote currencies in favor of the bottom doesn’t assure a constructive swap. Let’s have a look at the GBPCHF foreign money pair. For the British pound, the low cost price is even larger than for the USD within the earlier instance, however the swap right here is unfavourable.

Benefits and Disadvantages of Carry Buying and selling

The beneath desk exhibits the professionals and cons of carry buying and selling:

|

Professionals of Carry Buying and selling |

Cons of Carry Buying and selling |

|

Average dangers: The trade price threat is capped by a cease loss order at breakeven |

Small swap dimension: To get a tangible revenue, you might want to hold the place in the marketplace for weeks. Leverage is used to extend the purpose worth, nevertheless it additionally will increase the dangers if the cease loss isn’t set on the breakeven stage. |

|

Passive earnings: Constructive swap is credited each day so long as low cost charges stay unchanged |

Restricted choice of property: Solely property with a constructive swap can be utilized |

Technique for Carry Commerce in Foreign exchange

Discovering a foreign money pair with a constructive swap is a matter of minutes, you simply must evaluation the specs within the buying and selling platform. However this nonetheless doesn’t assure you any revenue. Let me remind you that purchasing an asset with a constructive swap for lengthy positions will probably be unprofitable if the speed goes down – the constructive swap won’t repay the distinction in quotes. Due to this fact, I like to recommend to stick to the next ways:

Step 1. Select a foreign money

Examine the low cost charges of the Central Banks, have a look at the specs and search for a constructive swap. Let’s suppose you’ve discovered a foreign money pair with a constructive lengthy place swap.

Step 2. Analyzing the information (basic evaluation)

It’s essential analyze the components and market sentiment affecting the speed (monetary disaster, financial insurance policies, and so forth.) and ensure that the speed in your open place doesn’t reverse in the other way. In different phrases, the motion of quotes ought to make it attainable to earn not solely on their distinction, but additionally on a constructive swap. And you will need to take basic components under consideration.

Step 3. Analyzing the chart (technical evaluation)

The distinction in low cost charges within the quick run is negligible. So you’ve two choices:

So as so that you can earn a living on a carry commerce, the pattern should be moving into the correct route, or at the least sideways. Ideally, with a constructive lengthy place swap, you might want to catch the start of an uptrend on the D1-MN timeframe.

Development indicators that may aid you discover the start of a long-term pattern:

-

Shifting averages. All variations of shifting averages present the route of the long-term pattern fairly nicely. Learn extra about them within the evaluation “Shifting Common: How one can Use the EMA Indicator“.

-

Alligator. It is a primary indicator by Invoice Williams for MT4 and MT5, consisting of three shifting averages with completely different intervals and shift parameters. The simultaneous divergence of shifting averages signifies the start of a pattern. Learn extra about it within the evaluation “Alligator by Invoice Williams“.

- Momentum. A number one indicator that lets you measure the quantity of change within the worth of a monetary instrument over a sure time frame. “The Momentum Indicator: A Full Information with Charts and Examples“.

Moreover, you need to use confirming oscillators to assist establish the moments of pattern reversal.

Step 4. In search of market exit factors

The quantity of revenue of a constructive swap doesn’t rely upon the dynamics of the pattern, solely its route is necessary. However when you have already caught an uptrend, the most suitable choice is to get as a lot revenue as attainable from it by closing the place on the time of the reversal. However in any case, the place will shut in revenue in case you set a cease loss on the stage of “commerce opening level + unfold”.

Abstract

Key takeaways from the Foreign exchange carry curiosity commerce technique:

-

The essence of the technique is to open a brief or lengthy place in an asset with a constructive swap. You could find the swap worth within the specs.

-

In accordance with the technique, you’ll be able to solely get revenue when the speed goes within the route of the place or is in a flat. If the speed goes in the other way, the loss will exceed the revenue from the swap. Due to this fact, with a long-term technique, you will need to have time to regulate the cease loss to a stage that ensures no loss.

-

A constructive swap is credited each day, a unfavourable swap is deducted.

-

Pairs with excessive volatility should not appropriate for the technique because of the threat of losses on the distinction in charges.

-

A excessive price on the funding foreign money isn’t all the time good, since there’s a risk that the central financial institution will decrease it to revive the economic system.

-

Swap earnings with a minimal commerce quantity for a number of days quantities to mere cents. A dealer can use margin buying and selling, thus rising the dangers, or improve the amount of the deposit and, accordingly, the place, all of the whereas freezing the cash for a very long time. Carry commerce isn’t appropriate for intraday buying and selling. The evaluation must be carried out on weekly and month-to-month timeframes.

The technique is appropriate for merchants as a further earnings to trade price actions buying and selling, in addition to passive buyers with giant capital. You identify the quantity of capital your self, primarily based in your revenue targets.

Carry commerce appears to be a comparatively risk-free technique, however an entry error can value you most of your deposit.

The content material of this text displays the writer’s opinion and doesn’t essentially replicate the official place of LiteFinance. The fabric revealed on this web page is supplied for informational functions solely and shouldn’t be thought of as the availability of funding recommendation for the needs of Directive 2004/39/EC.

[ad_2]

Source_link

Forex

USD/CAD Beneficial properties After Financial institution of Canada Holds Charges Regular, Retains Dovish Steering

[ad_1]

BANK OF CANADA DECISION:

- Financial institution of Canada stands pat on financial coverage, preserving its key rate of interest unchanged at 4.50%, according to expectations

- The financial institution retains a bearish steering, signaling that it’s going to maintain borrowing prices at present ranges whereas assessing the cumulative results of previous tightening measures

- USD/CAD extends positive aspects after BoC’s determination

Advisable by Diego Colman

Get Your Free USD Forecast

Most Learn: Gold Costs Collapse as Powell Flags Threat of Larger Peak Charges, Silver Hammered

The Financial institution of Canada in the present day concluded its second financial coverage gathering of 2023. According to consensus estimates, the establishment led by Tiff Macklem voted to maintain its benchmark rate of interest unchanged at 4.50%, after elevating borrowing prices at every of its earlier 9 conferences.

In its assertion, BoC mentioned that the financial system has advanced as anticipated, noting that the labor market continues to be very tight, and that inflation stays elevated, however underscored that CPI is anticipated to average and are available all the way down to round 3% in the midst of the yr on the again of weaker development within the coming quarters.

By way of the coverage outlook, the financial institution retained a dovish steering, indicating that it’s going to maintain borrowing prices at present ranges, conditional on financial developments evolving broadly according to forecasts. This can be an indication that the terminal fee has been reached – a damaging end result for the Canadian greenback.

Instantly after the central financial institution launched its determination, USD/CAD prolonged positive aspects, rising to its highest degree since November 2022 close to the 1.3800 deal with. With the Fed hell-bent on extending its tightening marketing campaign and BoC on pause for the foreseeable future, the Canadian greenback is prone to exhibit a bearish bias within the close to time period. This implies USD/CAD may quickly retest its 2022 highs.

Advisable by Diego Colman

Foreign exchange for Inexperienced persons

USD/CAD FIVE-MINUTE CHART

Supply: TradingView

[ad_2]

Source_link

Forex

How To Determine Engulfing Candle on Value Charts? • Asia Foreign exchange Mentor

[ad_1]

Engulfing Candle is a candlestick sample in technical evaluation that’s used to establish a possible pattern reversal. It happens when a bigger candle “engulfs” the smaller candle that got here earlier than it. The physique of the next candle utterly covers or “engulfs” the primary candle’s physique. There are two sorts of Engulfing Candles – Bullish Engulfing Candles and Bearish Engulfing Candles.

This sample is taken into account a key ingredient in technical evaluation as a result of it could point out a major shift in market sentiment. Merchants and analysts use this sample to establish potential pattern reversals and make buying and selling selections.

Engulfing Candles can present helpful insights into market actions and assist merchants make extra knowledgeable selections when mixed with different technical indicators and evaluation.

Additionally Learn: How To Commerce the Hanging Man Candlestick Sample

Table of Contents

Contents

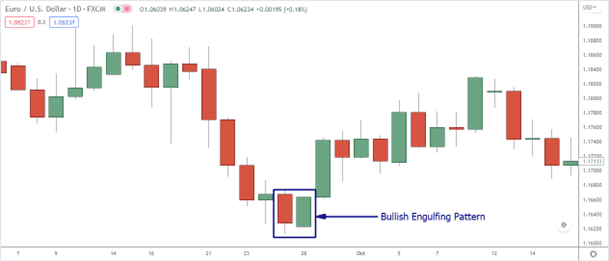

Bullish Engulfing Sample

A bullish engulfing candle is a two-candlestick sample fashioned when a bigger bullish candlestick follows a small bearish candlestick. The bullish candle utterly engulfs the bearish candle, opening beneath the earlier candle’s low and shutting above the earlier candle’s excessive.

This sample is taken into account a bullish reversal sample, which can point out a possible reversal of a earlier downtrend. The sample means that the shopping for stress has overwhelmed the promoting stress, and the bulls are accountable for the market.

Merchants typically use bullish engulfing candles to sign to enter lengthy positions or add to present ones. Technical indicators and analyses can verify the validity or power of the sample earlier than making any buying and selling selections. Moreover, the sample could be extra vital when it happens after a protracted downtrend slightly than in a sideways or consolidating market.

The right way to Determine and Interpret Bullish Engulfing Candlesticks

To establish a bullish engulfing sample, it’s worthwhile to search for two consecutive candlesticks on a worth chart.

Listed below are the steps to establish and interpret a bullish engulfing candlestick sample:

- Search for a small bearish candlestick: The primary candlestick within the sample ought to be a small bearish candlestick with a small actual physique. This candlestick signifies that the bears are accountable for the market.

- Search for a big bullish candlestick: The second candlestick ought to be a big bullish engulfing sample with an extended actual physique that utterly engulfs the primary candlestick. This candlestick signifies that the bulls have taken management of the market.

- Verify the sample: Different technical indicators and evaluation ought to verify the bullish engulfing sample to find out whether or not it’s a robust reversal sign.

- Interpret the sample: The bullish engulfing sample is a bullish reversal sample that signifies a pattern reversal from a downtrend to an uptrend. The bigger the engulfing candlestick, the extra vital the sample is taken into account to be.

- Contemplate the amount: Larger quantity on the engulfing sample can additional verify the power of the sample.

The bullish engulfing sample is a robust bullish pattern sign that may point out a possible pattern reversal.

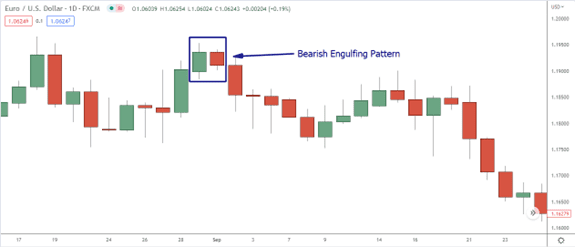

Bearish Engulfing Sample

A bearish engulfing sample is a two-candlestick sample that’s fashioned when a bigger bearish candlestick follows a small bullish candlestick. The bearish candle utterly engulfs the earlier bullish candle, opening above the excessive of the earlier candle and shutting beneath the low of the earlier candle.

The sample means that the promoting stress has overwhelmed the shopping for stress, and the bears are accountable for the market. Consequently, the sample is taken into account to be a bearish pattern reversal sample which will point out a possible pattern reversal from an uptrend to a downtrend.

The right way to Determine and Interpret Bearish Engulfing Candlestick patterns

To establish and interpret bearish engulfing patterns, observe these steps:

- Search for a small bullish candlestick: The primary candlestick within the sample ought to be a small bullish engulfing sample with a small actual physique. This candlestick signifies that the bulls are accountable for the market.

- Search for a big bearish candlestick: The second candlestick ought to have an extended actual physique that utterly engulfs the primary candlestick. This candlestick signifies that the bears have taken management of the market.

- Verify the sample: Different technical indicators and evaluation ought to verify the bearish engulfing sample to find out whether or not it’s a robust reversal sign.

- Interpret the sample: The bearish engulfing sample is a bearish reversal sample that signifies a possible pattern reversal from an upward pattern to a downtrend. The bigger the engulfing candlestick, the extra vital the sample is taken into account to be.

- Contemplate the amount: Larger quantity on the engulfing sample can additional verify the power of the sample.

Whereas the bearish engulfing sample happens, a robust bearish sign that may point out a possible pattern reversal.

Execs And Cons of Engulfing Candlestick sample

Execs of Engulfing Candlestick patterns

- Gives a transparent and easy-to-identify visible sign for merchants.

- Can be utilized together with different technical indicators and evaluation to substantiate indicators and enhance buying and selling selections.

- The Bullish Engulfing Sample is a robust bullish sign that may point out a possible pattern reversal or a continuation of an uptrend.

Cons of Engulfing Candlestick patterns

- The sample could be subjective and open to interpretation, resulting in false indicators if not analyzed fastidiously.

- The sample could not at all times be dependable by itself and ought to be utilized in mixture with different technical indicators and analyses for higher accuracy.

- Engulfing patterns can happen steadily, resulting in potential confusion and overtrading if not used correctly.

Though Engulfing Candle patterns have professionals and cons, they could be a helpful software in technical evaluation when mixed with different indicators and evaluation.

Engulfing Candle Sample Buying and selling Methods

Engulfing candles can be utilized as a part of a buying and selling technique to establish potential pattern reversals available in the market. Listed below are some buying and selling methods that merchants typically use with engulfing candles:

- Engulfing candle as a reversal sign: Merchants searching for a bullish or bearish engulfing candle on a chart as a sign to enter an extended or quick place, respectively. This technique assumes that the engulfing candle is a robust reversal sign and that the market will seemingly reverse its pattern.

- Combining with different indicators: Merchants may also use engulfing candles together with different technical indicators, corresponding to transferring averages, pattern traces, or oscillators, to substantiate the reversal sign. For instance, if a bullish engulfing candle seems close to a help degree, it could be a stronger sign to enter an extended place.

- Engulfing patterns in a pattern: Merchants may also use engulfing candles to establish potential pullbacks in a pattern. For instance, in an uptrend, a bearish engulfing candle could sign a short lived pullback earlier than the uptrend resumes.

- Engulfing candles as a affirmation: Engulfing candles can be used to substantiate different technical evaluation indicators. For instance, if a breakout happens on a chart and is adopted by a bullish engulfing candle, it could be a stronger sign that the breakout is legitimate.

Total, merchants can use engulfing candles as a standalone sign or together with different technical indicators to make buying and selling selections.

Backside Line

Engulfing Candle is a crucial candlestick sample in technical evaluation that gives merchants with helpful insights into market actions. The Bullish Engulfing Candle, particularly, is a strong bullish sign that may point out a possible pattern reversal or a continuation of an uptrend.

Merchants can use this sample to establish buying and selling alternatives and make extra knowledgeable selections. By understanding and having the ability to establish Engulfing Candles, merchants can enhance their technical evaluation abilities and enhance their probabilities of success within the markets.

FAQs

What’s an Engulfing Candle?

An Engulfing Candle is a two-candlestick sample in technical evaluation, the place a bigger candle engulfs the earlier candle, indicating a possible pattern reversal.

Is Engulfing Candle Bullish or Bearish?

The Engulfing Candle could be both bearish or bullish, relying in the marketplace bias. A Bullish Engulfing Candle signifies a possible pattern reversal to the upside, whereas a Bearish Engulfing Candle factors to a possible pattern reversal to the draw back.

What’s the Success Price of Engulfing Sample?

The bearish enclosed candlestick is a widely-used candlestick. That is extraordinarily efficient in bearish reversed conduct and performs 79% in all cases (5 out of 100 sorts with an general rating of 1).

[ad_2]

Source_link

Forex

BoE Dhingra: Prudent to carry charges regular due to materials overtightening danger

[ad_1]

BoE dove Swati Dhingra warned in a speech that overtightening posses a extra materials danger now. She known as for holding rate of interest unchanged.

“Overtightening poses a extra materials danger at this level, via potential destructive impacts from elevated borrowing prices and lowered provide capability going forwards,” she defined. “It dangers unnecessarily denting output at a time when the economic system is weak and deepening the ache for households when budgets are already squeezed via vitality and housing prices.”

“For my part, a prudent technique would maintain coverage regular amidst rising indicators exterior value pressures are easing, and be ready to reply to developments in value evolution. This could keep away from overtightening and return the economic system sustainably to our 2% inflation goal within the medium-term.”

“General, the proof doesn’t level to persistent cost-push inflation changing into embedded in wages and margins,” she mentioned. “Even after a 12 months and a half of above-target inflation, there’s little proof for such cost-push inflation past what is likely to be anticipated following an unprecedented phrases of commerce shock.”

“Consumption stays weak and lots of the tightening results of financial coverage are but to completely take maintain,” she added.

[ad_2]

Source_link

-

Banking3 years ago

Banking3 years agoWhy investment banking best answers – 7 Tips to Remember

-

How to Make Money1 year ago

How to Make Money1 year ago10 Finest Apps Like OfferUp in 2023

-

Business Tech3 years ago

Business Tech3 years agoTop 10 Reasons Why CompTIA Security+ Training is Right for You

-

Law3 years ago

Law3 years agoHow to Find a Trustworthy Lawsuit Funding Company

-

insurance2 years ago

insurance2 years agoHow to Avoid Financial Ruin from Unexpected Car Repairs

-

Crypto2 years ago

Crypto2 years ago0x Protocol and ZRX Cryptocurrency

-

Affirmations3 years ago

Affirmations3 years agoTop 15 Bob Proctor Money Affirmations for Attracting Money and Wealth

-

Education3 years ago

Education3 years agoWho Invented Homework for schools? Top 10 Facts about Homework