Finance

Decide Out of Underpayment Penalty in TurboTax and H&R Block

[ad_1]

Whenever you do your taxes in tax software program, the software program typically calculates an underpayment penalty. It thinks you owe the penalty when your tax withholding plus any estimated tax funds had been under a sure threshold (the “secure harbor“):

- Inside $1,000 of your tax obligation; or

- 90% of your present yr’s tax obligation; or

- 100% of your earlier yr’s tax obligation (110% in case your AGI within the earlier yr was $150,000 or extra)

In case your revenue was uneven all year long, you’ll be able to attempt to get out of paying the underpayment penalty by way of a sophisticated train utilizing the “Annualized Earnings Installment Technique.” It principally comes all the way down to doing all of your taxes 4 instances by separating your revenue and deductions into 4 sub-periods inside the yr and calculating your taxes for every sub-period.

I don’t learn about you however I don’t have any urge for food for doing my taxes 4 instances.

There’s a significantly better manner. The tax software program is just making an attempt to be useful in calculating the underpayment penalty for you. You may decline its assist and let the IRS calculate the penalty and invoice you in the event that they determine to evaluate a penalty.

The IRS really usually doesn’t assess a penalty when the tax software program thinks you owe a penalty. You don’t should volunteer the penalty now.

Right here’s methods to decide out of calculating the underpayment penalty in TurboTax and H&R Block software program.

TurboTax

I’m utilizing TurboTax downloaded software program. TurboTax downloaded software program is each extra highly effective and cheaper than TurboTax on-line software program.

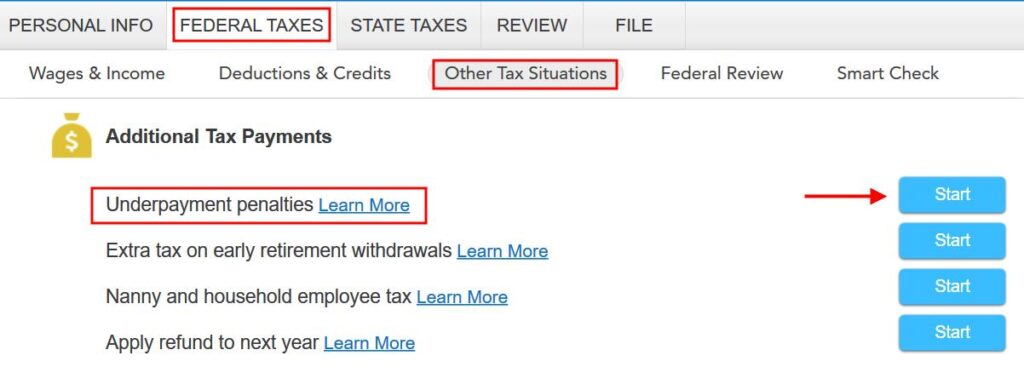

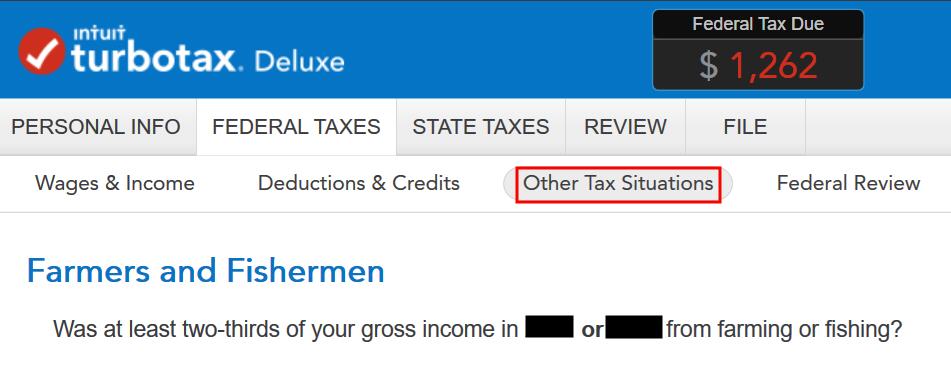

Discover “Underpayment penalties” underneath Federal Taxes -> Different Tax Conditions. Click on on Begin.

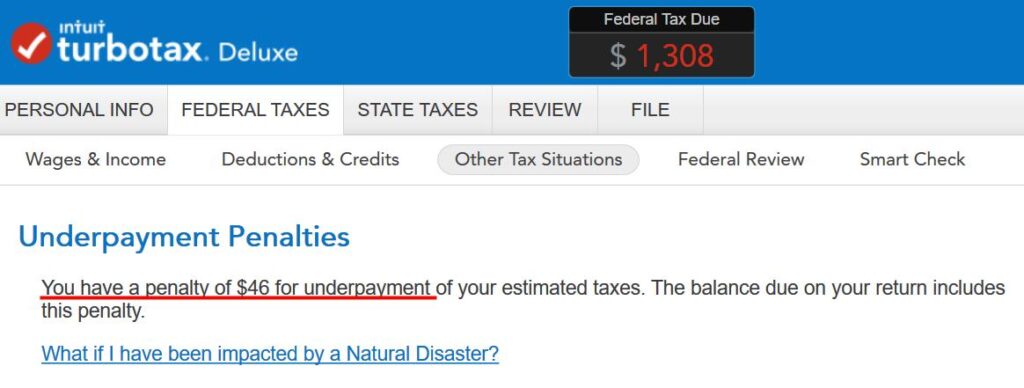

If TurboTax says you have got a penalty for underpayment. Click on on Proceed.

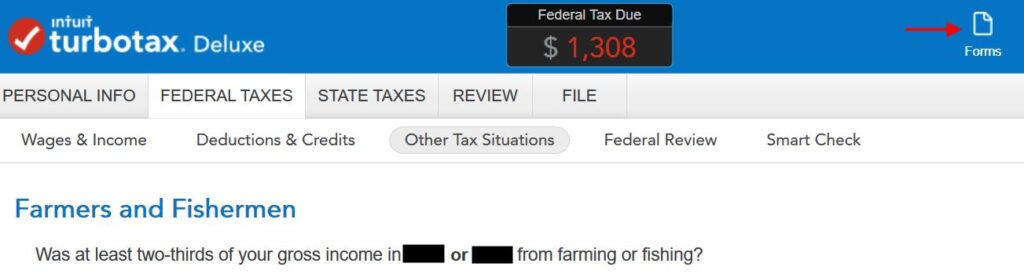

TurboTax asks you about farming or fishing, which doesn’t apply to most individuals.

You may proceed the complicated interview with extra hoops to leap by way of but it surely’s a lot faster in the event you swap to the Kinds mode now by clicking on Kinds on the highest proper.

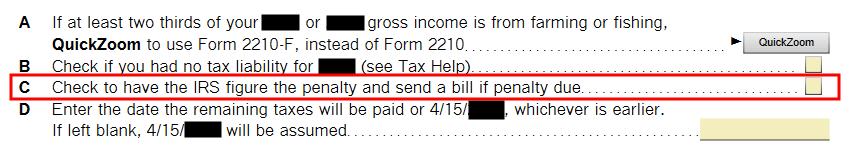

TurboTax opens a kind. Test the field subsequent to merchandise C to have the IRS calculate the penalty and ship a invoice if essential. Chances are high they received’t.

The underpayment penalty calculated by TurboTax is eliminated instantly after you test that field. Be aware in our instance the tax owed meter dropped from $1,308 to $1,262 after we checked the field.

Click on on Step-by-Step to return to the interview.

You’re again to the display about farming and fishing. Click on on “Different Tax Conditions” within the sub-menu to exit this part.

H&R Block

It’s far more simple within the H&R Block downloaded software program. H&R Block obtain can also be each extra highly effective and cheaper than H&R Block on-line software program.

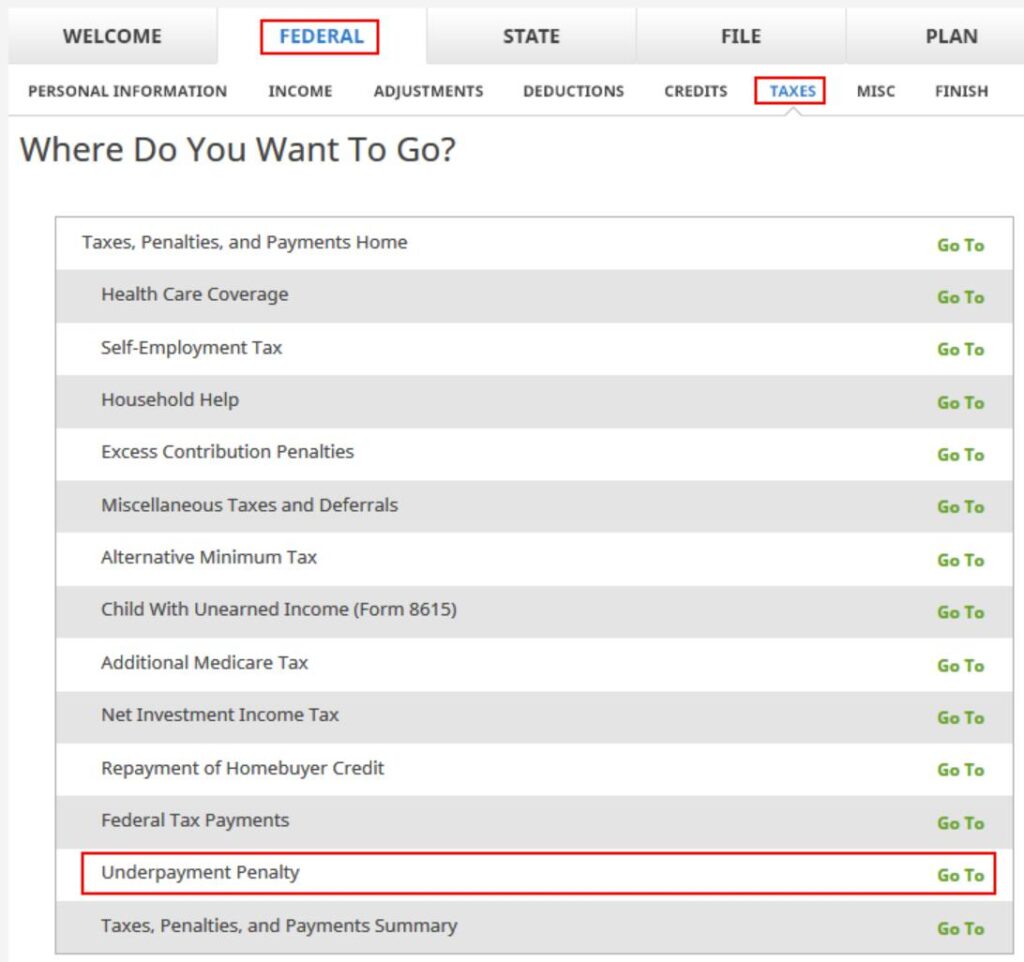

Discover “Underpayment Penalty” underneath Federal -> Taxes. Click on on Go To.

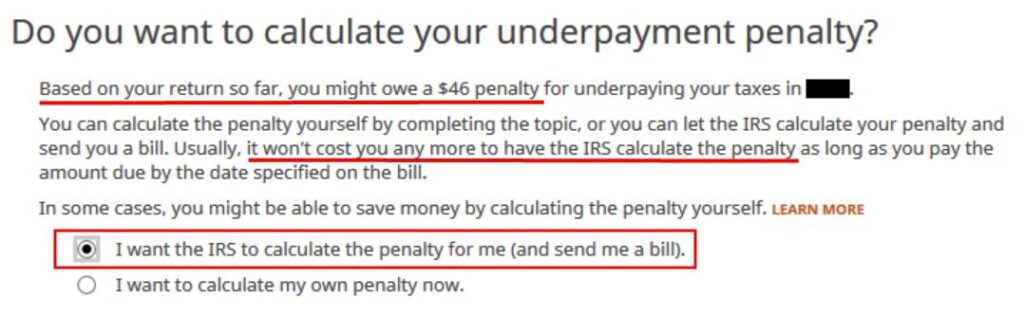

H&R Block affords the choice to let the IRS calculate the penalty immediately. The choice is chosen by default.

H&R Block explains that it received’t value you any extra to have the IRS calculate the penalty. It really will value you much less when the IRS doesn’t assess a penalty.

Say No To Administration Charges

If you’re paying an advisor a proportion of your property, you might be paying 5-10x an excessive amount of. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation.

[ad_2]

Source_link

Finance

The Fascinating Universe of Collectible American Coins

Table of Contents

The Fascinating Universe of Collectible American Coins

Did you know gold has been a go-to for people wanting to diversify their investments and guard their income for centuries? Believe it or not, in today’s topsy-turvy economy, gold’s steady yields and proven durability are hot commodities for investors worldwide.

One of the trendiest ways to convert greenbacks into gold is by purchasing gold bars and coins.

Gold coins might be particularly tempting to investors due to their snazzy aesthetic and historical value–in addition to their monetary worth. But where to start–that’s the million dollar question? With so many gold coins out there, how do you decide what (and how) to bet on?

Golden Eagles Soaring High – American Gold Eagle Coins

Let’s dive in with the American Gold Eagle coins — a red-hot favorite and a well-known player in the gold coins market.

The U.S Mint whips up these 22-karat gold coins decorated with a Lady Liberty design on the obverse side, while the reverse side flaunts a bald eagle nesting or a bald eagle’s head, year-dependent.

And here’s what’s also interesting–you can claim these American Gold Eagle coins in various weights: 1 oz, 1/2 oz, 1/4 oz and 1/10 oz. The same goes for its ‘cousin’– the American eagle silver coin.

The Canadian Maple Leaf–Not Quiet American, but Close Enough

The 24-karat gold Canadian Gold Maple Leaf coin, sculpted by the Royal Canadian Mint, is an absolute stunner.

Hitting the ground in 1979, this golden wonder was in toe-to-toe competition with the South African Gold Krugerrand and is still regarded as one of the world’s purest and most coveted gold bullion coins.

The design? A maple leaf on the obverse side and an image of Queen Elizabeth II on the reverse.

What’s rad is that Canadian Gold Maple Leaf coins come in an array of weights, from 1/25 oz all the way up to 1 ounce.

Unleashing the Golden Buffalo – American Gold Buffalo Coins

Say hello to the American Gold Buffalo coin–another popular (and very favored)choice among investors and collectors alike.

The design is a tribute to the 1913 Buffalo Nickel conceived by renowned James Earle Fraser. You’ll see a Native American chief’s profile on the obverse side and an American buffalo on the reverse.

What’s fun to note is that American Gold Buffalo coins are 24 karats—higher purity than American Gold Eagle coins.

The Golden Wrap Up

Dropping some money into gold coins can be a savvy strategy to protect your overall investment bundle from losses and fend off inflation.

The coins discussed above are top-notch options for anyone keen on adding a dash of the shiny metal to their investment portfolio or who gets a kick out of curating a collection.

Always remember — before making any investment decision, do your legwork, contemplate your investment goals and risk tolerance, and seek advice from a financial guru for individualized guidance based on your unique financial situation. Good Luck!

Fact Check

We strive to provide the latest valuable information for our readers with accuracy and fairness. If you would like to add to this post or advertise with us, don’t hesitate to contact us. If you see something that doesn’t look right, contact us!

Finance

Writing Essays Online – The Pros and Cons of Plagiarism

An report accuses some students to utilize online paid essay services to attempt to better their grades. Students may use these to attempt to improve their scores on standardized tests. Is this true? How does it work?

Academic researchers believe that students could be using essay writing solutions to attempt and boost their grades. (more…)

Finance

Top 13 Richest Cities in the World by Number of Millionaires

Table of Contents

Top 13 Richest Cities In The World By Number of Millionaires

We live in an era of rapid economic growth and prosperity. Many cities around the globe have become thriving hubs of wealth, attracting millionaires from various industries.

In this article, we will explore the top 13 richest cities in the world by the number of millionaires. By understanding these prosperous urban centers, we can glean valuable insights into the global economy and the distribution of wealth.

1. New York City, United States

New York City, often referred to as the Big Apple, is undoubtedly one of the wealthiest cities globally. With a high concentration of millionaires and billionaires, it is home to the world’s largest financial market, the New York Stock Exchange. The city’s vibrant economy is powered by diverse sectors, including finance, real estate, technology, and media.

Key Industries:

- Finance

- Real Estate

- Technology

- Media

2. Tokyo, Japan

The bustling capital of Japan, Tokyo is a hub of commerce and innovation. With its strong economy, the city has attracted numerous millionaires who have made their fortunes in various industries. Tokyo’s Stock Exchange is the third-largest in the world, contributing significantly to the city’s wealth.

Key Industries:

- Technology

- Manufacturing

- Finance

- Retail

3. London, United Kingdom

A global center for finance and culture, London is home to a large number of millionaires. Its status as a financial capital has attracted wealthy individuals in banking, hedge funds, and private equity. Additionally, the city’s thriving arts and cultural scene attracts high net worth individuals from around the world.

Key Industries:

- Finance

- Real Estate

- Arts and Culture

- Technology

4. San Francisco, United States

San Francisco and the surrounding Silicon Valley have become synonymous with technological innovation and entrepreneurship. The city’s thriving tech ecosystem has generated a significant number of millionaires and billionaires, thanks to the success of companies like Apple, Google, and Facebook.

Key Industries:

- Technology

- Venture Capital

- Biotechnology

- Green Energy

5. Hong Kong, China

Hong Kong, a Special Administrative Region of China, is a major financial hub in Asia. Its strategic location and business-friendly environment have made it a magnet for wealthy individuals in finance, real estate, and trade. The Hong Kong Stock Exchange is one of the largest and most active in the world.

Key Industries:

- Finance

- Real Estate

- Trade

- Retail

6. Sydney, Australia

As Australia’s most populous city, Sydney has a diverse and robust economy. The city’s natural beauty, high quality of life, and thriving business sectors have made it a popular destination for millionaires. Its key industries include finance, real estate, tourism, and technology.

Key Industries:

- Finance

- Real Estate

- Tourism

- Technology

7. Singapore

Singapore is a small island nation with a powerful and dynamic economy. Its strategic location as a global trade hub has attracted wealthy individuals from various industries. The city-state’s pro-business environment, excellent infrastructure, and high quality of life make it a top choice for millionaires.

Key Industries:

- Finance

- Trade

- Real Estate

- Technology

8. Zurich, Switzerland

Zurich is Switzerland’s largest city and a global center for banking and finance. Its stable economy, low tax rates, and renowned private banking sector have attracted a significant number of millionaires. The city is also home to major international corporations and a growing technology sector.

Key Industries:

- Finance

- Pharmaceuticals

- Technology

- Manufacturing

9. Los Angeles, United States

Los Angeles is a global entertainment hub, known primarily for its thriving film and television industry. As the home of Hollywood, the city has attracted numerous millionaires and billionaires involved in media, entertainment, and technology.

Los Angeles also has a strong presence in industries like aerospace, fashion, and tourism.

Key Industries:

- Entertainment

- Media

- Technology

- Aerospace

10. Mumbai, India

As India’s financial capital, Mumbai is home to the country’s largest corporations, stock exchanges, and banking institutions. The city’s growing economy has generated a significant number of millionaires, particularly in industries such as finance, real estate, and technology. Mumbai is also known for its thriving Bollywood film industry.

Key Industries:

- Finance

- Real Estate

- Technology

- Entertainment

11. Paris, France

Paris, the romantic capital of France, is not only known for its rich cultural heritage and history but also for its robust economy. As a major global financial center, Paris has attracted numerous millionaires who have made their fortunes in industries such as fashion, finance, luxury goods, and tourism.

Key Industries:

- Finance

- Fashion

- Luxury Goods

- Tourism

12. Toronto, Canada

Toronto is Canada’s largest city and economic powerhouse. The city’s thriving economy is driven by diverse industries, including finance, technology, and real estate. Toronto’s stock exchange is the largest in Canada and the ninth-largest in the world, contributing significantly to the city’s wealth.

Key Industries:

- Finance

- Real Estate

- Technology

- Life Sciences

13. Shanghai, China

As one of China’s most populous and prosperous cities, Shanghai has experienced rapid economic growth in recent decades. The city is a global financial hub and home to the Shanghai Stock Exchange, one of the world’s largest. Key industries in Shanghai include finance, real estate, and technology.

Key Industries:

- Finance

- Real Estate

- Technology

- Manufacturing

Conclusion

The top 13 richest cities in the world by the number of millionaires showcase the diversity and strength of the global economy.

From finance hubs like New York City and London to technology centers like San Francisco and Tokyo, these cities represent the pinnacle of wealth and success.

As the world continues to evolve, we can expect these urban centers to remain at the forefront of innovation, driving economic growth and prosperity.

Frequently Asked Questions (FAQs)

1. Which city has the most millionaires?

New York City currently has the highest number of millionaires, thanks to its strong economy and status as a global financial capital.

2. Which industries are most prevalent in these wealthy cities?

Key industries among these cities include finance, real estate, technology, and trade. However, each city has its unique mix of thriving sectors, such as entertainment in Los Angeles and luxury goods in Paris.

3. What factors make a city attractive to millionaires?

Factors that attract millionaires to a city include a strong economy, business-friendly environment, high quality of life, and opportunities for investment and wealth creation. Additionally, cities with well-developed infrastructure, excellent healthcare, and education systems, as well as cultural and recreational opportunities, are also attractive to high net worth individuals.

4. How does the concentration of millionaires impact a city’s economy?

A high concentration of millionaires can contribute to a city’s economic growth by driving investments, creating job opportunities, and stimulating local businesses. Their wealth and spending can also contribute to the city’s tax revenue, helping to fund public services and infrastructure projects.

5. Are there any emerging cities that could make this list in the future?

Emerging cities like Dubai, United Arab Emirates; Bangalore, India; and São Paulo, Brazil have experienced rapid economic growth and are home to a growing number of millionaires. As these cities continue to develop, they could potentially join the ranks of the top 13 richest cities in the world.

6. Do these cities also have a high number of billionaires?

Yes, many of these cities also have a high concentration of billionaires. For example, New York City, San Francisco, and Hong Kong are known for their significant number of billionaires in addition to millionaires.

7. How do wealthy individuals contribute to a city’s cultural scene?

Wealthy individuals often invest in and support the arts, museums, and cultural institutions in their cities. They may also sponsor events, donate to charitable causes, and commission works of art, contributing to a vibrant and diverse cultural scene.

Fact Check

We hope you enjoyed reading this article. What are your thoughts on the topic?

“At [Dogsvets.com], our goal is to bring you the most accurate and up-to-date information on all things pet-related.

If you have any additional insights or would like to advertise with us, don’t hesitate to get in touch.

If you notice any errors or discrepancies in our content, please let us know so we can correct them.

We welcome your feedback and encourage you to share this article with others.”

-

Banking3 years ago

Banking3 years agoWhy investment banking best answers – 7 Tips to Remember

-

Business Tech2 years ago

Business Tech2 years agoTop 10 Reasons Why CompTIA Security+ Training is Right for You

-

Law3 years ago

Law3 years agoHow to Find a Trustworthy Lawsuit Funding Company

-

insurance2 years ago

insurance2 years agoHow to Avoid Financial Ruin from Unexpected Car Repairs

-

Affirmations3 years ago

Affirmations3 years agoTop 15 Bob Proctor Money Affirmations for Attracting Money and Wealth

-

Education3 years ago

Education3 years agoWho Invented Homework for schools? Top 10 Facts about Homework

-

Crypto1 year ago

Crypto1 year ago0x Protocol and ZRX Cryptocurrency

-

Business2 years ago

Business2 years ago7 Things You Can Expect From Managed IT Services